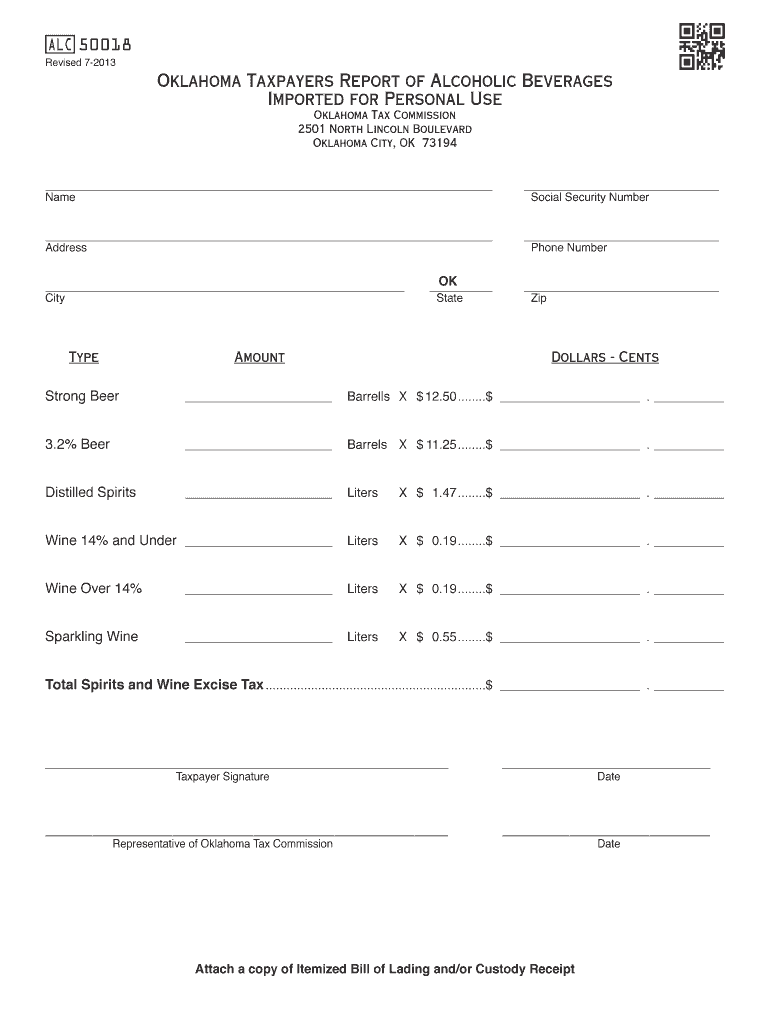

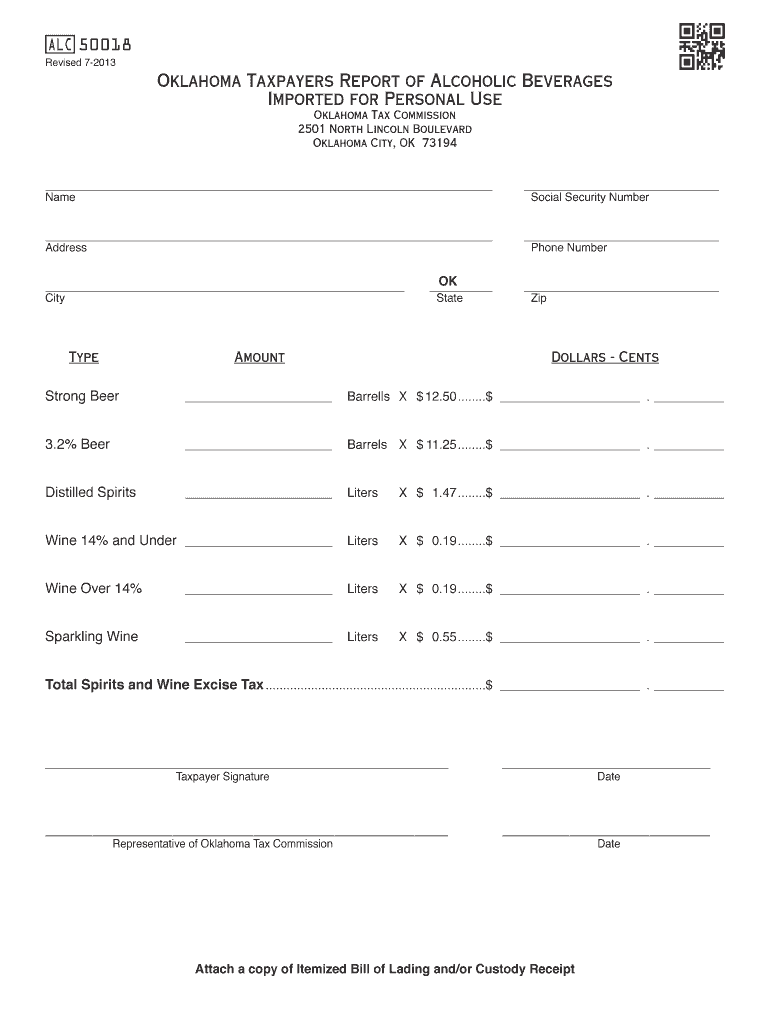

Get the free Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use

Show details

This document serves as a tax report for taxpayers in Oklahoma to declare alcoholic beverages imported for personal use and calculate the associated excise tax.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma taxpayers report of

Edit your oklahoma taxpayers report of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma taxpayers report of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma taxpayers report of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oklahoma taxpayers report of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma taxpayers report of

How to fill out Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use

01

Obtain the Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use form from the Oklahoma Tax Commission website or relevant office.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Indicate the type and quantity of alcoholic beverages you are importing for personal use.

04

Provide details regarding the origin of the alcoholic beverages, including the name of the state or country from which they are being imported.

05

Calculate the total value of the imported alcoholic beverages and fill in the relevant section on the form.

06

Sign and date the form to certify that all information provided is accurate and complete.

07

Submit the completed form to the Oklahoma Tax Commission as instructed on the form.

Who needs Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use?

01

Individuals who are importing alcoholic beverages for personal use into Oklahoma and who wish to comply with state reporting requirements.

Fill

form

: Try Risk Free

People Also Ask about

Does tax exempt apply to alcohol in Oklahoma?

While customers that present a valid sales tax exemption permit are exempt of sales tax on their purchase of alcoholic beverages, they are still subject to the mixed beverage tax on the purchase of alcoholic beverages.

What tax is placed on alcohol?

Alcoholic Beverage Tax CategoriesRate Per Wine Gallon July 15, 1991 – Present Distilled Spirits (100 proof or less) $3.30 Distilled Spirits (over 100 proof) $6.60 Beer $0.20 Wine $0.202 more rows

What is the import tax on alcohol?

What is the import tax on alcohol? The import tax on alcohol varies depending on the type of drink. Generally, duty rates on beer and wine remain low, approximately $1-2 per liter, while fortified wines and spirits attract significantly higher rates.

