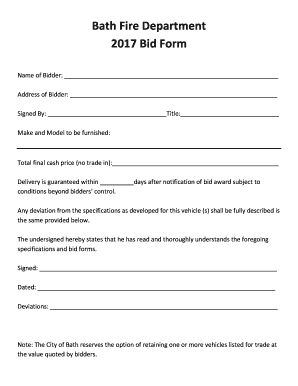

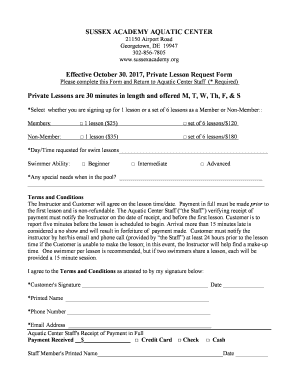

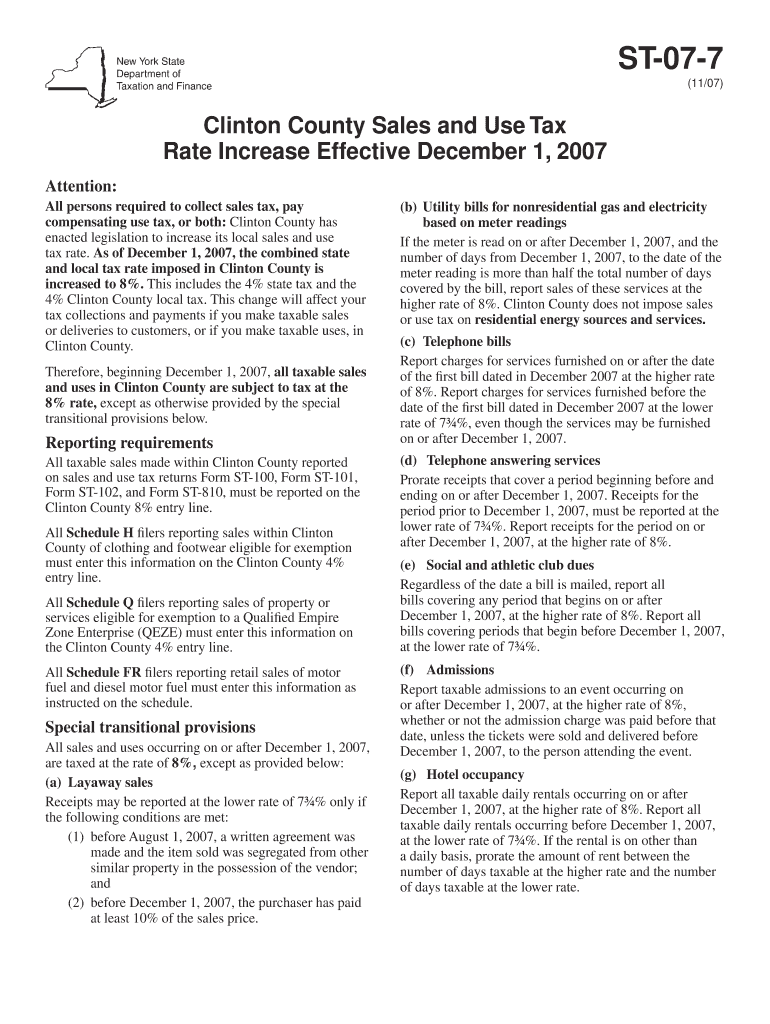

Get the free Clinton County Sales and Use Tax Rate Increase - tax ny

Show details

Notification regarding the increase in local sales and use tax rates in Clinton County, including specific guidelines for reporting and transitional provisions for various taxable sales and services.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign clinton county sales and

Edit your clinton county sales and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your clinton county sales and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit clinton county sales and online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit clinton county sales and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

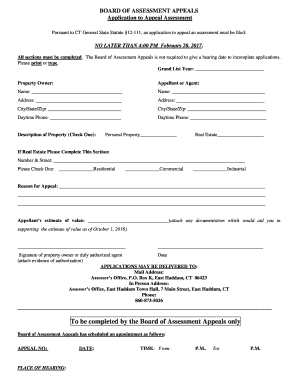

How to fill out clinton county sales and

How to fill out Clinton County Sales and Use Tax Rate Increase

01

Obtain the Clinton County Sales and Use Tax Rate Increase form from the county website or local government office.

