Get the free DTF-686 - Tax Shelter Reportable Transactions - tax ny

Show details

This document provides instructions for filing Form DTF-686, which pertains to the reporting requirements for tax shelter transactions under New York State Tax Law. It outlines who must file, when

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dtf-686 - tax shelter

Edit your dtf-686 - tax shelter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dtf-686 - tax shelter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

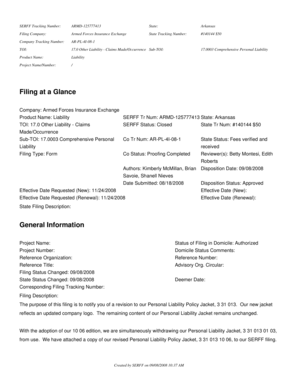

Editing dtf-686 - tax shelter online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dtf-686 - tax shelter. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

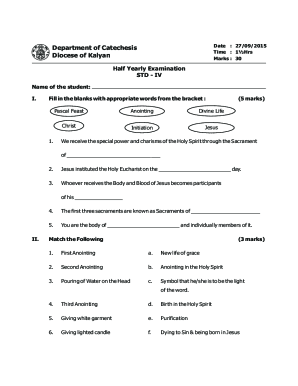

How to fill out dtf-686 - tax shelter

How to fill out DTF-686 - Tax Shelter Reportable Transactions

01

Obtain a copy of the DTF-686 form from the New York State Department of Taxation and Finance website.

02

Read the instructions carefully to understand the purpose of the form and the information required.

03

Fill in your name, address, and taxpayer identification number at the top of the form.

04

Provide detailed information about the tax shelter, including its name and identification number.

05

Describe the type of transaction that is reportable and the tax treatment of the transaction.

06

If applicable, include any additional information required in the section for attachments.

07

Review all information for accuracy and completeness before submission.

08

Sign and date the form where indicated.

09

Submit the completed form by mail to the appropriate address provided in the instructions.

Who needs DTF-686 - Tax Shelter Reportable Transactions?

01

Any taxpayer who participates in a tax shelter that is reportable under New York State tax laws is required to fill out the DTF-686 form.

02

Taxpayers seeking to maintain compliance with reporting requirements for tax shelters must file this form.

Fill

form

: Try Risk Free

People Also Ask about

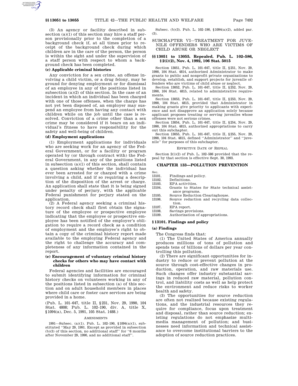

What are the five types of reportable transactions?

These reportable transactions are classified into five different types: Listed transactions. Confidential transactions. Transactions with contractual protection. Loss transactions. Transactions of interest.

What is DTF 686?

Attach Form DTF‑686 to the return or report you file for the current tax year. General information. The Tax Law requires all taxpayers to disclose information relating to transactions that present the potential for tax avoidance (a tax shelter).

What is tax shelter on my paycheck?

A tax shelter provides a way to lower your taxable income and, in turn, the tax you pay. There are many ways to lower your taxes, including deductions, credits, and contributing to tax- advantaged accounts.

What qualifies as a tax shelter?

Tax shelters are ways individuals and corporations reduce their tax liability. Shelters range from employer-sponsored 401(k) programs to overseas bank accounts. The phrase “tax shelter” is often used as a pejorative term, but a tax shelter can be a legal way to reduce tax liabilities.

What does "sheltered from tax" mean?

Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities, including state and federal governments. The methodology can vary depending on local and international tax laws.

What are the disadvantages of a tax sheltered annuity?

The IRS imposes a penalty of 10% on withdrawals made before age 59 1/2, unless the withdrawal is made due to certain qualifying events, such as disability or death. Additionally, withdrawals from a TSA are subject to income taxes, which can further reduce the amount of money the employee receives.

What are the reportable transactions rules?

You must disclose a reportable transaction if you are: a person who gets or expects to get a tax benefit. a person who enters into the reportable transaction for the benefit of the above-noted person. a promoter or an advisor entitled to a fee for the transaction, or.

What is a tax shelter transaction?

Investments that yield tax benefits are sometimes called "tax shelters." Generally, abusive tax shelters are schemes involving transactions with little or no substance. Participants in certain shelters and transactions are required to disclose their participation, and may be subject to penalties for failing to do so.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DTF-686 - Tax Shelter Reportable Transactions?

DTF-686 is a form used to report tax shelter transactions that meet certain criteria as defined by tax authorities. It is designed to inform the state of potential tax avoidance schemes.

Who is required to file DTF-686 - Tax Shelter Reportable Transactions?

Taxpayers who participate in reportable transactions that are considered tax shelters must file DTF-686. Additionally, promoters of these transactions may also be required to file.

How to fill out DTF-686 - Tax Shelter Reportable Transactions?

To fill out DTF-686, gather all necessary information about the transaction, including the names and taxpayer identification numbers of participants, describe the transaction, and provide details on any related tax shelter.

What is the purpose of DTF-686 - Tax Shelter Reportable Transactions?

The purpose of DTF-686 is to disclose tax shelter transactions to tax authorities to ensure compliance and transparency, and to facilitate the identification of tax avoidance strategies.

What information must be reported on DTF-686 - Tax Shelter Reportable Transactions?

Information that must be reported includes the name and identification number of the taxpayer, details of the reportable transaction, and any other relevant information that helps describe the tax shelter.

Fill out your dtf-686 - tax shelter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dtf-686 - Tax Shelter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.