Get the free Claim for Conservation Easement Tax Credit - tax ny

Show details

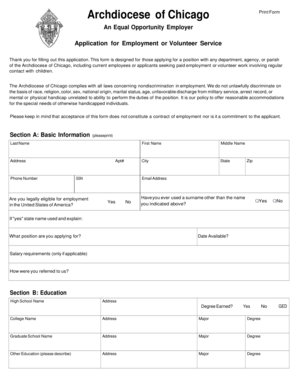

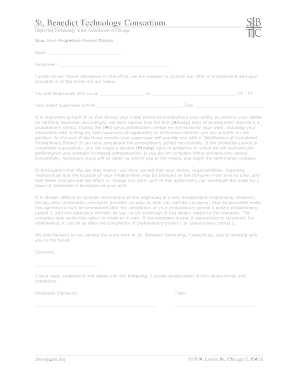

This form is used by corporations to claim a conservation easement tax credit as part of the New York State tax process, detailing allowable property taxes, credit computations, and partnership information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for conservation easement

Edit your claim for conservation easement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for conservation easement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for conservation easement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claim for conservation easement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for conservation easement

How to fill out Claim for Conservation Easement Tax Credit

01

Obtain the Claim for Conservation Easement Tax Credit form from your state tax authority's website or office.

02

Review the eligibility requirements to ensure you qualify for the tax credit.

03

Gather necessary documentation to support your claim, including proof of the conservation easement agreement.

04

Complete the personal information section of the form, including your name, contact information, and tax identification number.

05

Provide details about the conservation easement, including the location, size, and the entity holding the easement.

06

Calculate the amount of the tax credit you are claiming based on the value of the easement and any applicable state guidelines.

07

Attach the required documentation, including the conservation easement deed and appraisal, if necessary.

08

Double-check the form for accuracy and completeness before signing.

09

Submit the completed form and documentation to the appropriate tax authority by the specified deadline.

Who needs Claim for Conservation Easement Tax Credit?

01

Individuals or organizations that have donated a conservation easement on their property for the purpose of preserving land and natural resources may need to file a Claim for Conservation Easement Tax Credit.

Fill

form

: Try Risk Free

People Also Ask about

What is the federal tax credit for conservation easements?

Conservation easements facilitate other conservation tools Federal law allows an annual exclusion from the gift tax. In 2022 the exclusion amount is $16,000 per donor per donee. By reducing the value of land, a conservation easement allows more land to pass, tax free, to the next generation.

Is income from a conservation easement taxable?

If you donate some of that land to an entity through a conservation easement, you promise to conserve, or not develop, the donated land. In return for the donation, you get a federal income tax break. Taxpayers can deduct the difference in their donated property's appraised value before and after their donation.

What is the deduction for conservation expenses?

Deductions for Conservation Expenses The deduction for conservation expenses is capped at 25% of the gross income from farming. Conservation expenses can only be deducted by those in the business of farming for profit. See the IRS “Farmer's Tax Guide” for details.

What are the downsides of a conservation easement?

Drawbacks Of Conservation Easements Most conservation easements are permanent and bind all future landowners (including heirs). Conservation easement holders and farmers may not always share a common vision. Conservation easements can reduce the property's overall value, making the land worth less for future sales.

How are conservation easements taxed?

A conservation easement lowers the property value — and, correspondingly, estate taxes. In some cases, a conservation easement may drop the value of the estate below the threshold for estate taxes altogether. Heirs can exclude 40% of the value of land under conservation easement from estate taxes.

How do you record easement income?

How do I report compensation received for an permanent easement reported on a 1099-misc? You would report it as a sale of property (land) under investment income.

What are the downsides of a conservation easement?

Drawbacks Of Conservation Easements Most conservation easements are permanent and bind all future landowners (including heirs). Conservation easement holders and farmers may not always share a common vision. Conservation easements can reduce the property's overall value, making the land worth less for future sales.

Is money received for an easement taxable?

If it is impossible or impractical to separate the basis of the part of the property on which the easement is granted, the basis of the whole property is reduced by the amount received. Any amount received that is more than the basis to be reduced is a taxable gain. The transaction is reported as a sale of property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Conservation Easement Tax Credit?

A Claim for Conservation Easement Tax Credit is a tax incentive that allows landowners to receive a tax credit for donating a conservation easement, which is a legally binding agreement that restricts the development of their land to promote conservation.

Who is required to file Claim for Conservation Easement Tax Credit?

Landowners who donate a conservation easement to a qualified organization or governmental entity to preserve open space, agriculture, or natural resources are required to file a Claim for Conservation Easement Tax Credit.

How to fill out Claim for Conservation Easement Tax Credit?

To fill out the Claim for Conservation Easement Tax Credit, landowners must complete the appropriate tax credit form provided by the tax authority, which typically includes information about the property, details of the easement, and the value of the donation.

What is the purpose of Claim for Conservation Easement Tax Credit?

The purpose of Claim for Conservation Easement Tax Credit is to encourage landowners to preserve the natural environment and promote conservation efforts by providing a financial incentive through tax credits.

What information must be reported on Claim for Conservation Easement Tax Credit?

Information that must be reported includes the owner's details, the description of the conservation easement, the appraised value of the easement, and the dates of the donation.

Fill out your claim for conservation easement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Conservation Easement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.