02

Fill in personal information such as name, address, and contact details in the designated sections of the form.

03

Provide specific details about the sales and use tax rate increase, including the current tax rate and the proposed new rate.

04

Include any required financial information or supporting documentation as indicated on the form.

05

Review the completed form for accuracy and ensure all necessary signatures are included.

06

Submit the form to the designated county office either in person, by mail, or electronically, as per the instructions provided.

Who needs Clinton County Sales and Use Tax Rate Increase?

01

Local businesses and retailers operating in Clinton County that are affected by sales and use tax changes.

02

Residents of Clinton County who need to understand the implications of tax rate increases on their purchases.

03

Economic development agencies and community planners looking to assess the impact of tax changes on local growth.

04

Government officials and policymakers responsible for implementing and communicating tax changes to the public.

Fill

form

: Try Risk Free

People Also Ask about

What state has a 7% sales tax?

State-by-state sales tax breakdown State guidesState base rateTotal range Rhode Island 7% 7% South Carolina 6% 6%–9% South Dakota 4.50% 4.5%–6.5% Tennessee 7% 7%–10%47 more rows

Why did my federal taxes go up?

As your income goes up, the tax rate on the next layer of income is higher. When your income jumps to a higher tax bracket, you don't pay the higher rate on your entire income. You pay the higher rate only on the part that's in the new tax bracket.

Did taxes go up in 2025?

The seven federal tax rates remain the same for 2025: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The qualifying income for each 2025 tax bracket moves slightly higher compared to 2024. A key income threshold to watch for high-income filers is $197,300 for single filers and $394,600 for married couples filing jointly.

What are the highest taxed counties in the US?

Drilling down to the county level, disparities are even more pronounced. Salem County, NJ has the highest effective tax rate in the country at 2.382%, followed by Monroe County, NY, at 2.314%. Other counties in Illinois and New Jersey dominate the top of the list.

Will income taxes increase in 2026?

For individuals The TCJA reduced the top marginal income tax rate from 39.6% to 37% and updated the income tax thresholds across several income tax brackets. In 2026, the top rate is set to revert to 39.6%.

Will tax refunds be bigger in 2025?

Are tax refunds bigger this year? As of April 4, 2025, the average tax refund was $3,116, about 3.5% more than the $3,011 average in 2024. For filers with direct deposit, the average refund is now $$3,186, up from $3088 last year.

Will I pay more taxes in 2025?

For heads of households, the standard deduction will be $22,500 for tax year 2025, an increase of $600 from the amount for tax year 2024. Marginal rates. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly).

Why did my tax rate go up?

A progressive tax system means that tax rates increase as your taxable income goes up and your income enters a higher tax bracket. This has you pay a greater rate of tax on each successive chunk of income. Each chunk of income—income in a tax bracket—shows the percentage of tax you pay on that portion of your income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Clinton County Sales and Use Tax Rate Increase?

The Clinton County Sales and Use Tax Rate Increase is a legislative measure that raises the sales and use tax rates within Clinton County to provide funding for various public services and projects.

Who is required to file Clinton County Sales and Use Tax Rate Increase?

Businesses and individuals engaged in taxable sales or purchases within Clinton County are required to file for the Clinton County Sales and Use Tax Rate Increase.

How to fill out Clinton County Sales and Use Tax Rate Increase?

To fill out the Clinton County Sales and Use Tax Rate Increase form, you need to provide your business information, calculate the tax due based on the new rate, and submit the form to the appropriate county tax authority.

What is the purpose of Clinton County Sales and Use Tax Rate Increase?

The purpose of the Clinton County Sales and Use Tax Rate Increase is to generate additional revenue for funding essential local services such as education, infrastructure, and public safety.

What information must be reported on Clinton County Sales and Use Tax Rate Increase?

The information that must be reported includes total sales made, taxable purchases, the calculated sales tax amount due, and any applicable exemptions or deductions.

Fill out your clinton county sales and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Clinton County Sales And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.