Get the free Form 580

Show details

Form 580 is used to claim a refundable credit for qualified capital expenditures, wages, or training expenses incurred by businesses providing data processing services and computer-related services

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 580

Edit your form 580 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 580 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 580 online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 580. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

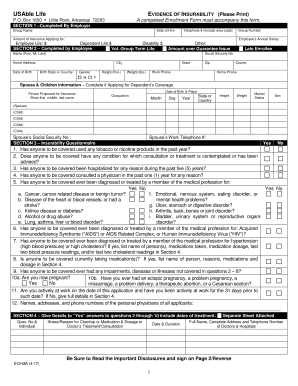

How to fill out form 580

How to fill out Form 580

01

Obtain Form 580 from the appropriate agency or website.

02

Fill in your personal information in the designated sections, including your name, address, and Social Security number.

03

Complete the relevant details regarding your income and expenses as required by the form.

04

Review the instructions carefully for any additional information or documentation that may be required.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form to the appropriate agency as instructed.

Who needs Form 580?

01

Individuals or businesses that need to report certain types of income or claim specific tax credits.

02

Taxpayers who meet the eligibility requirements outlined by the IRS or state tax authority.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 16A for NRI?

Form 16A is a Tax Deducted at Source (TDS) Certificate issued quarterly that captures the amount of TDS, Nature of Payments and the TDS deposited with the Income Tax Department. 4. Details provided in the form: Tax Deducted / Collected at Source.

What is the minimum salary to get Form 16?

Under the Income Tax Act, 1961, employers must issue Form 16 to employees whose annual salary exceeds Rs.2.5 lakh. In the following circumstances, the employer is not permitted to withhold TDS: The employee might not be subject to the applicable income tax slab.

What is form 16 in English?

Form 16 is a key tax document for salaried taxpayers and it is issued by the employer every year. This annual tax certificate which contains tax deducted at source (TDS) source data needs to be issued by 15th June of the subsequent financial year.

What is Form 16 for filing?

Why is Form 16 required? Form 16 helps you easily file your income tax returns. It is proof that the employer did submit the money to the authorities that it deducted as TDS from your salary. It also details how your tax was computed based on the investment declarations you made at the beginning of the financial year.

What is form 145 in English?

Form 145 is a form used in Spain for workers to communicate to their employer certain personal and family data that affect tax withholdings on their income. These withholdings are applied to earned income, such as wages and salaries, and are used to pay Personal Income Tax (IRPF).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

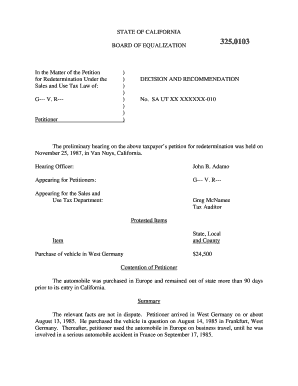

What is Form 580?

Form 580 is a tax form used in California for reporting tax credits related to split interest trusts.

Who is required to file Form 580?

Entities that have a split interest trust or that are required to report certain tax credits must file Form 580.

How to fill out Form 580?

To fill out Form 580, follow the instructions provided by the California Franchise Tax Board, which include entering identifying information, calculating credits, and providing necessary signatures.

What is the purpose of Form 580?

The purpose of Form 580 is to report and claim specific tax credits associated with split interest trusts as required by California tax law.

What information must be reported on Form 580?

Form 580 requires reporting identifying information about the trust, the amount of credits being claimed, and any relevant financial details related to the trust's income and distributions.

Fill out your form 580 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 580 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.