Get the free APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE

Show details

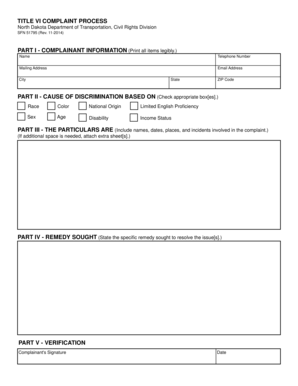

This application is for establishing a Loan Production Office (LPO) or Deposit Production Office (DPO), outlining the types of services to be provided and necessary operational details according to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application to establish a

Edit your application to establish a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application to establish a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application to establish a online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application to establish a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application to establish a

How to fill out APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE

01

Obtain the official APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE form from the regulatory authority's website or office.

02

Review the instructions provided with the application form carefully to understand the requirements.

03

Fill out the application form with accurate information, including the name and address of the proposed office, and the name of the institution applying.

04

Include details about the proposed location, such as its address and the market area it will serve.

05

Provide information on the management team, including relevant qualifications and experience.

06

Attach a business plan that outlines the services the office will provide, estimated costs, revenue projections, and staffing plans.

07

Include any required supporting documents, such as financial statements or letters of support.

08

Review the completed application for any errors or omissions.

09

Submit the application and any associated fees to the relevant regulatory authority.

Who needs APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE?

01

Financial institutions or banks that wish to expand their services by opening a loan production office or deposit production office.

02

Businesses looking to establish a new location to facilitate loan processing or deposit activities.

Fill

form

: Try Risk Free

People Also Ask about

What can an LPO do?

An LPO deals primarily in requests for residential mortgages but also handles other types of loans. The LPO can't make loans directly but can carry out all the administrative functions that accompany the requesting and receiving of loans.

What is a deposit production office?

A deposit production office (DPO) may solicit deposits, provide in- formation about deposit products, and assist persons in completing applica- tion forms and related documents to open a deposit account. A DPO is not a branch within the meaning of 12 U.S.C.

What are the duties of loan office?

Duties Contact businesses or people to ask if they need a loan. Talk with loan applicants to gather information and answer questions. Explain to applicants the different types of loans and the terms of each type. Obtain, verify, and analyze applicants' financial information, such as credit rating and income.

What does loan production mean?

A Loan Production Office (“LPO”) is a type of banking facility that conducts loan activities, including origination (assembling credit information, soliciting or processing applications, etc.), approval, and closing.

What is the highest salary for a loan officer?

The best Loan Officer jobs can pay up to $142,000 per year. Other certifications are available in various specialties and may help give you an edge when seeking employment.

What is a loan production office?

A Loan Production Office (“LPO”) is a type of banking facility that conducts loan activities, including origination (assembling credit information, soliciting or processing applications, etc.), approval, and closing.

What is the FDIC definition of loan production office?

The Federal Reserve defines an LPO as “a staffed facility, other than a branch, which is open to the public and provides lending-related services such as loan information and applications.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE?

It is a formal document submitted by financial institutions to request approval for the establishment of a dedicated office for loan production or deposit collection.

Who is required to file APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE?

Financial institutions, including banks and credit unions, that wish to open a loan production or deposit production office must file this application.

How to fill out APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE?

The application should be completed by providing information regarding the institution's business plan, financial status, anticipated location, and details about the services to be offered at the new office.

What is the purpose of APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE?

The purpose is to allow regulatory authorities to evaluate the proposed office's impact on the financial market and to ensure compliance with laws and regulations.

What information must be reported on APPLICATION TO ESTABLISH A LOAN PRODUCTION/DEPOSIT PRODUCTION OFFICE?

The application must include details such as the institution's name, proposed location, type of services to be offered, financial projections, and compliance with regulatory requirements.

Fill out your application to establish a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application To Establish A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.