Get the free Claim for ZEA Wage Tax Credit - tax ny

Show details

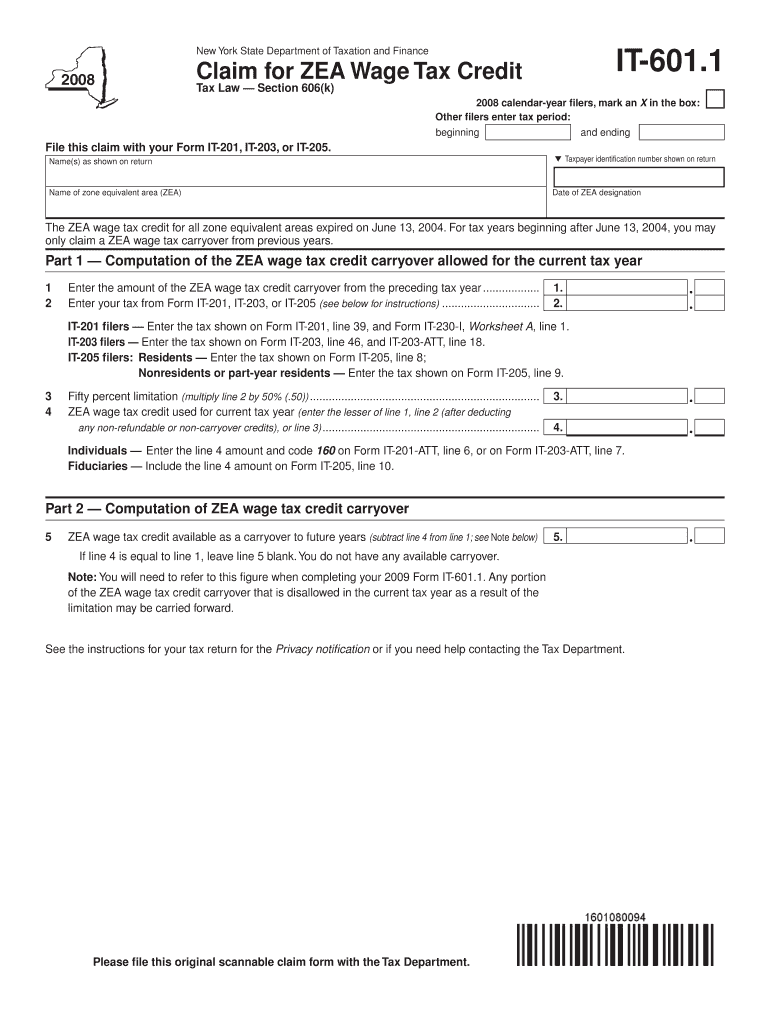

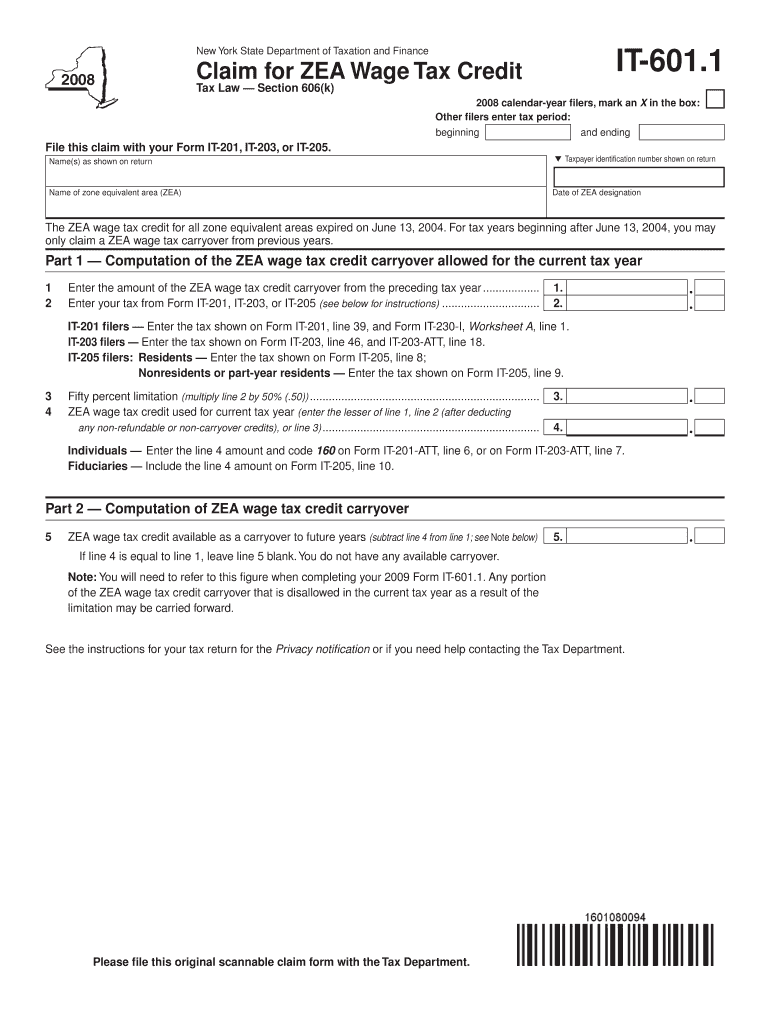

This form is used to claim the ZEA wage tax credit carryover for tax filings in New York State.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for zea wage

Edit your claim for zea wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for zea wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for zea wage online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claim for zea wage. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

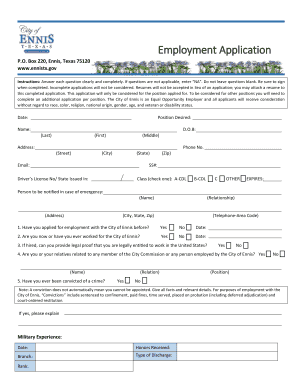

How to fill out claim for zea wage

How to fill out Claim for ZEA Wage Tax Credit

01

Gather necessary documents including business identification and employee information.

02

Access the official Claim for ZEA Wage Tax Credit form online or from your local tax office.

03

Fill in your business details, including your tax identification number.

04

Provide the details of the employees for whom you are claiming the tax credit.

05

Indicate the period for which you are claiming the credit.

06

Calculate the amount eligible for the tax credit based on the guidelines provided.

07

Review the form for accuracy and completeness.

08

Submit the completed form along with any required documentation to the relevant tax authority.

Who needs Claim for ZEA Wage Tax Credit?

01

Businesses that have been affected by economic disruptions and are eligible for the ZEA Wage Tax Credit.

02

Employers looking to support their workforce while receiving tax relief.

03

Companies that meet the specific criteria set forth by the tax authority for wage tax credits.

Fill

form

: Try Risk Free

People Also Ask about

Why do I get a NYC school tax credit?

New York City school tax credit (rate reduction amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had New York City taxable income of $500,000 or less.

What is the tax credit for wages?

More In Credits & Deductions The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

Who qualifies for a school tax credit?

Who can claim an education credit? There are additional rules for each credit, but you must meet all three of the following for both: You, your dependent or a third party pays qualified education expenses for higher education. An eligible student must be enrolled at an eligible educational institution.

Why am I getting a tax credit?

