Get the free 2007 Oklahoma Nonresident Fiduciary Income Tax

Show details

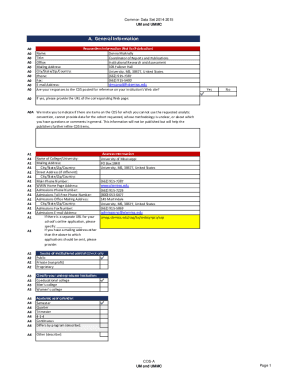

This document provides instructions and forms necessary for nonresident trusts and estates to file income tax returns in Oklahoma for the year 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2007 oklahoma nonresident fiduciary

Edit your 2007 oklahoma nonresident fiduciary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2007 oklahoma nonresident fiduciary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2007 oklahoma nonresident fiduciary online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2007 oklahoma nonresident fiduciary. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2007 oklahoma nonresident fiduciary

How to fill out 2007 Oklahoma Nonresident Fiduciary Income Tax

01

Obtain the 2007 Oklahoma Nonresident Fiduciary Income Tax form from the Oklahoma Tax Commission website.

02

Fill out personal information at the top of the form including the name of the trust or estate and its federal identification number.

03

Check the appropriate box to indicate whether this is an original return or an amended return.

04

Complete the income section by reporting all sources of income earned by the trust or estate during the tax year.

05

Calculate the Oklahoma taxable income by applying any applicable deductions or exemptions.

06

Fill out the tax calculation section, based on the Oklahoma tax rates for nonresident fiduciaries.

07

Include any applicable credits that the trust or estate may qualify for.

08

Sign and date the form at the bottom, certifying that all information provided is accurate and complete.

09

Mail the completed form to the address provided in the instructions, along with any required payment for taxes owed.

Who needs 2007 Oklahoma Nonresident Fiduciary Income Tax?

01

Any individual or entity that is managing a trust or estate that earned income in Oklahoma during the tax year.

02

Fiduciaries who represent a nonresident trust or estate that must file a tax return in Oklahoma due to income sourced from within the state.

03

Tax professionals who assist fiduciaries in their tax obligations may also need to understand this form.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a fiduciary tax return?

The IRS requires the filing of an income tax return for trusts and estates on Form 1041—formerly known as the fiduciary income tax return. This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

What is the minimum amount you can make and not file taxes?

If you were under 65 at the end of 2024 If your filing status is:File a tax return if your gross income is: Single $14,600 or more Head of household $21,900 or more Married filing jointly $29,200 or more (both spouses under 65) $30,750 or more (one spouse under 65) Married filing separately $5 or more1 more row • Jan 28, 2025

How do I know if I need to file a nonresident tax return?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

What is the nonresident filing threshold in Oklahoma?

For the period you were a nonresident, filing is required if you have gross income of $1,000 or more from Oklahoma sources. Nonresidents: Nonresidents with gross income of $1,000 or more from Oklahoma sources must file a state income tax return, with some exceptions under the Pass-Through Entity Act of 2019.

Does Oklahoma tax non-resident income?

Non-residents: If you have gross income from Oklahoma sources of $1,000 or more you are required to file an Oklahoma return, unless otherwise provided for in the Pass-Through Entity Tax Equity Act of 2019. You are allowed $1,000 per exemption.

How much can you make in Oklahoma before you have to file taxes?

Except as otherwise provided for in the Pass-Through Entity Tax Equity Act of 2019, every nonresident with Oklahoma source gross income of $1,000 or more is required to file an Oklahoma income tax return. A nonresident partner may elect to be included in a composite partnership return; see Rule 710:50-19-1.

What is the nonresident income tax form for Oklahoma?

Form 511-NR (2023): Oklahoma Nonresident / Part-Year Individual Income Tax Return. Form 511-NR is an Oklahoma (OK) tax return specifically designed for nonresidents and part-year residents who have filing obligations within the state.

What is a 513 NR in Oklahoma?

Form 513-NR, Part 2, may be used for the grantor information. If income is reported to Oklahoma under one entity identification number and the grantor files under a different identification number, a Form 513-NR must be filed with a schedule showing the name, address, and social security number of the grantor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2007 Oklahoma Nonresident Fiduciary Income Tax?

The 2007 Oklahoma Nonresident Fiduciary Income Tax is a tax imposed on the income earned by trusts or estates that are administered by fiduciaries who are not residents of Oklahoma but have income sourced from Oklahoma.

Who is required to file 2007 Oklahoma Nonresident Fiduciary Income Tax?

Entities that are required to file include nonresident fiduciaries of estates and trusts that have income derived from Oklahoma sources.

How to fill out 2007 Oklahoma Nonresident Fiduciary Income Tax?

To fill out the tax form, you need to gather all pertinent financial information, including income generated from Oklahoma sources, deductions, and credits. Complete the appropriate tax forms provided by the Oklahoma Tax Commission, ensuring accurate reporting of all income and applicable calculations.

What is the purpose of 2007 Oklahoma Nonresident Fiduciary Income Tax?

The purpose of the 2007 Oklahoma Nonresident Fiduciary Income Tax is to ensure that nonresident fiduciaries pay state taxes on income that is earned from Oklahoma sources, in compliance with state tax laws.

What information must be reported on 2007 Oklahoma Nonresident Fiduciary Income Tax?

The information that must be reported includes the gross income sourced from Oklahoma, deductions, and any credits applicable to the fiduciary income, along with identification details of the trust or estate and the fiduciary.

Fill out your 2007 oklahoma nonresident fiduciary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2007 Oklahoma Nonresident Fiduciary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.