Get the free CT-605 Claim for EZ Investment Tax Credit and EZ - tax ny

Show details

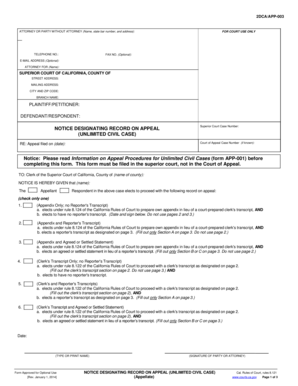

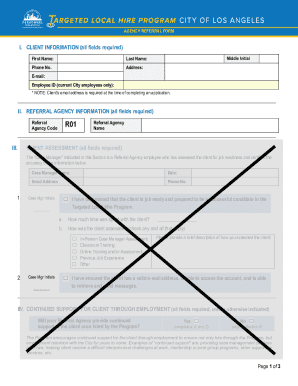

This document is a tax form used by businesses in New York to claim the EZ Investment Tax Credit and Employment Incentive Credit, particularly aimed at financial services corporations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct-605 claim for ez

Edit your ct-605 claim for ez form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-605 claim for ez form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct-605 claim for ez online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ct-605 claim for ez. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct-605 claim for ez

How to fill out CT-605 Claim for EZ Investment Tax Credit and EZ

01

Download the CT-605 form from the state's Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Specify the tax year for which you are claiming the investment tax credit.

04

Report the total amount of qualified investments made during the tax year in the appropriate section.

05

Calculate the credit amount based on the guidelines provided on the form and insert it in the designated area.

06

Provide any required documentation or supporting materials, such as receipts or investment statements.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs CT-605 Claim for EZ Investment Tax Credit and EZ?

01

Businesses and individuals who have made qualified investments in designated areas and wish to claim the EZ Investment Tax Credit.

02

Taxpayers who meet specific eligibility criteria set forth by the state to benefit from the EZ investment tax incentive.

Fill

form

: Try Risk Free

People Also Ask about

How to claim $7500 EV tax credit?

You will need to file Form 8936, Clean Vehicle Credits when you file your tax return for the year in which you took delivery of the vehicle. You must file the form whether you transferred the credit at the time of sale or you're claiming the credit on your return.

How does the investment tax credit work?

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

How does the 30% solar tax credit work?

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034.

How does the 30% tax credit for solar work?

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034.

What is the EZ wage tax credit?

Some government policies, such as investment tax credits, basically lower the cost of borrowing money at every real interest rate. Such policies would increase the demand for loanable funds.

How do investment tax credits work?

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

How does investment tax credit affect interest rate?

Some government policies, such as investment tax credits, basically lower the cost of borrowing money at every real interest rate. Such policies would increase the demand for loanable funds.

How does investment tax credit affect interest rates?

If you're in the situation where you have to file IRS Form 4255, you might have to pay back a tax credit you've earned in prior years. This process, known as recapture, occurs if you claim a credit—in this case, a credit for a specific type of business investment—and then no longer qualify for that credit.

What effect will an investment tax credit have on interest rates and quantity of savings?

If the passage of an investment tax credit encouraged firms to invest more, the demand for loanable funds would increase. As a result, the equilibrium interest rate would rise, and the higher interest rate would stimulate saving.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CT-605 Claim for EZ Investment Tax Credit and EZ?

CT-605 is a form used to claim the EZ (Enterprise Zone) Investment Tax Credit, which provides tax incentives for businesses that invest in certain areas designated as enterprise zones.

Who is required to file CT-605 Claim for EZ Investment Tax Credit and EZ?

Businesses and organizations that have made qualified investments in an enterprise zone and wish to claim the EZ Investment Tax Credit must file the CT-605.

How to fill out CT-605 Claim for EZ Investment Tax Credit and EZ?

To fill out the CT-605, you need to provide information about your business, the investment made, the location of the investment, and any other required documentation that supports your claim for the tax credit.

What is the purpose of CT-605 Claim for EZ Investment Tax Credit and EZ?

The purpose of the CT-605 is to incentivize businesses to invest in economically distressed areas, promote job creation, and stimulate economic development within those zones.

What information must be reported on CT-605 Claim for EZ Investment Tax Credit and EZ?

The CT-605 requires reporting information such as the type and amount of investment, the location of the investment, the number of jobs created or retained, and other supporting details pertaining to the investment made in the enterprise zone.

Fill out your ct-605 claim for ez online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct-605 Claim For Ez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.