Get the free Claim for QEZE Tax Reduction Credit - tax ny

Show details

This form is used by taxpayers in New York State to claim the QEZE tax reduction credit based on employment and business operations within qualified empire zones.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for qeze tax

Edit your claim for qeze tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for qeze tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for qeze tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit claim for qeze tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for qeze tax

How to fill out Claim for QEZE Tax Reduction Credit

01

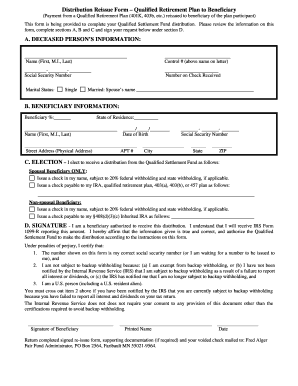

Obtain the Claim for QEZE Tax Reduction Credit form from the relevant tax authority's website or office.

02

Read the instructions carefully to understand the eligibility requirements for the credit.

03

Fill in your business information, including name, address, and tax identification number.

04

Provide detailed information about your qualifying economic development zone and how you meet the criteria.

05

Calculate the amount of QEZE tax reduction credit you are claiming based on the provided guidelines.

06

Attach any necessary documentation that supports your claim, such as proof of eligibility or financial statements.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the appropriate tax authority by the specified deadline.

Who needs Claim for QEZE Tax Reduction Credit?

01

Businesses operating in a Qualified Empire Zone Enterprise (QEZE) that meet the eligibility requirements for the tax reduction.

Fill

form

: Try Risk Free

People Also Ask about

What is the foreign tax deduction credit?

The foreign tax credit is intended to relieve you of the double tax burden when your foreign source income is taxed by both the United States and the foreign country. The foreign tax credit can only reduce U.S. taxes on foreign source income; it cannot reduce U.S. taxes on U.S. source income.

What is a qeze credit?

Certain businesses that still have Empire Zone Certification can get special tax credits. These businesses are called Qualified Empire Zone Enterprises (QEZEs). Please note that the Empire Zone program is closed to new participants. Credits are available for investment in property or hiring new employees.

What is credit reduction?

If a state fails to repay the loan in time, they are deemed a Credit Reduction State. Contrary to popular belief, the default rate for Federal Unemployment Tax (FUTA) is not 0.6%. The actual FUTA base rate is 6%. However, the IRS allows employers to receive a credit of up to 5.4% if their FUTA liability is paid timely.

What does a tax reduction do?

Tax credits lower the tax owed, while tax deductions reduce taxable income. Credits provide the most substantial savings. 12 For example, a $1,000 tax credit lowers a tax bill by that same $1,000. Meanwhile, a $1,000 tax deduction reduces taxable income by that amount.

What is tax credit reduction?

What is a tax credit? A tax credit is a dollar-for-dollar reduction of the income tax owed. A tax credit directly decreases the amount of tax you owe .

Is a tax credit money you get back?

Some tax credits are refundable. If a taxpayer's tax bill is less than the amount of a refundable credit, they can get the difference back in their refund. Some taxpayers who aren't required to file may still want to do so to claim refundable tax credits. Not all tax credits are refundable, however.

What is a tax credit and how does it work?

A credit is an amount you subtract from the tax you owe. This can lower your tax payment or increase your refund. Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software.

What is a deduction tax credit allowance?

You can use credits and deductions to help lower your tax bill or increase your refund. Credits can reduce the amount of tax due. Deductions can reduce the amount of taxable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for QEZE Tax Reduction Credit?

The Claim for QEZE Tax Reduction Credit is a tax document used by qualified businesses in New York State to apply for a tax reduction based on their eligibility as a Qualified Empire Zone Enterprise (QEZE).

Who is required to file Claim for QEZE Tax Reduction Credit?

Qualified businesses that are recognized as QEZE and meet the necessary criteria to receive tax benefits are required to file the Claim for QEZE Tax Reduction Credit.

How to fill out Claim for QEZE Tax Reduction Credit?

To fill out the Claim for QEZE Tax Reduction Credit, businesses must complete the specified form by providing necessary business information, tax identification numbers, and any required supporting documentation, following the instructions outlined on the form.

What is the purpose of Claim for QEZE Tax Reduction Credit?

The purpose of the Claim for QEZE Tax Reduction Credit is to provide financial relief and incentivize business growth within designated Empire Zones in New York State by reducing the tax burden on qualifying enterprises.

What information must be reported on Claim for QEZE Tax Reduction Credit?

The Claim for QEZE Tax Reduction Credit requires reporting of business identification details, tax identification numbers, qualifying income, applicable deductions, and any relevant financial data that supports the claim for the credit.

Fill out your claim for qeze tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Qeze Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.