Get the free Fulton County Sales and Use Tax Rate Increase - tax ny

Show details

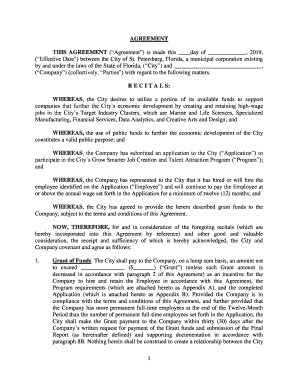

This document provides information regarding the increase of the sales and use tax rate in Fulton County, effective December 1, 2005, outlining the new tax rates, reporting requirements, and special

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fulton county sales and

Edit your fulton county sales and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fulton county sales and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fulton county sales and online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fulton county sales and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fulton county sales and

How to fill out Fulton County Sales and Use Tax Rate Increase

01

Obtain the Fulton County Sales and Use Tax Rate Increase application form from the official website or local government office.

02

Read the instructions carefully to understand the requirements and guidelines for filling out the form.

03

Begin filling out the form by entering your personal information, including your name, address, and contact details.

04

Provide details about your business or property that is subject to the sales and use tax.

05

Clearly state the reason for the tax rate increase and how it will benefit the county.

06

Include any necessary documentation or supporting materials that are required by the form.

07

Review all information for accuracy and completeness before submission.

08

Submit the completed form to the designated office, either in person or via the specified online platform.

Who needs Fulton County Sales and Use Tax Rate Increase?

01

Businesses operating within Fulton County that collect sales tax.

02

Residents of Fulton County who may be affected by changes in local tax rates.

03

Local government officials and policymakers involved in the administration of tax rates.

04

Consumers who purchase goods and services in Fulton County and may be impacted by the tax rate increase.

Fill

form

: Try Risk Free

People Also Ask about

Why did I get a $500 check from Georgia?

ing to the state's Department of Revenue, Georgia tax surplus refund amounts will be as follows: $250 for single and married filing separate filers. $375 for heads of household. $500 for married filing joint filers.

Did Georgia taxes go up?

With this second acceleration cutting the state income tax rate by another 20 basis points, the total income tax rate will now be down to just 5.19 percent - a decrease of 56 basis points from the original rate of 5.75 percent.

What is the current tax rate in Georgia?

In 2024, Georgia simplified its tax system by consolidating its six tax rates into one flat tax rate of 5.39%. Georgia Department of Revenue. 2023 IT-511 Individual Income Tax Booklet. Accessed Dec 18, 2024.

What is the sales tax rate for Fulton County, GA?

Fulton County sales tax details The minimum combined 2025 sales tax rate for Fulton County, Georgia is 8.9%. This is the total of state, county, and city sales tax rates. The Georgia sales tax rate is currently 4.0%. The Fulton County sales tax rate is 3.0%.

How much is $70,000 a year after taxes in Georgia?

If you make $70,000 a year living in the region of Georgia, USA, you will be taxed $17,065. That means that your net pay will be $52,935 per year, or $4,411 per month. Your average tax rate is 24.4% and your marginal tax rate is 35.4%.

What city in Georgia has the highest taxes?

Those who reside in Fulton and Gwinnett paid the highest property tax in all of the Georgia counties assessed by Attom last year, with taxes on average of $6,931 in Fulton and $4,276 in Gwinnett.

Did Fulton County property taxes increase?

The millage rate adopted by the Fulton County Commission on Aug. 21 will raise property taxes by 3.74 percent, ing to figures released by the county.

Did Georgia income tax go up?

With this second acceleration cutting the state income tax rate by another 20 basis points, the total income tax rate will now be down to just 5.19 percent - a decrease of 56 basis points from the original rate of 5.75 percent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fulton County Sales and Use Tax Rate Increase?

The Fulton County Sales and Use Tax Rate Increase refers to an adjustment in the local sales tax rate applied to goods and services sold within Fulton County, aimed at generating additional revenue for local public services and infrastructure.

Who is required to file Fulton County Sales and Use Tax Rate Increase?

Businesses and individuals who sell tangible personal property or certain services within Fulton County are required to file for the Fulton County Sales and Use Tax Rate Increase.

How to fill out Fulton County Sales and Use Tax Rate Increase?

To fill out the Fulton County Sales and Use Tax Rate Increase form, you must provide relevant business information, details about sales transactions, calculate the tax based on sales, and submit the form along with any required payment to the appropriate county tax authority.

What is the purpose of Fulton County Sales and Use Tax Rate Increase?

The purpose of the Fulton County Sales and Use Tax Rate Increase is to raise funds for essential public services, such as education, public safety, infrastructure development, and community improvement projects.

What information must be reported on Fulton County Sales and Use Tax Rate Increase?

Businesses must report total sales amounts, the applicable tax rate, the total amount of tax collected, and any exemptions that may apply on the Fulton County Sales and Use Tax Rate Increase form.

Fill out your fulton county sales and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fulton County Sales And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.