Get the free IT-220 Minimum Income Tax - tax ny

Show details

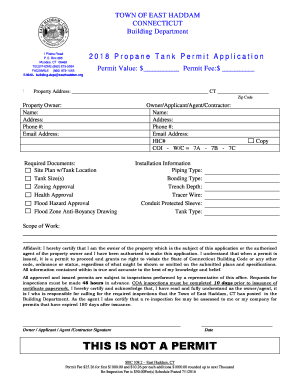

This form is used to report and calculate the minimum income tax due in New York State and New York City for various types of filers including residents, nonresidents, and estates or trusts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-220 minimum income tax

Edit your it-220 minimum income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-220 minimum income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-220 minimum income tax online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it-220 minimum income tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-220 minimum income tax

How to fill out IT-220 Minimum Income Tax

01

Gather all necessary information including your total income and any exemptions.

02

Obtain a copy of the IT-220 form from the tax authority's website or office.

03

Fill out your personal information such as name, address, and Social Security number at the top of the form.

04

Report your total income for the year in the designated section of the form.

05

Calculate any allowable deductions or credits as specified in the instructions.

06

Subtract your deductions from your total income to determine your taxable income.

07

Follow the instructions to calculate the minimum income tax owed based on your taxable income.

08

Review all entries for accuracy before signing and dating the form.

09

Submit your completed IT-220 form to the appropriate tax authority by the deadline.

Who needs IT-220 Minimum Income Tax?

01

Individuals or entities that have reached a minimum income threshold as defined by state laws.

02

Taxpayers who do not pay sufficient taxes through withholding or estimated payments.

03

Residential property owners who may qualify for a tax exemption but are required to file.

04

Those who are required to report minimum income taxes on specific income types.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum amount for income tax?

Income Tax Slab Rates - An Overview Up to Rs. 4 lakh - NIL. 4 lakh - Rs. 8 lakh - 5% 8 lakh - Rs. 12 lakh - 10% 12 lakh - Rs. 16 lakh - 15% 16 lakh - Rs. 20 lakh - 20% 20 lakh - Rs. 24 lakh - 25% Above Rs. 24 lakh - 30%.

What is the minimum salary to pay income tax in USA?

Filing status and minimum income requirements Filing StatusAgeMinimum Income Requirement (2024) Single Under 65 $14,600 Single 65 or older $16,550 Married filing separately Any age $5 Head of household Under 65 $21,9007 more rows

How much do you need to earn before paying tax in the USA?

Single filing status. don't have any special circumstances that require you to file (like self-employment income) earn less than $14,600 (which is the 2024 Standard Deduction for a taxpayer filing as Single)

What is the minimum income before paying taxes?

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least: single under 65 $12,950 single 65 or older $14,700 head of household under 65 $19,400 head of household 65 or older $21,1506 more rows

What is Section 220 of the income tax?

When tax payable and when assessee deemed in default. (1)Any amount, otherwise than by way of advance tax, specified as payable in a notice of demand under section 156 shall be paid within [thirty days] [ Substituted by Act 4 of 1988, Section 85, for " thirty-five days" (w.e.f. 1.4. 1989).]

What is the minimum salary to pay taxes?

R95 750 if you are younger than 65 years. If you are 65 years of age to below 75 years, the tax threshold (i.e. the amount above which income tax becomes payable) is R148 217. For taxpayers aged 75 years and older, this threshold is R165 689.

How much money can I make without having to pay income tax?

This can pay anywhere from $285 to $7,830. So as long as you earned income, there is no minimum to file taxes in California.

What's the minimum income to file taxes?

Minimum Income to File Taxes in California IF your filing status is . . .AND at the end of 2022 you were* . . .THEN file a return if your gross income** was at least . . . Married filing separately any age $5 Head of household under 65 65 or older $20,800 $22,650 Qualifying widow(er) under 65 65 or older $27,700 $29,2002 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-220 Minimum Income Tax?

IT-220 Minimum Income Tax is a tax form used in certain jurisdictions to establish a minimum tax obligation for individuals or entities whose income falls below a certain threshold.

Who is required to file IT-220 Minimum Income Tax?

Individuals or entities whose income is below a specified minimum level or those who do not meet the standard filing requirements are typically required to file IT-220 Minimum Income Tax.

How to fill out IT-220 Minimum Income Tax?

To fill out IT-220 Minimum Income Tax, taxpayers must provide personal and financial information, report total income, and calculate the minimum tax due based on established rates and guidelines.

What is the purpose of IT-220 Minimum Income Tax?

The purpose of IT-220 Minimum Income Tax is to ensure that all taxpayers contribute a minimum amount of tax, even if their income is low, thereby helping to maintain state revenue.

What information must be reported on IT-220 Minimum Income Tax?

The IT-220 Minimum Income Tax typically requires reporting of personal identification information, total income, exemptions or deductions, and the calculation of the minimum tax owed.

Fill out your it-220 minimum income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-220 Minimum Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.