Get the free New York State Empire State Film Production Credit & New York City Made In New York ...

Show details

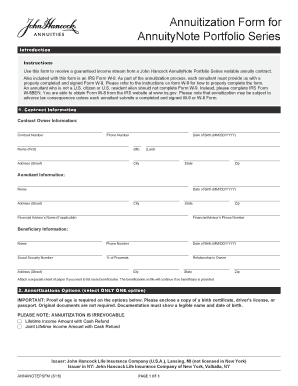

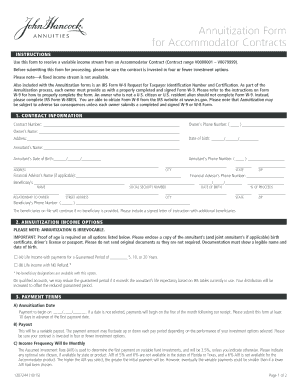

This document serves as the final application for obtaining film production tax credits from New York State and New York City, requiring submission of various financial and production details to qualify

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new york state empire

Edit your new york state empire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york state empire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new york state empire online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new york state empire. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new york state empire

How to fill out New York State Empire State Film Production Credit & New York City Made In New York Film Production Tax Credit Final Application

01

Gather all necessary documents including production budgets, filming schedules, and location agreements.

02

Complete the applicable sections of the New York State Empire State Film Production Credit application form.

03

Provide detailed information on the production including cast, crew, and expenses.

04

Collect all receipts and invoices that support your claimed expenses.

05

Fill out the New York City Made In New York Film Production Tax Credit application, ensuring compatibility with the State application.

06

Submit both applications along with all required supporting documentation before the deadline.

07

Review the final submitted application for any errors or missing information.

08

Respond promptly to any inquiries or requests for additional information from the tax credit program administrators.

Who needs New York State Empire State Film Production Credit & New York City Made In New York Film Production Tax Credit Final Application?

01

Film and television production companies producing eligible projects in New York State and New York City.

02

Producers seeking financial incentives to help offset production costs.

03

Companies looking to benefit from tax credits to enhance their project's budget.

Fill

form

: Try Risk Free

People Also Ask about

Do I qualify for the New York City school tax credit?

The New York City School Tax credit is available to New York City residents or part-year residents who cannot be claimed as a dependent on another taxpayer's federal income tax return. The credit amounts vary. This credit must be claimed directly on the New York State personal income tax return.

What is the film tax credit?

The government released the specific regulations for the Independent Film Tax Credit (IFTC) on 9th October 2024, which ratify the expenditure credit and enable film productions to claim back some of their costs each year. The IFTC offers an uplift of 53% compared to the normal rate of 34% for other productions.

What is the S481 tax credit for film?

Ireland's 32% Tax Credit for Film, Television and Animation 'Section 481' is a tax credit, incentivising film and TV, animation and creative documentary production in Ireland, administered by Ireland's Department of Culture and the Revenue Commissioners (Revenue).

What are tax credits for film industry?

CALIFORNIA Incentive20%-30% Tax Credit Minimum/Caps Minimum Spend $1M budget Minimum Filming Days A minimum of 75% of total “principal photography” days must occur wholly in California. Annual Cap $330M14 more rows

What is the Empire State film production tax credit?

New York's film tax credit is worth up to 30% of qualifying production costs for projects filmed in New York state, with an additional 10% available in certain counties north of New York City. The film tax credit is one of the largest industry-specific tax breaks in New York.

What is the New York State tax credit?

The Working Families Tax Credit is an expanded, improved refundable tax credit that combines the Empire State Child Credit (ESCC), the Earned Income Tax Credit (EITC), and the dependent exemption (DE) into one bigger, better credit!

Who gets the Empire State tax credit?

The Empire State child credit is a refundable credit available to full-year New York State residents who have at least one qualifying child. For tax years beginning on or after January 1, 2023, the credit includes qualifying children under four years of age but under 17, who meet income limitations.

What is the NY state tax credit for film?

TV/Film. The New York State Film Production Tax Credit program provides qualifying film and television productions a 25% credit for qualified production expenditures. All eligible productions shot in New York City may qualify for this program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New York State Empire State Film Production Credit & New York City Made In New York Film Production Tax Credit Final Application?

The New York State Empire State Film Production Credit and the New York City Made In New York Film Production Tax Credit Final Application are tax incentive programs designed to encourage film and television production in New York. These credits provide financial assistance to qualified productions that meet specific spending and filming requirements in the state and city.

Who is required to file New York State Empire State Film Production Credit & New York City Made In New York Film Production Tax Credit Final Application?

Producers and production companies that have completed a qualified film or television production within New York State or New York City are required to file the final application to receive the tax credits.

How to fill out New York State Empire State Film Production Credit & New York City Made In New York Film Production Tax Credit Final Application?

To fill out the application, applicants must provide detailed information about the production, including the project title, budget, expenditures, and locations utilized. Specific forms and documentation, as dictated by the state and city guidelines, must also be submitted alongside the application.

What is the purpose of New York State Empire State Film Production Credit & New York City Made In New York Film Production Tax Credit Final Application?

The purpose of these credits is to stimulate local economies, create jobs, and promote the state and city's film and television industry by incentivizing producers to film in New York.

What information must be reported on New York State Empire State Film Production Credit & New York City Made In New York Film Production Tax Credit Final Application?

Applicants must report information such as production details, total eligible expenditures, a breakdown of costs, and documentation evidencing the production's impact on local economies. This can include payroll records, vendor payments, and any other relevant financial data.

Fill out your new york state empire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York State Empire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.