Get the free Claim for Alternative Fuels Credit - tax ny

Show details

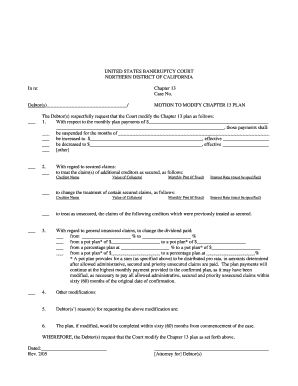

This document provides instructions for taxpayers to claim credits for alternative-fuel vehicle refueling property in New York State, detailing eligibility, filing requirements, and computation of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for alternative fuels

Edit your claim for alternative fuels form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for alternative fuels form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for alternative fuels online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit claim for alternative fuels. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for alternative fuels

How to fill out Claim for Alternative Fuels Credit

01

Gather all relevant documents and receipts related to alternative fuel purchases.

02

Obtain Form 8849 from the IRS website.

03

Complete the identification section of Form 8849 with your name, address, and tax identification number.

04

Fill out the appropriate section for the Claim for Alternative Fuels Credit on the form.

05

Calculate the total amount of credit based on eligible fuel quantities and rates.

06

Attach supporting documents like invoices and receipts to substantiate your claim.

07

Review the form for accuracy and completeness.

08

Submit Form 8849 along with any required documentation to the IRS.

Who needs Claim for Alternative Fuels Credit?

01

Individuals or businesses that use alternative fuels for transportation.

02

Taxpayers seeking to reduce their tax liability through credits for alternative fuel usage.

03

Companies involved in the production or distribution of alternative fuels.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies as an alternative fuel vehicle?

The term typically refers to internal combustion engine vehicles or fuel cell vehicles that utilize synthetic renewable fuels such as biofuels (ethanol fuel, biodiesel and biogasoline), hydrogen fuel or so-called "Electrofuel".

Which vehicle is not considered an alternative fuel vehicle?

Note that traditional hybrids are not considered alternative fuel vehicles because combustion engines recharge the batteries in these types of vehicles.

Why do I have to pay an alternative fuel vehicle fee?

It's not meant to be a penalty. It's to account for lost revenue from the gas taxes. In most states roads are maintained with significant funding from gasoline taxes. Of everyone switches to hybrid/electric the funds for maintenance and development of roads are going to be running dry.

What is alternative fuel credit?

If you property to store or dispense clean-burning fuel or recharge electric vehicles in your home or business, you may be eligible for the Alternative Fuel Vehicle Refueling Property Tax Credit. The property must be installed in a qualifying location.

What are examples of alternative fuel vehicles?

Biodiesel | Diesel Vehicles. Electricity | Electric Vehicles. Ethanol | Flex Fuel Vehicles. Hydrogen | Fuel Cell Vehicles. Natural Gas | Natural Gas Vehicles. Propane | Propane Vehicles. Renewable Diesel. Sustainable Aviation Fuel.

Who can claim credit for federal tax paid on fuels?

Businesses get a refundable credit for fuel used in a specific work-related activity with the Fuel Tax Credit. To qualify, you must: Own or operate a business. Meet certain requirements, such as running a farm or purchasing aviation gasoline.

What is an alternative fuel car?

What is an AFV (Alternative Fuel Vehicle)? An alternative fuel vehicle is any vehicle that runs on something other than diesel or petrol. The most popular choices are Hybrid, Plug-In Hybrid and Electric. The least common choices are Hydrogen Fuel Cell Electric, Bi-Fuel and Synthetic fuel.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Alternative Fuels Credit?

The Claim for Alternative Fuels Credit is a tax form that allows taxpayers to claim a credit for certain alternative fuels used to produce energy, reducing their tax liability.

Who is required to file Claim for Alternative Fuels Credit?

Businesses and individuals who produce or sell alternative fuels, such as biodiesel, renewable diesel, or other biofuels, are required to file this claim.

How to fill out Claim for Alternative Fuels Credit?

To fill out the Claim for Alternative Fuels Credit, taxpayers must provide detailed information about the quantity of alternative fuels used, their production, and any related expenses on the designated form provided by the IRS.

What is the purpose of Claim for Alternative Fuels Credit?

The purpose of the Claim for Alternative Fuels Credit is to encourage the use of cleaner energy sources by providing financial incentives to those who produce or utilize alternative fuels.

What information must be reported on Claim for Alternative Fuels Credit?

Claimants must report details including the type and amount of alternative fuel produced or sold, the dates of production or sale, and the related expenses to qualify for the credit.

Fill out your claim for alternative fuels online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Alternative Fuels is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.