Get the free Nonattorney Completion of Mortgage Instruments

Show details

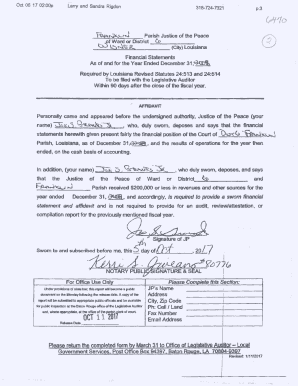

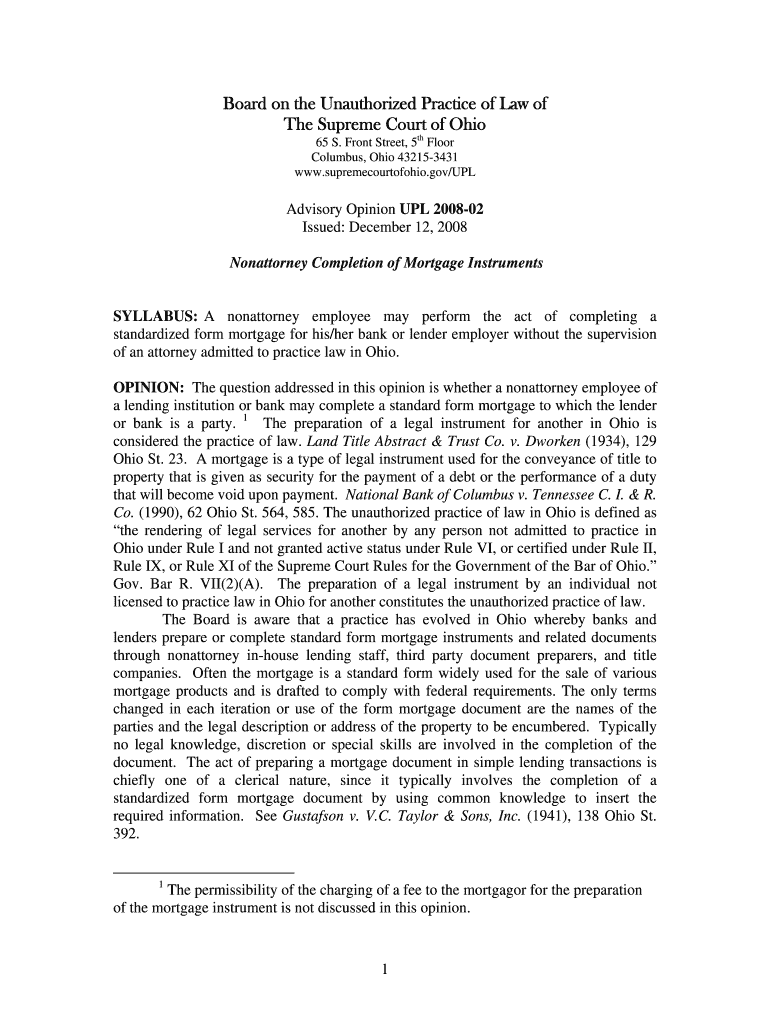

This document provides an advisory opinion on whether a nonattorney employee of a lending institution or bank may complete a standardized mortgage form without attorney supervision under Ohio law.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonattorney completion of mortgage

Edit your nonattorney completion of mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonattorney completion of mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonattorney completion of mortgage online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nonattorney completion of mortgage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonattorney completion of mortgage

How to fill out Nonattorney Completion of Mortgage Instruments

01

Gather all necessary documents related to the mortgage.

02

Ensure you have the proper form for Nonattorney Completion of Mortgage Instruments.

03

Fill in the borrower’s legal name and contact information accurately.

04

Provide the property address that is being mortgaged.

05

Include the loan amount and terms of the mortgage.

06

Make sure to list the lender's name and contact information.

07

Review all filled information for accuracy.

08

Sign and date the form where required.

Who needs Nonattorney Completion of Mortgage Instruments?

01

Homeowners looking to secure a mortgage without legal representation.

02

Lenders who require documentation for mortgage processing without an attorney.

03

Individuals refinancing their mortgage without attorney assistance.

04

Parties involved in a mortgage transaction seeking a simplified documentation process.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a mortgage?

What is a mortgage example? Mortgage means pledging a piece of land, a home, or any other type of property to get a loan. If you fail to repay the loan in the agreed period, the lender has the right to take your property. Loan Against Property is the most common example of a mortgage loan.

What clause in the mortgage prevents an assumable mortgage?

Mortgage alienation clauses prevent assumable mortgage contracts from occurring. An alienation clause requires a mortgage lender to be immediately repaid if an owner transfers ownership rights or sells a collateral property.

How can I use "use" in a sentence?

How to Use use in a Sentence Who used the last match? Did you use all the eggs? I need to use the phone when you're done. The machine is easy to use. He used his time there well. After the accident, she could no longer use her legs. Which accountant do you use? We use only organic fertilizers on our farm.

How do you use mortgage in a sentence?

They hope to pay off the mortgage on their home soon. He will have to take out a mortgage in order to buy the house.

What does it mean to mortgage something?

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you don't repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

What is considered a mortgage security instrument?

The term "Security Instrument" means any underlying lease, mortgage or deed of trust which now or hereafter affects the Project, and any renewal, modification, consolidation, replacement or extension thereof.

How do you use mortgage in English sentence?

Examples of mortgage in a Sentence Noun He will have to take out a mortgage in order to buy the house. They hope to pay off the mortgage on their home soon. Verb She mortgaged her house in order to buy the restaurant. I've mortgaged all my free time this week to the hospice and won't be able to come to the party.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nonattorney Completion of Mortgage Instruments?

Nonattorney Completion of Mortgage Instruments refers to the practice of filling out mortgage documents without the direct involvement of an attorney. This process allows individuals to complete necessary paperwork related to mortgages without legal counsel.

Who is required to file Nonattorney Completion of Mortgage Instruments?

Individuals or entities who are engaging in mortgage transactions and are completing necessary paperwork without the assistance of an attorney are typically required to file Nonattorney Completion of Mortgage Instruments.

How to fill out Nonattorney Completion of Mortgage Instruments?

To fill out Nonattorney Completion of Mortgage Instruments, one should gather all required documentation related to the mortgage, accurately complete the forms provided, and ensure all required fields are filled in correctly, including borrower information, loan details, and property information.

What is the purpose of Nonattorney Completion of Mortgage Instruments?

The purpose of Nonattorney Completion of Mortgage Instruments is to facilitate the processing of mortgage loans by allowing individuals to prepare the necessary documents for their mortgage transactions without needing legal representation.

What information must be reported on Nonattorney Completion of Mortgage Instruments?

The information that must be reported on Nonattorney Completion of Mortgage Instruments typically includes the names and addresses of the borrowers, the loan amount, interest rate, loan term, property details, and any other relevant financial details or disclosures required by the lender.

Fill out your nonattorney completion of mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonattorney Completion Of Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.