Get the free PT-100 - tax ny

Show details

Use this form to report transactions for the month of December 2005 related to petroleum business taxes in New York State.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pt-100 - tax ny

Edit your pt-100 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pt-100 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pt-100 - tax ny online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pt-100 - tax ny. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

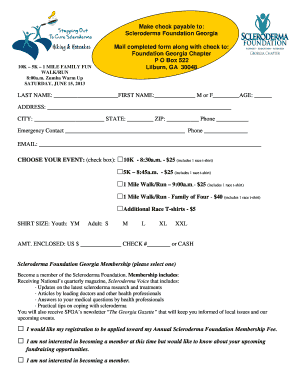

How to fill out pt-100 - tax ny

How to fill out PT-100

01

Start with the applicant's name and contact information in the designated fields.

02

Provide the date on which the form is being filled out.

03

Complete the section for identifying the nature of the claim or request.

04

Fill in any relevant dates related to the claim.

05

Include detailed descriptions as required in each section.

06

Attach any necessary supporting documents with the form.

07

Review all entries for accuracy before submission.

08

Sign and date the form where indicated.

Who needs PT-100?

01

Individuals filing for benefits or claims that require the use of PT-100.

02

Organizations that assist clients with financial claims or benefits.

03

Professionals in fields related to health care or social services.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of PT-100?

PT100 refers to a type of temperature sensor with a platinum resistance element. The “PT” stands for platinum, and “100” denotes its nominal resistance at 0 degrees Celsius. PT100 sensors are widely used for precise temperature measurements in various industrial and scientific applications.

What is PT200?

A PT200 temperature sensor is a type of resistance temperature detector (RTD) that uses platinum as the sensing element. The "PT" denotes platinum, and "200" refers to the sensor's resistance in ohms at 0°C.

What is the difference between PT100 and PT 1000?

The main difference between Pt100s and Pt1000s in general is the electrical resistance at 0⁰C, which is the number in the name: a Pt100 is 100Ω at 0⁰C and a Pt1000 is 1000Ω at ⁰C. This makes Pt1000s more accurate for small temperature changes as they would result in larger changes in resistance when compared to Pt100s.

What is Pt1000?

The first part of the name Pt1000, 'Pt', is the chemical symbol for Platinum and this shows that the sensor is Platinum-based. The second part, 1000, indicates the nominal resistance of the sensor at 0°C. In this case 1000Ω.

What is the difference between PT100 and PT200?

PT100 sensors provide accurate readings and are known for their stability over a wide temperature range, which is why they are the preferred choice in many sectors. On the other hand, PT200 sensors have a 200-ohm resistance, which results in different performance characteristics.

What is the PT-100 form?

The PT-100 form serves to report the personal property owned by businesses for tax assessments. It provides necessary information to local tax authorities for accurate billing. Proper filing ensures compliance and avoids penalties associated with late submissions.

What is a PT-100 tax form?

The PT-100 form serves to report the personal property owned by businesses for tax assessments. It provides necessary information to local tax authorities for accurate billing. Proper filing ensures compliance and avoids penalties associated with late submissions.

What is the difference between PT and RTD?

There is no difference a PT100 is a version of a RTD (resistance temperature detector). What is an RTD? A resistance temperature detector, also known as an RTD or resistance thermometer, is a type of temperature sensor.

What is the difference between PT100 and PT500?

PT100 has a resistance of 100 Ohm, PT500 of 500 Ohm and PT1000 of 1000 Ohm, resulting in different sensitivities and application ranges. All are made of high-purity platinum and guarantee excellent long-term stability and precise measurement results even under difficult conditions.

What is the PA 100 form used for?

New businesses file PA-100 to set up state tax accounts. Existing businesses file PA-100 to add or amend state tax accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PT-100?

PT-100 is a tax form used for reporting personal income and determining tax obligations for individuals or entities in certain jurisdictions.

Who is required to file PT-100?

Individuals or entities earning income within the jurisdiction that requires PT-100 must file the form, typically including self-employed individuals and businesses.

How to fill out PT-100?

To fill out PT-100, gather all necessary financial documents, complete each section of the form accurately with reported income, deductions, and other required information, and submit it by the designated deadline.

What is the purpose of PT-100?

The purpose of PT-100 is to report personal income to tax authorities to ensure accurate taxation based on earnings and to document tax liability.

What information must be reported on PT-100?

PT-100 must report information such as total income, deductions, taxable income, and any applicable credits or adjustments.

Fill out your pt-100 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pt-100 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.