Get the free Form IT-182 - tax ny

Show details

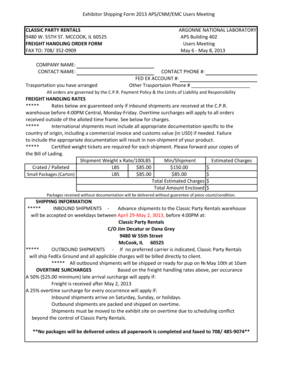

This form is used by nonresident and part-year resident individuals, estates, or trusts to report the amount of allowed passive activity losses from New York sources for the current tax year, addressing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form it-182 - tax

Edit your form it-182 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form it-182 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form it-182 - tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form it-182 - tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form it-182 - tax

How to fill out Form IT-182

01

Obtain Form IT-182 from the official tax website or local tax office.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Indicate your filing status (single, married, etc.) in the appropriate section.

04

Report your income as required in the designated fields.

05

Calculate any deductions and credits you are eligible for.

06

Double-check all the entries for accuracy.

07

Sign and date the form at the bottom.

08

Submit the completed form according to the instructions (electronically or via mail).

Who needs Form IT-182?

01

Individuals who have claimed a tax credit or have specific deductions to report.

02

Taxpayers seeking to claim certain adjustments to their income.

03

Residents who are required to file state income tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the 203 tax form?

NY Form IT-203 is a New York State income tax return for nonresidents and part-year residents. It is used to report income earned in New York State by individuals who are not considered to be full-year residents of the state.

What is a 1099b form for taxes?

Form 1099-B reports transaction proceeds from broker transactions or bartering networks. If you've sold stocks, bonds, or other securities, you'll receive a 1099-B from each broker by February 17th. This form contains vital details, such as the item description, purchase and sale dates, and any federal tax withheld.

What does form It-201 mean?

The State Tax Form 201, also known as IT-201, is the standard income tax return form for New York State residents. This form is used to report income, calculate tax liability, and claim credits or deductions. Think of it as the New York equivalent of the federal Form 1040.

What is the difference between Form IT 201 and 203?

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203.

What is the tax code 203?

What Is Tax Topic 203? Tax Topic 203, also referred to as Reduced Refund, is an informative page that the IRS will direct you to if they have deducted a portion of your federal income tax refund to satisfy specific financial debts through the Treasury Department's tax refund offset program.

What is an IT 203 B form?

New York Form IT-203-B is used to allocate income to the state during the period of the taxpayer's (and spouse's) period of nonresidency and to indicate where in the state the taxpayer and/or spouse maintained living quarters, if any.

What is the purpose of the Schedule B tax form?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What is the difference between earned income, passive income, and investment income?

You must file Form Y-203, Yonkers Nonresident Earnings Tax Return, if you file or are required to file a New York State return, and you are a nonresident of Yonkers who earns wages or carries on a trade or business there, or are a member of a partnership that carries on a trade or business there.

Who must file form it 203?

The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201 and both spouses' income will be taxed as full-year residents of New York State.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form IT-182?

Form IT-182 is a New York State tax form used for claiming a New York State resident personal income tax credit for certain taxpayers.

Who is required to file Form IT-182?

Individuals who are New York State residents and are eligible for certain tax credits must file Form IT-182, specifically those who qualify based on income and family size.

How to fill out Form IT-182?

To fill out Form IT-182, taxpayers need to provide personal information, enter income details, claim the appropriate credits, and calculate the resulting tax liability or refund.

What is the purpose of Form IT-182?

The purpose of Form IT-182 is to enable eligible taxpayers in New York State to claim personal income tax credits that can reduce their tax liability.

What information must be reported on Form IT-182?

Taxpayers must report their personal identification information, income, details of any credits being claimed, and any necessary financial documentation.

Fill out your form it-182 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form It-182 - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.