Get the free Registrants Performing Governmental Audits in Accordance with Government Auditing St...

Show details

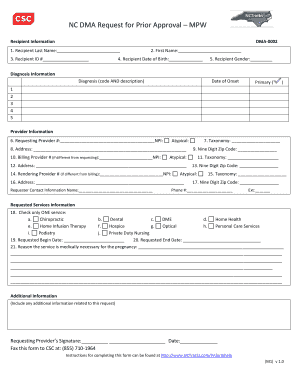

This document lists registrants who have met particular continuing education and performance standards for conducting governmental audits as required by the Oklahoma Accountancy Board.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registrants performing governmental audits

Edit your registrants performing governmental audits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registrants performing governmental audits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing registrants performing governmental audits online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit registrants performing governmental audits. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registrants performing governmental audits

How to fill out Registrants Performing Governmental Audits in Accordance with Government Auditing Standards

01

Review the Government Auditing Standards to understand the requirements.

02

Gather all necessary documentation related to the audit.

03

Complete the registrant form with accurate and up-to-date information.

04

Include details about the audit objectives and scope.

05

Ensure that all team members are qualified auditors as per the guidelines.

06

Sign and date the form to certify its accuracy.

07

Submit the completed form to the relevant authority as per the submission guidelines.

Who needs Registrants Performing Governmental Audits in Accordance with Government Auditing Standards?

01

Government agencies conducting audits.

02

Non-profit organizations that receive government funding.

03

Private auditors working with government contracts.

04

Oversight bodies responsible for ensuring compliance with governmental auditing standards.

Fill

form

: Try Risk Free

People Also Ask about

Who conducts government audits?

GAO has been auditing the federal government's consolidated financial statements since FY 1997 (as well as various other federal financial statements).

When auditing an entity's financial statements in ance with Government Auditing Standards, an auditor is required to report on?

Answer and Explanation: In performing an audit of the financial statement under government auditing standards, an auditor is required to report on the firm's compliance with laws and regulations. This report should include a description of the scope of an auditor's testing of compliance with laws and regulations.

What is paragraph 3.88 of the Yellow Book?

Paragraph 3.88 states that when preparing a client's financial statements in their entirety from the client's trial balance or underlying accounting records, firms should conclude that significant threats to independence exist.

What is the meaning of yellow book?

in any industry could be subject to the Yellow Book Requirements if the funding agency requests the audit, or if local, state, or federal regulations require the audit based on the level of funding spent (or received) by the entity.

What are the three types of government audits?

Types of Audits Financial Audits. The primary purpose of a financial audit is to render an opinion on whether the City's financial statement reports are presented fairly in conformity to applicable generally accepted accounting standards. Performance Audits. Other Audit Work.

What is the other matter paragraph in audit report?

Yellow Book: Government Auditing Standards Generally Accepted Government Auditing Standards (GAGAS), also known as the Yellow Book, provides the preeminent standards for government auditing.

What triggers a yellow book audit?

The Yellow Book is the book of standards and guidance for auditors and audit organizations, outlining the characteristics of good audit reports, professional qualifications for auditors, and audit quality guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Registrants Performing Governmental Audits in Accordance with Government Auditing Standards?

It refers to the guidelines and criteria that auditors must follow when conducting audits for government entities, ensuring accountability and transparency in the management of public funds.

Who is required to file Registrants Performing Governmental Audits in Accordance with Government Auditing Standards?

Organizations and auditors that conduct audits of government entities and receive federal funds are required to file under these standards.

How to fill out Registrants Performing Governmental Audits in Accordance with Government Auditing Standards?

To fill out the forms, auditors need to provide accurate information about their audit practices, compliance with standards, and findings during the audit process.

What is the purpose of Registrants Performing Governmental Audits in Accordance with Government Auditing Standards?

The purpose is to ensure that governmental audits are conducted consistently and transparently, promoting accountability and effective use of public resources.

What information must be reported on Registrants Performing Governmental Audits in Accordance with Government Auditing Standards?

The report should include the scope of the audit, findings, compliance issues, and any recommendations for improvement concerning the use of funds.

Fill out your registrants performing governmental audits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registrants Performing Governmental Audits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.