Get the free REQUEST FOR PIN

Show details

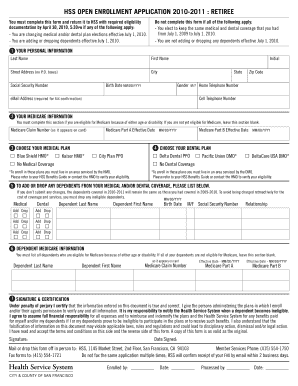

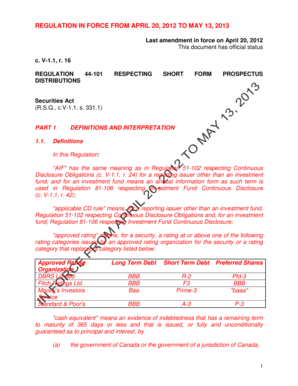

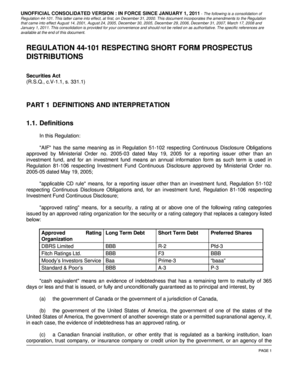

A form for acquiring a Personal Identification Number (PIN) required for logging into the Oklahoma Accountancy Board portal to complete applications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for pin

Edit your request for pin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for pin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for pin online

Follow the steps below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit request for pin. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for pin

How to fill out REQUEST FOR PIN

01

Obtain the REQUEST FOR PIN form from the relevant authority or website.

02

Fill in your personal information accurately, including your full name, address, and contact details.

03

Provide any identification information required, such as social security number or tax identification number.

04

Specify the purpose for requesting the PIN if asked.

05

Double-check all the information filled out for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the form through the specified method (mail, online, etc.) as directed.

Who needs REQUEST FOR PIN?

01

Individuals who are filing taxes and need a Personal Identification Number for identification.

02

Tax preparers who require a PIN to electronically sign tax returns.

03

Individuals applying for certain government services that require a PIN.

04

Businesses requesting a PIN for tax reporting or compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

How to get a personal identification number?

Your Personal Identification Number (PIN) Retrieve your IP PIN online at the IRS's Get an IP PIN site; or. Call the IRS at 1-800-908-4490 to have your IP PIN mailed to you. Will take up to 21 days. Pandemic delays it longer.

Does everyone have an IRS PIN?

Most taxpayers don't need one. You can still opt into the IP PIN program, even if you aren't a victim of identity theft. An IP PIN adds another layer of security protection, giving you peace of mind when you're filing your taxes.

How do I recover my self-select pin?

What if I can't remember last years AGI or PIN? You may call the IRS toll free number at 1-800-829-1040 or use the link on our self select pin page to enter data to receive that information.

What is my ID me PIN?

An Identity Protection PIN (IP PIN) is a six-digit number that helps protect your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) from unauthorized use on tax returns. The IRS encourages all taxpayers to sign up for an IP PIN. You must request your IP PIN directly from the IRS.

Can I put a hold on my social security number?

Lock Your Social Security Number To block electronic access to your SSN, call the Social Security Administration at 800-772-1213. Once you've made your request, any automated telephone and electronic access to your Social Security file is blocked.

Can I get a pin for my Social Security number?

If you don't already have an IP PIN, you may get an IP PIN as a proactive step to protect yourself from tax-related identity theft. Anyone with an SSN or an ITIN can get an IP PIN including individuals living abroad.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is REQUEST FOR PIN?

REQUEST FOR PIN is a formal document submitted to obtain a Personal Identification Number (PIN) that is often required for authentication and security purposes in various financial or governmental processes.

Who is required to file REQUEST FOR PIN?

Individuals or entities that need to access secure systems, complete certain transactions, or verify their identity may be required to file a REQUEST FOR PIN.

How to fill out REQUEST FOR PIN?

To fill out a REQUEST FOR PIN, one should provide necessary personal details, identification information, and any required supporting documents as specified on the form.

What is the purpose of REQUEST FOR PIN?

The purpose of REQUEST FOR PIN is to ensure secure access to sensitive information or services, allowing authorized individuals to authenticate their identity effectively.

What information must be reported on REQUEST FOR PIN?

Information required on a REQUEST FOR PIN typically includes personal identification details, contact information, reason for PIN request, and any reference numbers as applicable.

Fill out your request for pin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Pin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.