Get the free CT-47 - tax ny

Show details

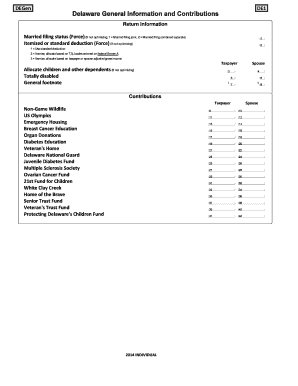

This form is used by agricultural property owners in New York to claim a tax credit based on eligible school district property taxes paid on qualified agricultural land.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct-47 - tax ny

Edit your ct-47 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-47 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct-47 - tax ny online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ct-47 - tax ny. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct-47 - tax ny

How to fill out CT-47

01

Gather all necessary personal information, including your name, address, and Social Security number.

02

Enter your filing status accurately in the designated section.

03

Fill out your income information, including wages, interest, and other sources of income.

04

Calculate your total income and ensure it is correctly reported.

05

Deduct any applicable exemptions and adjustments as instructed.

06

Report your credits and any additional taxes owed.

07

Review all sections for accuracy and completeness.

08

Sign and date the form before submission.

Who needs CT-47?

01

Individuals or businesses filing for a CT-47 form may include self-employed persons, contractors, and those who need to report additional income or tax credits.

02

People who are claiming certain tax deductions or adjustments also need this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the range of the CT47 scan?

Quick and accurate data capture from 3 inches (8 centimeters) up to 80 feet (24 meters) with Honeywell's innovative FlexRange XLR scan engine; supporting virtually every use case. Outfitted with Multi-factor Biometric Authentication, the CT47 keeps user and company data secure.

What is the Honeywell recipe computer?

The Honeywell Kitchen Computer was a special offering of the H316 pedestal model by Neiman Marcus in 1969 as one of a continuing series of extravagant gift ideas. It was offered for US$10,000 (equivalent to US$86,000 in 2024), weighed over 100 pounds (over 45 kg) and was advertised as useful for storing recipes.

What processor is in the Honeywell CT47?

Inside the CT47 lies a 2.7 GHz Qualcomm QCS6490/QCM6490 octa core processor with 6 or 8 GB DDR4x RAM and 128 GB UFS for reliable performance. The 4,750 mAh battery (standard) or the 4,400 mAh battery (wireless) ensure plenty of power.

How to factory reset Honeywell CT47?

- How do I reset my Honeywell CT47 to factory settings? Go to Settings > System > Reset options > Erase all data (factory reset). Confirm the action and follow the prompts to reset the device.

What is the range of the CT47 scan?

Quick and accurate data capture from 3 inches (8 centimeters) up to 80 feet (24 meters) with Honeywell's innovative FlexRange XLR scan engine; supporting virtually every use case. Outfitted with Multi-factor Biometric Authentication, the CT47 keeps user and company data secure.

What is CT47?

CT47 mobile computer, built on the Mobility Edge™ platform, are ultra-rugged, all-purpose productivity devices ensuring reliable performance, 5G data connectivity and communications for front-line mobile workers in logistics, warehouse and fieldwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CT-47?

CT-47 is a tax form used to report certain financial information to state tax authorities, typically related to business income or activity.

Who is required to file CT-47?

Businesses operating within the jurisdiction that meet specific income or activity thresholds are required to file CT-47.

How to fill out CT-47?

To fill out CT-47, gather required financial records, complete all sections of the form accurately, and ensure all calculations are correct before submission.

What is the purpose of CT-47?

The purpose of CT-47 is to provide tax authorities with accurate information regarding a business's financial activities for proper tax assessment.

What information must be reported on CT-47?

CT-47 must report total income, deductible expenses, and any pertinent financial data required for tax calculations.

Fill out your ct-47 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct-47 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.