Tax credits are dollar-for-dollar reductions on the amount of income tax you owe. Depending on your expenses and financial situation, you may be eligible for a range of tax credits–from child-related credits to environmental and energy-efficient credits–to offset your tax bill.

Who pays the NYC UBT tax?

Sole proprietors, partnerships, LLCs, and other unincorporated businesses conducting business in New York City are generally subject to the Unincorporated Business Tax (UBT). This includes income earned from activities such as selling goods or services within the city.

Should I claim the foreign tax credit?

You are allowed to deduct all of your foreign taxes but can only take the foreign tax credit in the current year to the extent of your US income tax on foreign income. So if your foreign tax rate is high and your foreign income is low in relation to your US income, the deduction may have the better result.

Why am I getting a NYC school tax credit?

New York City school tax credit (rate reduction amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had New York City taxable income of $500,000 or less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for ZEA Wage Tax Credit?

The Claim for ZEA Wage Tax Credit is a tax credit available to eligible employers that helps reduce the tax liability associated with wages paid to employees. It is designed to encourage job retention and support businesses in specific sectors.

Who is required to file Claim for ZEA Wage Tax Credit?

Employers who meet specific eligibility criteria, such as those who have paid qualifying wages to employees and operate within designated sectors, are required to file the Claim for ZEA Wage Tax Credit.

How to fill out Claim for ZEA Wage Tax Credit?

To fill out the Claim for ZEA Wage Tax Credit, employers need to complete the designated form, providing necessary details about the business, employee wages, and any other relevant information as outlined in the instructions accompanying the form.

What is the purpose of Claim for ZEA Wage Tax Credit?

The purpose of the Claim for ZEA Wage Tax Credit is to provide financial relief to employers by reducing their tax burden, thus incentivizing them to retain employees and invest in their workforce.

What information must be reported on Claim for ZEA Wage Tax Credit?

Employers must report details such as the total number of qualifying employees, the wages paid to those employees during the eligible period, and any additional information required by the form to substantiate the claim.

Fill out your claim for zea wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Zea Wage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.