Get the free Claim for Long-Term Care Insurance Credit - tax ny

Show details

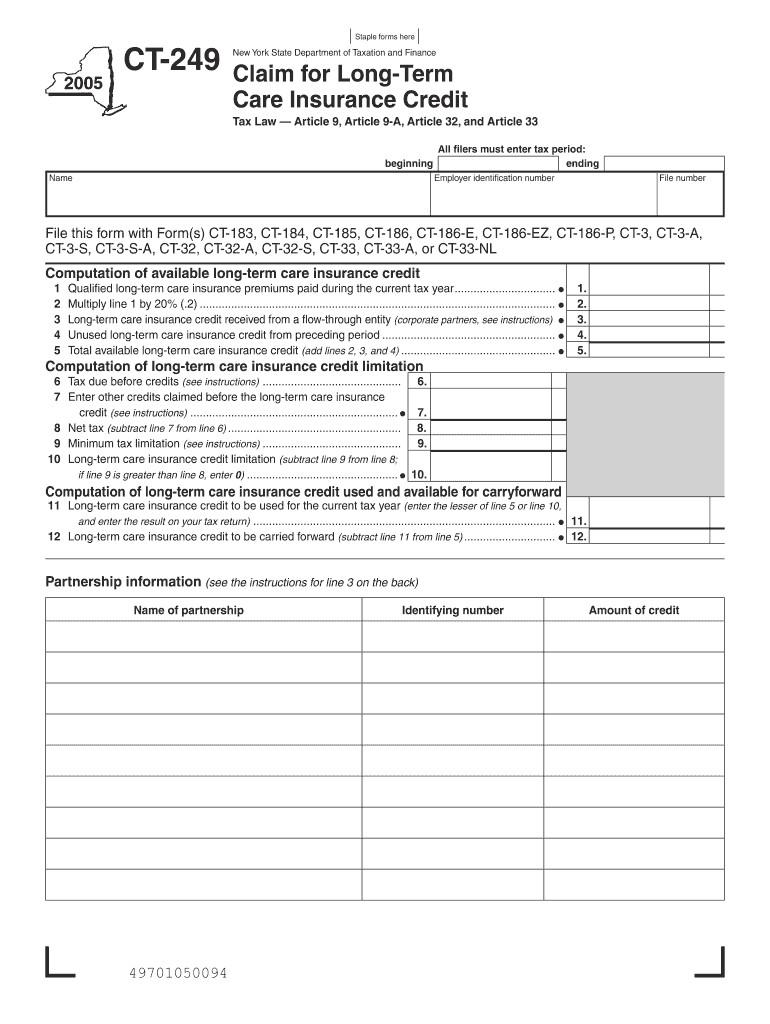

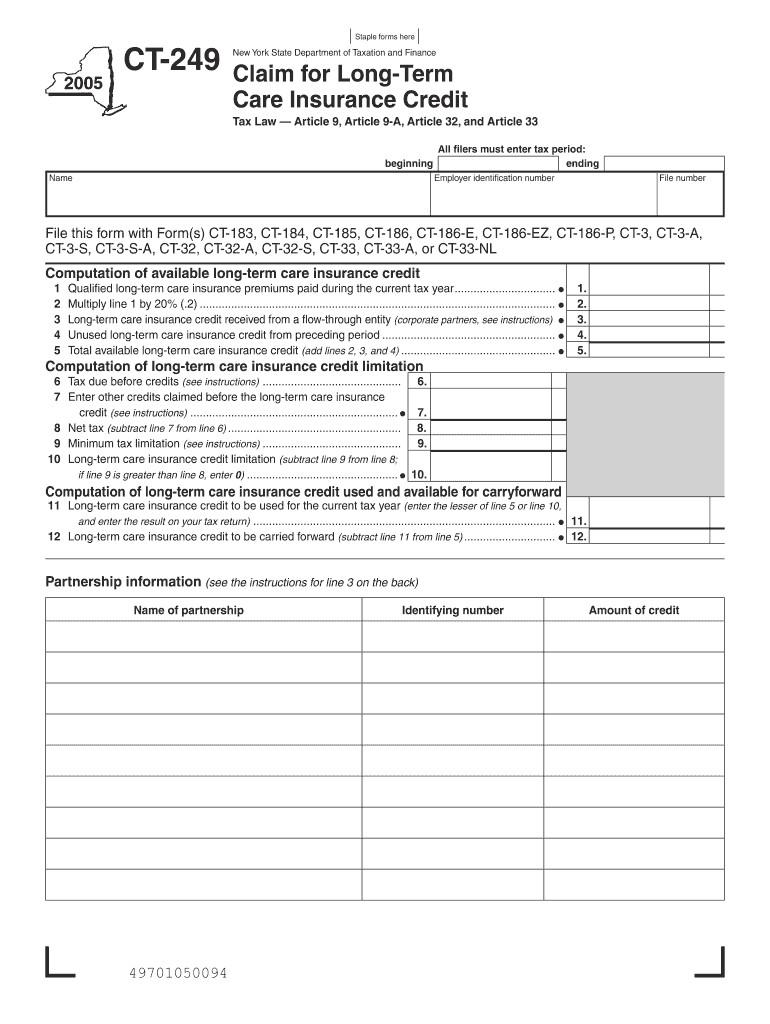

This form is used by corporate taxpayers in New York to claim a credit against taxes for premiums paid for long-term care insurance policies that meet specific qualifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for long-term care

Edit your claim for long-term care form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for long-term care form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for long-term care online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claim for long-term care. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for long-term care

How to fill out Claim for Long-Term Care Insurance Credit

01

Gather necessary documents including your Long-Term Care Insurance policy.

