Get the free property transfer paper form

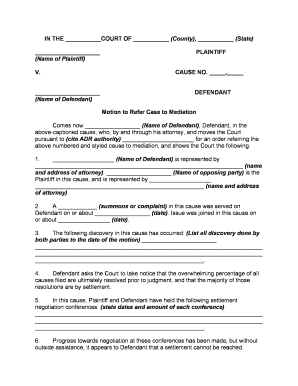

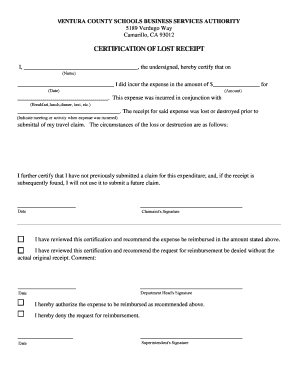

Get, Create, Make and Sign property transfer paper form

Editing property transfer paper form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property transfer paper form

How to fill out a property transfer paper form:

Who needs a property transfer paper form:

Instructions and Help about property transfer paper form

We have a Facebook query coming in apartheid patent once you know how much twill cost if an aunt that is his father sister wishes your transfer ownership of land non-agricultural land to her nephew buy a stamp paper this since is transfer between relatives he asks if there is any provision for exemption from paying this about he also asks ISAF the transfer should be done by conveyance or gifted and wants you to elaborate on the process of registration and transfer I think you'll have some good news for him right no unfortunately wouldn't have any good news in this case because article 34 says that you will end up being Sam duty at 5×generally but if the first proviso gives you a break if you are transferring to your spouse or your lineal ascendant descendant then our siblings then you are entitled to a reduced rate of 2%, and then you have a second proviso which came into effect last year which again limits it to lineal descendants and in that event you would be entitled to dot for 200 rupees, so these are all sublimity which you know you need to study carefully unfortunately both of this donor apply to and arena×39’t giving to any of you, so you would have to pay 5% anyway now whether to take it as a gift or conveyance is your choice if you have the money to pay it you can pay it because anyway the Stamp Duty is not going to change you can pay that and toucan be the owner as a purchaser if paying the money is an issue then you can take it as a gift so the 200rupee gift deed that you×39’re speaking about when I will only apply it from if the trance is being done from father Tyson mother to daughter father to daughter etc absolutely not between the spouses and if my husband were to transfer property to me no spouse will work there but lineal ascendants phone you cannot give to your mother my mother how you cannot give to your father that would then fall into your category of 2×okay so then that father so then thereat three categories over here within relatives as if it×39’s outside the immediate family of mother father brother sister mother father and children then you have to pay for percent between if you're transferring property to your parents it would, you know it would attract a charge of two percent and if you were to transfer property to your children then you candy that with a two hundred rupee gifted but if you're transferring property between aunt and nephew then you have today the five percent or stamp duty charge you can watch live TV on our website MP now dot in find us on Facebook at facebook.com forward slash magic tricks now and done×39’t forget to click thelike button you can also follow us on Twitter at magic bricks now to stay updated with all our programming hit the subscribe button on our YouTube channel by logging on to YouTube.com forward slash magic bricks now

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my property transfer paper form in Gmail?

How can I edit property transfer paper form on a smartphone?

Can I edit property transfer paper form on an Android device?

What is property transfer paper form?

Who is required to file property transfer paper form?

How to fill out property transfer paper form?

What is the purpose of property transfer paper form?

What information must be reported on property transfer paper form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.