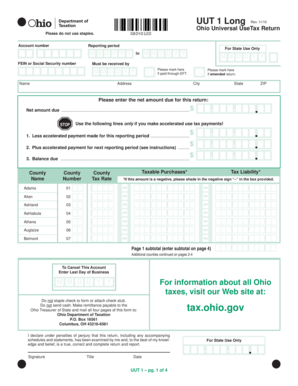

OH UUT 1 Long 2006 free printable template

Show details

Signature Title Date UUT 1 pg. 1 of 4 tax. ohio. gov Ohio Universal UseTax Return Brown Carroll Champaign Clark Clermont Clinton Columbiana Coshocton Crawford Cuyahoga Darke Defiance Delaware Delaware COTA Erie Fairfield Fayette Franklin Fulton Gallia Geauga Greene Guernsey Hamilton Hancock Hardin Harrison Henry Highland Hocking Holmes Butler Huron Knox Lake Lawrence Licking Licking COTA Logan Lorain Lucas Madison Mahoning Marion Medina Meigs Mercer Miami Monroe Montgomery Morgan Morrow...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form uut 1

Edit your form uut 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form uut 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form uut 1 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form uut 1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH UUT 1 Long Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form uut 1

How to fill out OH UUT 1 Long

01

Gather necessary information including business details and transaction data.

02

Download or obtain a copy of the OH UUT 1 Long form.

03

Fill in the business name and address in the designated fields.

04

Provide your Ohio vendor's license number if applicable.

05

Enter the details of the transactions for the reporting period.

06

Calculate the total utility usage and any tax owed based on the rates.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form by the due date through the appropriate channels (mail or online).

Who needs OH UUT 1 Long?

01

Businesses and individuals engaged in utility transactions in Ohio.

02

Tax professionals assisting clients with utility reporting.

03

Anyone required to report utility usage for tax purposes as specified by the Ohio Department of Taxation.

Fill

form

: Try Risk Free

People Also Ask about

What form do I need to file my Ohio state taxes?

Ohio IT 1040 and SD100 Forms.

What is an Ohio universal use tax?

Use tax is a complementary tax to the sales tax. In general, use tax is owed by a purchaser on a transaction when the vendor does not col lect sales tax (assuming the item or service being purchased is taxable).

What qualifies for sales tax exemption Ohio?

Tax-exempt goods Some goods are exempt from sales tax under Ohio law. Examples include most non-prepared food items, items purchased with food stamps, and prescription drugs.

What is exempt from use tax in Ohio?

Certain telecommunication services. Satellite broadcasting service. Personal care service, including skin care, application of cosmetics, manicures, pedicures, hair removal, tattoos, body piercing, tanning, massage and other similar services. It does not include hair care: cutting, coloring, and styling.

What is a UST 1?

Ohio Universal Sales Tax Return (UST 1) – Department of Taxation Government Form in Ohio – Formalu. Locations. United States. Browse By State.

How do I file UST 1 on Ohio Gateway?

After signing into the Gateway, select the Sales Tax (UST-1) transaction. On step 1 select "Browse" and choose the properly formatted file. Continue to follow the on-screen instructions. Any errors in the file or with the calculations will be indicated on the top of the page.

Does Ohio require a state tax form?

Every Ohio resident and every part-year resident is subject to the Ohio income tax. Every nonresident having Ohio-sourced income must also file.

Do you charge sales tax on services in Ohio?

The Ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in Ohio. In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer.

What services are exempt from sales tax in Ohio?

Certain telecommunication services. Satellite broadcasting service. Personal care service, including skin care, application of cosmetics, manicures, pedicures, hair removal, tattoos, body piercing, tanning, massage and other similar services.

What businesses are exempt from sales tax in Ohio?

What purchases are exempt from the Ohio sales tax? Clothing. 5.75% Groceries. EXEMPT. Prepared Food. 5.75% Prescription Drugs. EXEMPT. OTC Drugs. 5.75%

Are cleaning services taxable in Ohio?

A career in building maintenance or janitorial services falls under the Ohio Department of Taxation's category of a “taxable service”.

What qualifies for Ohio use tax?

The Ohio sales and use tax applies to the retail sale, lease, and rental of tangible personal property as well as the sale of selected services in Ohio. In transactions where sales tax was due but not collected by the vendor or seller, a use tax of equal amount is due from the customer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form uut 1 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form uut 1. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute form uut 1 online?

pdfFiller has made filling out and eSigning form uut 1 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete form uut 1 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your form uut 1. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is OH UUT 1 Long?

OH UUT 1 Long is a form used in Ohio for reporting utility usage tax for businesses operating in the state.

Who is required to file OH UUT 1 Long?

Businesses that use utilities in Ohio and are subject to utility usage tax must file OH UUT 1 Long.

How to fill out OH UUT 1 Long?

To fill out OH UUT 1 Long, businesses need to provide their identification information, report utility consumption, and calculate the tax owed based on the provided rates.

What is the purpose of OH UUT 1 Long?

The purpose of OH UUT 1 Long is to ensure that businesses accurately report their utility usage and remit the appropriate usage tax to the state of Ohio.

What information must be reported on OH UUT 1 Long?

The information that must be reported on OH UUT 1 Long includes the business name, account numbers, the type and amount of utilities used, and the calculated tax amount.

Fill out your form uut 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Uut 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.