Get the free IT-112-C-I - tax ny

Show details

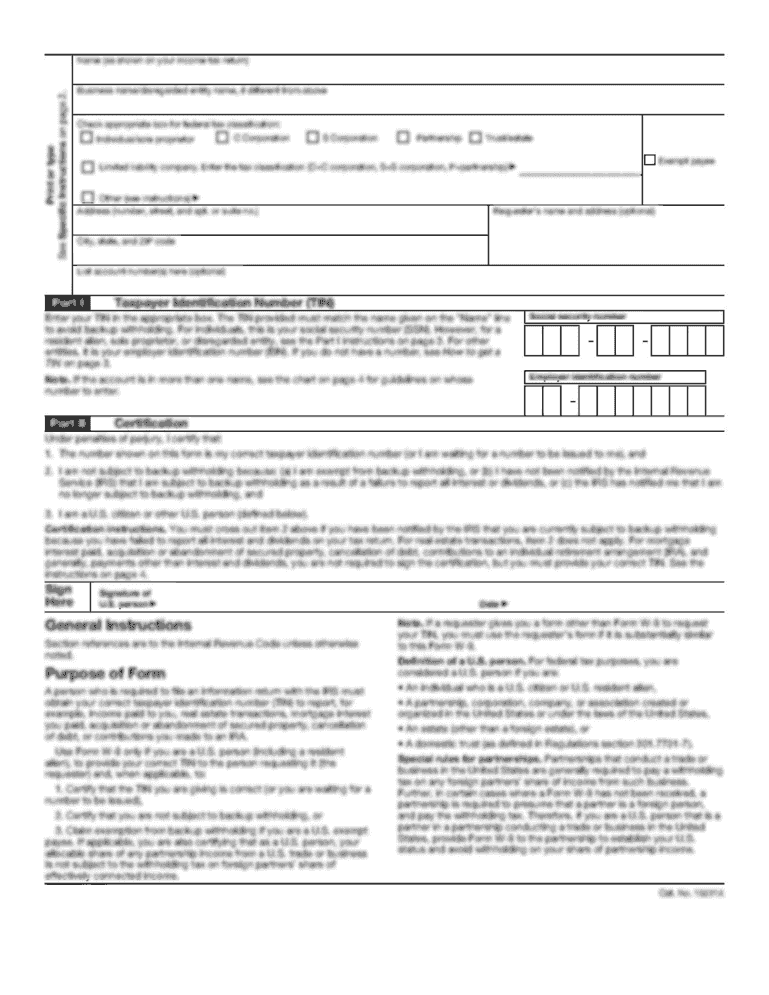

This document provides instructions for New York State residents to claim a credit against their state taxes for income taxes paid to a Canadian province.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-112-c-i - tax ny

Edit your it-112-c-i - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-112-c-i - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it-112-c-i - tax ny online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit it-112-c-i - tax ny. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-112-c-i - tax ny

How to fill out IT-112-C-I

01

Begin by downloading the IT-112-C-I form from the official tax website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) in the corresponding section.

04

Report your income details in the appropriate fields, including wages, dividends, and any other income sources.

05

Calculate your adjustments to income, if applicable, and enter them as instructed.

06

Follow the steps to determine your taxable income according to the guidelines provided.

07

Fill out the sections related to credits and deductions that you qualify for.

08

Review your completed form for any errors or omissions.

09

Sign and date the form before submission.

10

Submit the form either electronically or via mail, as per the instructions provided.

Who needs IT-112-C-I?

01

Individuals who have earned income and need to report it for tax purposes.

02

Taxpayers looking to claim specific deductions or credits available on the IT-112-C-I.

03

People who are residents of states that require this form for income tax reporting.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for the NYC school tax credit?

The New York City School Tax credit is available to New York City residents or part-year residents who cannot be claimed as a dependent on another taxpayer's federal income tax return. The credit amounts vary. This credit must be claimed directly on the New York State personal income tax return.

What is the New York State tax credit?

The Working Families Tax Credit is an expanded, improved refundable tax credit that combines the Empire State Child Credit (ESCC), the Earned Income Tax Credit (EITC), and the dependent exemption (DE) into one bigger, better credit!

Who qualifies for the New York State property tax credit?

The state Legislature enacted the real property tax credit to help senior citizens and lower- income households cope with their property tax burden. If your gross income is $18,000 or less and you pay $450 or less for rent or own your home, you may qualify for a tax credit.

Does NYS have a foreign tax credit?

New York does allow the foreign earned income and housing exclusions that may be claimed for federal tax purposes. New York does not allow a credit for income taxes paid to other countries, but does allow a credit for taxes paid to a province of Canada.

How much is the New York State child tax credit?

Expanding New York's Child Tax Credit This is the largest expansion of New York's child tax credit in its history — and it will benefit approximately 2.75 million children statewide. Governor Hochul's expansion of the credit will double the size of the average credit going out to families from $472 to $943.

How much is the NYS resident credit?

Earned Income Credit (New York City): The credit can range from 10% to 30% your allowable federal earned income credit based on your New York adjusted gross income. NOTE: Part-year residents, the amount of the credit depends on your income subject to New York City tax.

How do I know if I got a NYS star credit?

If you are registered for the STAR credit, the Tax Department will send you a STAR check in the mail each year.

How does the new tax credit work?

Nonrefundable tax credits reduce your tax liability by the corresponding credit amount. In other words, if you qualify for a $500 nonrefundable credit, your taxes owed are reduced by $500. Once you zero out your taxes owed, though, you won't get any overage of the unused tax credit back as a refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-112-C-I?

IT-112-C-I is a tax form used by New York State to report certain credits for individuals and business entities.

Who is required to file IT-112-C-I?

Individuals and businesses that are claiming specific tax credits related to investments or employment are required to file IT-112-C-I.

How to fill out IT-112-C-I?

To fill out IT-112-C-I, gather necessary financial documents, provide accurate information on income, report eligible credits, and complete the form based on provided instructions.

What is the purpose of IT-112-C-I?

The purpose of IT-112-C-I is to allow taxpayers to claim various tax credits that can reduce their overall tax liability in New York State.

What information must be reported on IT-112-C-I?

The information that must be reported includes personal identification details, income amounts, the specific tax credits being claimed, and supporting documentation for those credits.

Fill out your it-112-c-i - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-112-C-I - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.