What state has the highest alcohol tax?

Excise (Spirits) It may come as no surprise that spirits attract the highest tax rate of all alcoholic beverages. Excise is applied based on the pack size of the liquid, as well as the strength of the beverage.

Why is alcohol so expensive in Oklahoma?

The alcoholic beverage tax is a selective sales tax that is designed to raise revenue from sales of objects that society considers “sins.” Taxes on alcoholic beverages, which are collected by the state but shared with local governments, contributed $120 million in 2016, slightly less than one percent of all tax revenue

What is the alcohol tax in Oklahoma?

To clarify, the 13.5% alcohol tax is in *addition* to the regular sales tax which is 8.99%? So there is a regular combined state and local sales tax of roughly $5.21 on the total, which takes us to $63.21. 13.5% on the $48 in alcohol is roughly $6.48. That comes to $11.69, which is pretty spot on for the listed taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use?

The Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use is a form that residents must submit to report alcoholic beverages that they import into the state for personal consumption.

Who is required to file Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use?

Any resident of Oklahoma who imports alcoholic beverages for personal use is required to file the report.

How to fill out Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use?

To fill out the report, the individual must provide their name, address, the type and quantity of alcoholic beverages imported, and any other required information as specified on the form.

What is the purpose of Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use?

The purpose of the report is to track the amount of alcoholic beverages being brought into the state for personal use and to ensure compliance with state tax laws.

What information must be reported on Oklahoma Taxpayers Report of Alcoholic Beverages Imported for Personal Use?

Individuals must report their name, address, the type and quantity of alcoholic beverages imported, the date of importation, and any other relevant details required by the tax authorities.

Fill out your oklahoma taxpayers report of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Taxpayers Report Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.