Get the free APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS - tax ny

Show details

This document provides instructions for applying for a tax exemption on capital improvements made to multiple dwelling buildings converted to owner-occupied residences, specifically in certain cities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for real property

Edit your application for real property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for real property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for real property online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for real property. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

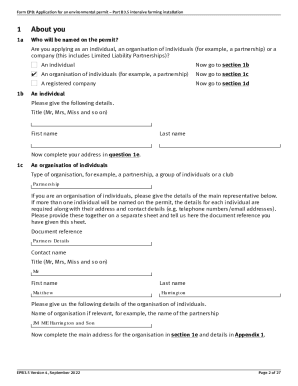

How to fill out application for real property

How to fill out APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS

01

Obtain the APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS form from your local tax office or their website.

02

Read the instructions carefully before starting to fill out the application.

03

Fill in your property information, including the address and parcel number.

04

Provide details about the capital improvements, including descriptions, costs, and dates of completion.

05

Include any required documentation, such as receipts or contracts, to support your claim.

06

Double-check the information for accuracy and completeness before submission.

07

Sign and date the application where required.

08

Submit the application by the specified deadline via mail or in-person to your local tax office.

Who needs APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS?

01

Property owners who have made capital improvements to their real estate and want to apply for a tax exemption.

02

Businesses that have undertaken significant renovations or expansions on their property.

03

Non-profit organizations that have improved their facilities and are seeking tax relief.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for CA property tax exemption?

Complete form BOE-266, Claim for Homeowners' Property Tax Exemption. Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office.

How do I write a property tax appeal?

Example: “Based on recent sales of comparable properties in my neighborhood, I believe the assessed value of my home is higher than its current market value. Attached are sales records of properties similar in size and condition to mine, which sold for significantly less.”

How to file for property tax exemption in Texas?

Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether property qualifies for an exemption.

What is the deadline to file a homestead exemption in Texas?

Per the Texas Comptroller, the completed application and required documentation are due no later than April 30 of the tax year for which you are applying. A late homestead exemption application, however, may be filed up to two years after the delinquency date, which is usually Feb. 1.

How long does it take to get property tax exemption in Texas?

Check the Status of Your Application We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45. Please allow at least 90 days to lapse before contacting our office to check when your application will be processed.

At what age do seniors stop paying property taxes in Georgia?

Homestead Exemption for 65+ Eligible taxpayers 65 years of age or over receive an exemption of $4,000 from all state and county property taxes. Through local option, counties may increase the amount of the exemption.

How to file property tax exemption in Texas?

Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether property qualifies for an exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS?

The APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS is a form that property owners use to request a tax exemption for improvements made to real property that enhance its value or utility.

Who is required to file APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS?

Property owners or developers who have made substantial capital improvements to their real property may be required to file the application to seek tax exemptions.

How to fill out APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS?

To fill out the application, property owners must provide accurate details about the property, the nature of the improvements, and supporting documentation that verifies the cost and impact of the improvements.

What is the purpose of APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS?

The purpose of the application is to allow property owners to potentially reduce their property tax burden by receiving exemptions for the costs incurred in enhancing or upgrading their property.

What information must be reported on APPLICATION FOR REAL PROPERTY TAX EXEMPTION FOR CAPITAL IMPROVEMENTS?

The application typically requires information such as the property address, owner's details, a description of the improvements made, the costs associated with the improvements, and any relevant documentation supporting the claims.

Fill out your application for real property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Real Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.