Get the free Oklahoma Fiduciary Income Tax Form 513

Show details

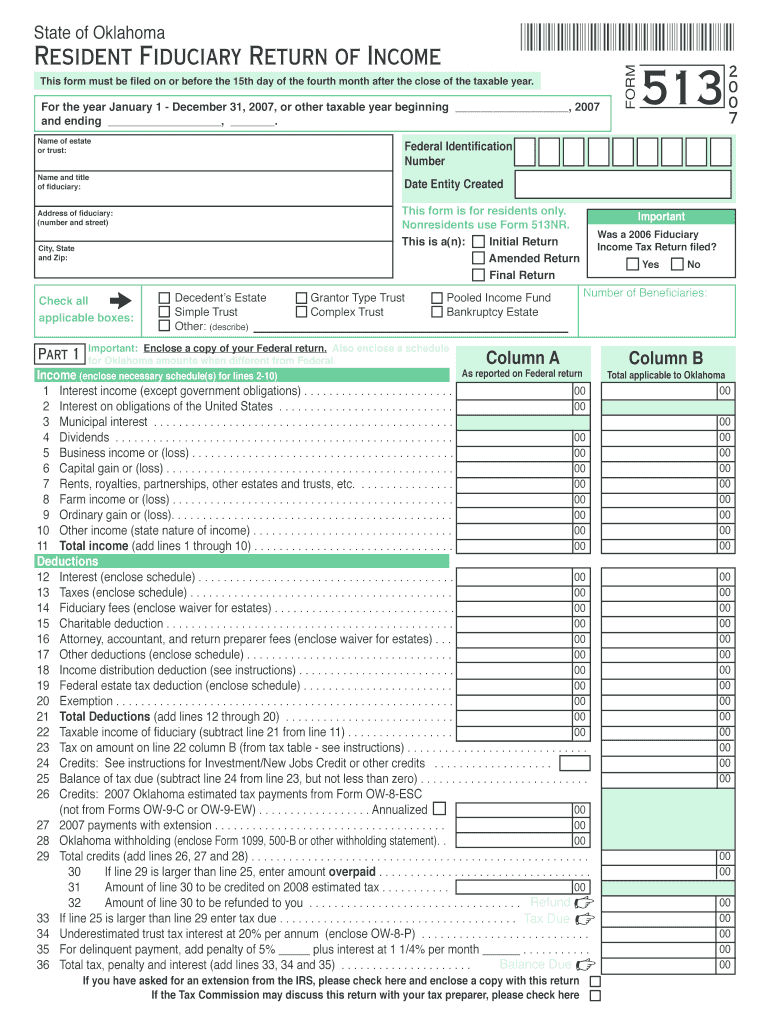

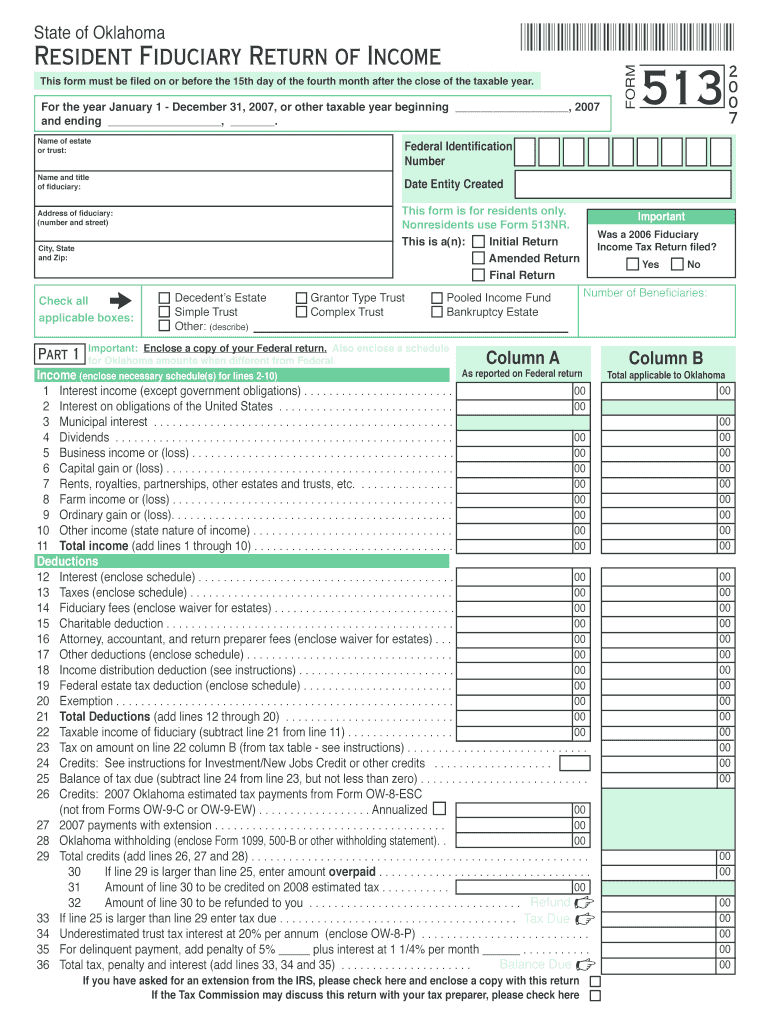

This document contains instructions and the tax form for filing the Oklahoma resident fiduciary income tax return (Form 513) for trusts and estates.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oklahoma fiduciary income tax

Edit your oklahoma fiduciary income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma fiduciary income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma fiduciary income tax online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oklahoma fiduciary income tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oklahoma fiduciary income tax

How to fill out Oklahoma Fiduciary Income Tax Form 513

01

Obtain the Oklahoma Fiduciary Income Tax Form 513 from the Oklahoma Tax Commission website or local tax office.

02

Fill in the basic information at the top of the form, including the name and address of the estate or trust.

03

Provide the federal employer identification number (EIN) for the estate or trust.

04

Complete the income section by reporting all income received by the estate or trust during the tax year.

05

Deduct any allowable expenses directly related to the administration of the estate or trust.

06

Calculate the total taxable income by subtracting the allowable deductions from the total income.

07

Fill out the tax calculation section to determine the amount of Oklahoma income tax owed.

08

Review the form for accuracy and sign at the designated area.

09

Submit the completed form along with any required payment by the tax deadline.

Who needs Oklahoma Fiduciary Income Tax Form 513?

01

Any estate or trust that generates taxable income in Oklahoma must file the Oklahoma Fiduciary Income Tax Form 513.

02

Trustees or personal representatives responsible for managing the estate or trust's financial affairs may also need to fill out this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the form for fiduciary income tax?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Do retirees pay state income tax in Oklahoma?

Oklahoma offers an income tax exemption of up to $10,000 to retirees age 65 and older. There is no state estate or inheritance tax in Oklahoma. The highest income tax bracket is lower in Oklahoma than in many other states, but most Oklahoma taxpayers fall into the state's highest bracket.

Who needs to file the IRS form 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

What is the difference between form 56 and form 2848?