02

Obtain the Claim for Long-Term Care Insurance Credit form from your insurance provider or their website.

03

Fill out personal information at the top of the form, including your name, address, and policy number.

04

Provide information about the long-term care services you received, including dates, type of service, and provider details.

05

Attach any required documentation such as invoices, receipts, or proof of payment.

06

Review your form for accuracy and completeness before signing.

07

Submit the completed form and attachments to your insurance provider via the method they specify (mail, fax, or online submission).

08

Keep a copy of the submitted form and all documentation for your records.

Who needs Claim for Long-Term Care Insurance Credit?

01

Individuals who have a Long-Term Care Insurance policy and have incurred eligible long-term care expenses.

02

Policyholders who want to receive tax benefits or credits for their long-term care insurance premiums.

03

Caregivers of individuals receiving long-term care who want to claim associated costs under their policy.

Fill

form

: Try Risk Free

People Also Ask about

Can I deduct long-term care insurance premiums on my taxes?

The IRS allows qualified taxpayers to deduct a portion of their long-term care insurance premiums on their tax returns based on their age. Generally, you must itemize deductions and have expenses that exceed the AGI threshold to qualify. There is an exception for qualified self-employed individuals.

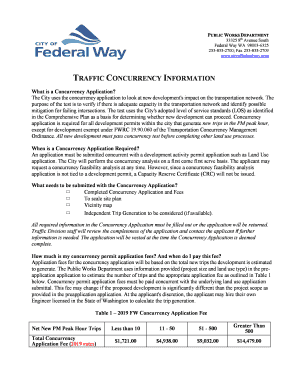

What is the income limit for the NYS long-term care credit?

For tax years beginning after 2020, the credit has been adjusted to allow a New York resident taxpayer to claim the credit only if the taxpayer's New York adjusted gross income (NYAGI) is less than $250,000. The change also limited the credit amount to $1,500.

Can I claim long-term care insurance on my taxes?

You may be eligible to deduct qualified long-term care expenses that exceed 7.5% of your AGI. Qualified expenses include any expenses to treat, cure, or improve any type of health condition. This includes the inability to care for yourself. Long-term care insurance premiums fall on the list of IRS-approved expenses.

How do I claim health care tax credit?

This means that you will be responsible for the full cost of your monthly premiums. To claim a Premium Tax Credit for any tax year in which no APTC was paid on your behalf, you must file a Form 8962 and attach it to your federal income tax return for the year you claim the Premium Tax Credit.

How to file a claim for long-term care insurance?

How to File a Long-Term Care Insurance Claim Contact the insurance company to get a claim packet. If you worked with a financial professional to get long-term care insurance, he or she will be able to help you start the process. Fill out the claim packet. Attend a phone interview. Wait for a response.

When did long-term care premiums become tax deductible?

Answer: Yes, if you itemize your deductions and your parent was your dependent either at the time the medical services were provided or at the time you paid the expenses, you may claim a deduction for the portion of their expenses that you paid during the taxable year, not compensated for by insurance or otherwise.

Are long-term care benefits taxable in the IRS?

Congress passed a new law in 1996 called the Health Insurance Portability and Accountability Act. Starting in 1997 tax year, this law may let you deduct all or part of the premium for a long-term care (LTC) insurance policy. Your LTC premium can be added to your other deductible medical expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Long-Term Care Insurance Credit?

A Claim for Long-Term Care Insurance Credit is a request submitted by policyholders to receive tax credits for expenses incurred from long-term care insurance premiums paid.

Who is required to file Claim for Long-Term Care Insurance Credit?

Individuals who have incurred expenses for long-term care insurance premiums and are eligible for tax credits are required to file the Claim for Long-Term Care Insurance Credit.

How to fill out Claim for Long-Term Care Insurance Credit?

To fill out the Claim for Long-Term Care Insurance Credit, you need to provide personal identification information, the amount of premiums paid, and any relevant details from the insurance policy.

What is the purpose of Claim for Long-Term Care Insurance Credit?

The purpose of the Claim for Long-Term Care Insurance Credit is to allow eligible taxpayers to receive a financial benefit through tax credits for the cost of long-term care insurance.

What information must be reported on Claim for Long-Term Care Insurance Credit?

The information that must be reported includes the taxpayer's identification, details of the insurance policy, amount of premiums paid, and any other necessary documentation to support the claim.

Fill out your claim for long-term care online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Long-Term Care is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.