Get the free Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act

Show details

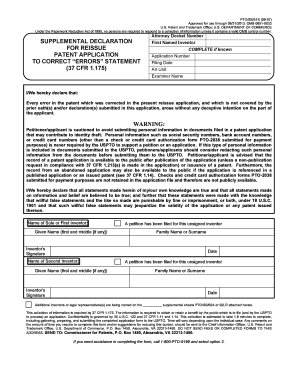

This document outlines the regulations, licensing requirements, and supervisory authority for mortgage brokers and mortgage loan originators in Oklahoma, aimed at ensuring consumer protection and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma secure and fair

Edit your oklahoma secure and fair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma secure and fair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma secure and fair online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oklahoma secure and fair. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma secure and fair

How to fill out Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act

01

Visit the official Oklahoma Mortgage Licensing website.

02

Download the application form for the Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act.

03

Gather required documentation, including proof of identity, background checks, and financial statements.

04

Complete the application form accurately, ensuring all information is current and truthful.

05

Submit the application along with the required fee to the appropriate licensing authority.

06

Await confirmation of receipt and further instructions for the next steps in the licensing process.

Who needs Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act?

01

Individuals seeking to operate as mortgage loan originators in Oklahoma.

02

Mortgage companies needing to comply with state regulations for licensing.

03

Anyone involved in residential mortgage lending activities within the state.

Fill

form

: Try Risk Free

People Also Ask about

What is secure and fair enforcement for mortgage licensing Act?

The Secure and Fair Enforcement for Mortgage Licensing Act of 2008 (SAFE Act), 12 U.S.C. § 5101, et seq. was enacted on July 30, 2008, and requires individuals who engage in the business of a residential mortgage loan originator (MLO) to be either state-licensed or federally-registered as MLOs.

What are the penalties for noncompliance of the Safe Act?

Enforcement of the SAFE Act The Act empowers both state and federal agencies to investigate and take action against individuals or institutions found to be in violation of the Act. Penalties for non-compliance include monetary fines, license revocation, and disciplinary action.

What is the penalty for violating the Safe Act?

Non-Compliance Leads to Financial Penalties and Legal Actions. One of the most immediate consequences of failing to meet regulatory requirements is the imposition of hefty fines. Businesses may also face lawsuits from stakeholders, customers, or even government agencies.

What are the potential penalties for noncompliance?

The SAFE Act requires that federal registration and state licensing/registration be accomplished through the same online registration system, the Nationwide Mortgage Licensing System and Registry (Registry).

What is the Safe Act compliance?

Appendix A to the SAFE Act regulation provides examples of activities of taking a loan application and offering or negotiating loan terms that fall within or outside of the definition of MLOs for federal registration purposes. 12 CFR Secs. 1007.101(c), 1007.102.

What loan types are covered by the Safe Act?

Covered loans for mortgages include lien loans, refinancings, home equity lines of credit, and reverse mortgages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act?

The Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act, often referred to as the SAFE Act, is legislation designed to enhance consumer protection and reduce fraud by establishing a framework for licensing mortgage loan originators and overseeing mortgage lending practices in Oklahoma.

Who is required to file Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act?

Individuals and entities engaged in mortgage loan origination, which includes mortgage brokers, lenders, and other financial institutions that originate mortgage loans, are required to file under the Oklahoma SAFE Act.

How to fill out Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act?

To fill out the Oklahoma SAFE Act application, applicants must provide personal information, including their name, address, Social Security number, employment history, and details about any criminal history. Additionally, applicants must submit required fees and provide fingerprints for a background check.

What is the purpose of Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act?

The purpose of the Oklahoma SAFE Act is to protect consumers by ensuring that mortgage loan originators are qualified and licensed, thereby promoting ethical practices in the mortgage industry and reducing the risk of fraud.

What information must be reported on Oklahoma Secure and Fair Enforcement for Mortgage Licensing Act?

Information that must be reported includes the applicant's personal identification details, employment history, financial disclosures, criminal history, and any disciplinary actions taken by regulatory authorities related to past mortgage lending or origination activities.

Fill out your oklahoma secure and fair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Secure And Fair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.