If you're taking on full financial responsibility, Form 56 gives you that broader legal authority as a fiduciary. But if the focus is only on handling specific tax matters, Form 2848 lets you work with the IRS without taking over all financial decisions.

Do I need to file a fiduciary tax return?

The IRS requires the filing of an income tax return for trusts and estates on Form 1041—formerly known as the fiduciary income tax return. This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

Can I file form 1041 electronically?

Form 1041 was added to the Modernized e-File (MeF) platform in January 2014. MeF can accept the current and prior two tax years. In processing year 2024, MeF will accept Form 1041 tax years 2021, 2022, and 2023.

Who must file IL 1041?

Trusts and Estates must complete Form IL-1041. 2024 Form IL-1041 is for tax year ending on or after December 31, 2024, and ending before December 31, 2025. For tax year ending on or after December 31, 2023 and before December 31, 2024, use the 2023 form. Using the wrong form will delay the processing of your return.

Where can I get Oklahoma tax forms?

Forms can be accessed from the OK Tax Commission website. Frequently requested forms can be accessed below. Notice: The Oklahoma Tax Commission is unable to mail forms to individuals or businesses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Oklahoma Fiduciary Income Tax Form 513?

Oklahoma Fiduciary Income Tax Form 513 is a tax form used by estates and trusts in Oklahoma to report income, deductions, and taxes owed by the entity.

Who is required to file Oklahoma Fiduciary Income Tax Form 513?

Estates and trusts that generate income or have a filing requirement under Oklahoma tax law are required to file the Oklahoma Fiduciary Income Tax Form 513.

How to fill out Oklahoma Fiduciary Income Tax Form 513?

To fill out the Oklahoma Fiduciary Income Tax Form 513, you must provide information about the estate or trust, report income and deductions, complete the appropriate sections for tax calculations, and submit it by the due date.

What is the purpose of Oklahoma Fiduciary Income Tax Form 513?

The purpose of the Oklahoma Fiduciary Income Tax Form 513 is to report the income and tax liability of estates and trusts to ensure compliance with state tax laws.

What information must be reported on Oklahoma Fiduciary Income Tax Form 513?

The form must report the estate or trust's income, deductions, credits, the identity of the fiduciaries, and other relevant financial information required by Oklahoma tax regulations.

Fill out your oklahoma fiduciary income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Fiduciary Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.