Get the free Claim for Low-Income Housing Credit - tax ny

Show details

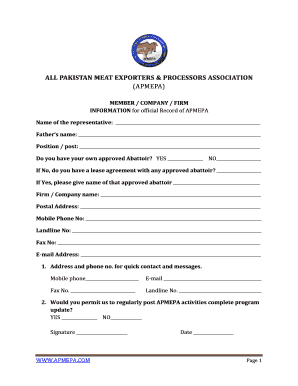

This form is used to claim a low-income housing credit for building owners and partners in New York State, attaching it to state tax returns.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for low-income housing

Edit your claim for low-income housing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for low-income housing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for low-income housing online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claim for low-income housing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

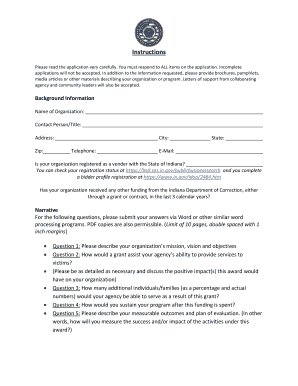

How to fill out claim for low-income housing

How to fill out Claim for Low-Income Housing Credit

01

Gather necessary documents such as proof of income, tax returns, and identification.

02

Obtain the Claim for Low-Income Housing Credit form from the appropriate housing authority or website.

03

Complete the personal information section, including name, address, and contact details.

04

Fill out the income section accurately, ensuring you include all sources of income.

05

Provide information on household members, including their incomes and relationship to you.

06

Verify that you meet the low-income criteria as outlined in the instructions.

07

Sign and date the form, certifying that all information provided is accurate.

08

Submit the completed form to the specified housing authority, either online or by mail.

Who needs Claim for Low-Income Housing Credit?

01

Individuals and families with low income seeking affordable housing opportunities.

02

Those who qualify under specific income limits set by local housing authorities.

03

Tenants living in or applying for low-income housing developments.

Fill

form

: Try Risk Free

People Also Ask about

What income qualifies for income tax credit?

Earned income tax credit 2024 Number of childrenAGI limit for single filers, head of household, married filing separately, or widowedAGI limit for married couples filing jointly Zero $18,591 $25,511 One $49,084 $56,004 Two $55,768 $62,688 Three or more $59,899 $66,819 Apr 8, 2025

Who qualifies for the low-income tax credit?

Who qualifies. You may claim the EITC if your income is low- to moderate. The amount of your credit may change if you have children, dependents, are disabled or meet other criteria. Military and clergy should review our special EITC rules because using this credit may affect other government benefits.

Who does not qualify for the earned income tax credit?

Your filing status cannot be “married filing separately.” • Generally, you must be a U.S. citizen or resident alien all year. You cannot be a qualifying child of another person. You cannot file Form 2555 or Form 2555-EZ (related to foreign earned income). Your income cannot exceed certain limitations.

What is the low-income tax credit?

The Low-Income Housing Tax Credit provides a tax incentive to construct or rehabilitate affordable rental housing for low-income households. The Low-Income Housing Tax Credit (LIHTC) subsidizes the acquisition, construction, and rehabilitation of affordable rental housing for low- and moderate-income tenants.

What is the federal tax credit for low-income?

Federal EITC: The federal Earned Income Tax Credit offers support for low-income working families and individuals. If you qualify, you may be eligible for cash back or a reduction of the taxes you owe.

What credit do you need for low-income housing?

Beyond income and assets, the government will not look at your credit score for government subsidies. The good news is that in some scenarios, that means you can get government housing without having a credit check. Sometimes though, these subsidies come in the form of vouchers.

What are the requirements for low-income housing in California?

The test is to verify that 50% or more of the tax-exempt bond proceeds are used to finance the aggregate basis of any building and the land on which the building is located. Failure to meet the 50% Test is catastrophic to a low-income housing tax credit project.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Low-Income Housing Credit?

The Claim for Low-Income Housing Credit is a tax form used by property owners to claim tax credits for investing in low-income housing. These credits are designed to encourage the development and rehabilitation of affordable rental housing for low-income tenants.

Who is required to file Claim for Low-Income Housing Credit?

The property owners or developers of qualified low-income housing are required to file the Claim for Low-Income Housing Credit. This includes individuals, partnerships, corporations, and other entities that own or operate eligible low-income housing projects.

How to fill out Claim for Low-Income Housing Credit?

To fill out the Claim for Low-Income Housing Credit, taxpayers need to complete the applicable tax forms provided by the IRS. This typically involves providing detailed information about the property, the amount of qualified expenses, the number of low-income units, and any previous credits claimed. Taxpayers should consult IRS guidelines and possibly a tax professional for accurate completion.

What is the purpose of Claim for Low-Income Housing Credit?

The purpose of the Claim for Low-Income Housing Credit is to incentivize the construction and rehabilitation of rental housing that is affordable for low-income households. It aims to increase the supply of affordable housing and reduce the financial burden on low-income families.

What information must be reported on Claim for Low-Income Housing Credit?

On the Claim for Low-Income Housing Credit, property owners must report information including the location of the property, the number of low-income units, the income levels of tenants, the amount of qualified expenses, and any previous credits taken. Compliance with specific state and federal guidelines is also required.

Fill out your claim for low-income housing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Low-Income Housing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.