Get the free Oneida County Sales and Use Tax Rate Increase - tax ny

Show details

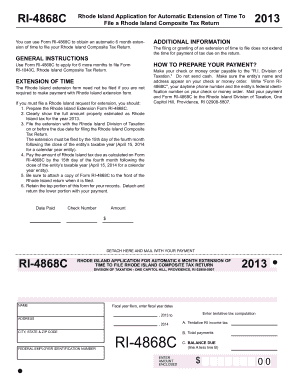

This document informs taxpayers about the increase in the sales and use tax rate in Oneida County, effective March 1, 2005, detailing reporting requirements and transitional provisions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oneida county sales and

Edit your oneida county sales and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oneida county sales and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oneida county sales and online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oneida county sales and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oneida county sales and

How to fill out Oneida County Sales and Use Tax Rate Increase

01

Obtain the Oneida County Sales and Use Tax Rate Increase form from the official county website or local government office.

02

Carefully read the instructions provided with the form to understand the requirements and eligibility.

03

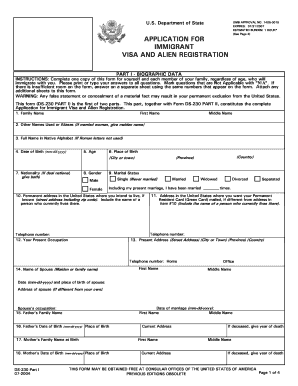

Fill out your personal and business information as required on the form.

04

Specify the reason for the tax rate increase in the designated section of the form.

05

Include any required documentation or proof of your claim if necessary.

06

Review your completed form for accuracy and completeness.

07

Submit the form by the specified deadline, either online or in person at the appropriate government office.

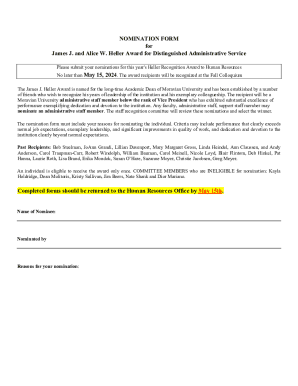

Who needs Oneida County Sales and Use Tax Rate Increase?

01

Businesses operating within Oneida County that need to adjust their tax rates due to changes in regulations.

02

Residents of Oneida County who will be impacted by the increase in sales and use tax.

03

Tax professionals assisting clients with tax compliance in Oneida County.

Fill

form

: Try Risk Free

People Also Ask about

What county in New York state has the highest sales tax?

New York County Sales Tax Rates in 2020 Tompkins County 8.00% Ulster County 8.00% Warren County 7.00% Washington County 7.00% Wayne County 8.00% Westchester County 8.88% Wyoming County 8.00% Yates County 8.00%

Which counties in NY have the highest property taxes?

The 16 counties with the highest median property tax payments all have bills exceeding $10,000: California: Marin County. New Jersey: Bergen, Essex, Hunterdon, Monmouth, Morris, Passaic, Somerset, and Union counties. New York: Nassau, New York, Putnam, Rockland, Suffolk, and Westchester counties.

What is New York County sales tax rate?

Purchases above $110 are subject to a 4.5% NYC sales tax and a 4% NY State sales tax. The City Sales Tax rate is 4.5%, NY State Sales and use tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total sales and use tax of 8.875 percent.

Where is the most expensive sales tax?

rates actually impose quite high combined state and local rates compared to other states. The five states with the highest average combined state and local sales tax rates are Louisiana (10.12 percent), Tennessee (9.56 percent), Arkansas (9.46 percent), Washington (9.43 percent), and Alabama (9.43 percent).

How do I calculate sales tax on a car in NY?

New York's statewide sales tax is 4%. That rate applies to all car purchases, whether you're buying new or used. However, you'll also need to pay county or local sales tax on top of that base 4%.

What is the sales tax rate in Oneida County, NY?

Oneida County sales tax details The minimum combined 2025 sales tax rate for Oneida County, New York is 8.75%. This is the total of state, county, and city sales tax rates. The New York sales tax rate is currently 4.0%.

What is the highest tax rate in New York State?

New York state income tax rates. New York has nine income tax rates: 4%, 4.5%, 5.25%, 5.5%, 6%, 6.85%, 9.65%, 10.3% and 10.9%. The tax rates and brackets below apply to taxable income earned in 2024, which is reported on tax returns that were due April 15, 2025.

What is the property tax rate in Oneida County NY?

In Oneida County, the effective property tax rate stands at 2.27%, significantly higher than the national median property tax rate of 1.02%. Within the county, Sylvan Beach has the highest median tax rate at 3.40%, while Sherrill boasts the lowest at 0.58%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oneida County Sales and Use Tax Rate Increase?

The Oneida County Sales and Use Tax Rate Increase refers to a change in the local sales tax rate implemented by Oneida County, which affects the amount of sales tax added to the purchase prices of goods and services within the county.

Who is required to file Oneida County Sales and Use Tax Rate Increase?

Businesses and vendors who sell goods and services subject to sales tax in Oneida County are required to file for the Oneida County Sales and Use Tax Rate Increase. This includes retailers, wholesalers, and service providers operating within the county.

How to fill out Oneida County Sales and Use Tax Rate Increase?

To fill out the Oneida County Sales and Use Tax Rate Increase form, you need to provide your business information, detail the sales amounts, calculate the applicable sales tax based on the new rate, and ensure all required sections of the form are completed accurately before submission.

What is the purpose of Oneida County Sales and Use Tax Rate Increase?

The purpose of the Oneida County Sales and Use Tax Rate Increase is to generate additional revenue for the county to fund public services, infrastructure projects, and community programs that benefit residents and improve overall quality of life.

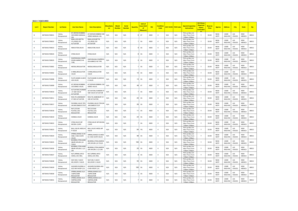

What information must be reported on Oneida County Sales and Use Tax Rate Increase?

The information that must be reported includes seller's identification, total sales amounts, breakdown of taxable and non-taxable sales, the amount of sales tax collected, and any deductions or exemptions claimed under the applicable law.

Fill out your oneida county sales and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oneida County Sales And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.