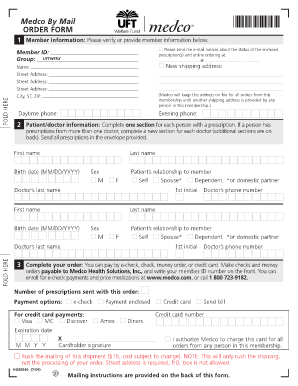

Get the free Consumer Use Tax Report

Show details

This document is used for reporting and remitting use tax on tangible personal property purchased outside Oklahoma and brought into the state for personal use or consumption. It includes instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consumer use tax report

Edit your consumer use tax report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consumer use tax report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consumer use tax report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit consumer use tax report. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consumer use tax report

How to fill out Consumer Use Tax Report

01

Obtain the Consumer Use Tax Report form from your state's tax authority website.

02

Enter your business information, including name, address, and tax identification number.

03

List all purchases made without sales tax during the reporting period, specifying item descriptions and amounts.

04

Calculate the taxable amount for each item and sum them up.

05

Apply the appropriate tax rate to the total taxable amount to determine the total use tax owed.

06

If applicable, include any credits for sales taxes paid in other jurisdictions.

07

Review all entries for accuracy.

08

Sign and date the report.

09

Submit the completed report to your state's tax authority by the due date.

Who needs Consumer Use Tax Report?

01

Individuals and businesses that purchase goods without sales tax and are responsible for reporting and paying the Consumer Use Tax.

02

Out-of-state retailers selling taxable items to residents in a state where they are not registered to collect sales tax.

03

Companies that purchase items for use in their business but do not pay sales tax at the time of purchase.

Fill

form

: Try Risk Free

People Also Ask about

What is consumer use tax in TN?

The general state tax rate is 7%. The local tax rate varies by county and/or city. Please click on the links to the left for more information about tax rates, registration and filing.

What is consumer use tax in TN?

The general state tax rate is 7%. The local tax rate varies by county and/or city. Please click on the links to the left for more information about tax rates, registration and filing.

How is NJ use tax calculated?

New Jersey assesses a 6.625% Sales Tax on sales of most tangible personal property, specified digital products, and certain services unless specifically exempt under New Jersey law.

Who has to pay CA use tax?

The use tax generally applies to the storage, use, or other consumption in California of goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchases shipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

What is an example of a consumer tax?

Examples of consumption taxes include retail sales taxes, excise taxes, value-added taxes, use taxes, taxes on gross business receipts, and import duties. These taxes are borne by consumers who pay a higher retail price for the good or service.

What is an example of a use tax?

Example of Use Tax Let's say that a Californian bought clothing from an online retailer in Oregon. Under Oregon law, the retailer does not collect sales tax on the goods but the retail buyer must still pay a use tax on that clothing purchase to the California tax authority called the Board of Equalization.

What is the difference between use tax and consumer use tax?

It differs from sales tax, however, in that vendor use tax is based on purchases made from a retailer who is based outside of the buyer's state. “Consumer use” tax, on the other hand, is the tax paid directly to the state by the purchaser when the retailer does not charge sales or use tax at the time of the sale.

What is the difference between vendor use tax and consumer use tax?

The difference is that seller's use tax applies to sales that are conducted by a vendor located outside of the state but is registered to collect tax in the state of the sale. Therefore, if a vendor charges a customer seller's use tax at the appropriate rate, the customer will not have a consumer's use tax obligation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consumer Use Tax Report?

The Consumer Use Tax Report is a tax report used by individuals or businesses to report use taxes owed on purchases made from out-of-state vendors.

Who is required to file Consumer Use Tax Report?

Individuals and businesses that purchase goods for use in their state without paying sales tax at the time of purchase are required to file the Consumer Use Tax Report.

How to fill out Consumer Use Tax Report?

To fill out the Consumer Use Tax Report, individuals or businesses should provide details about the purchases made, including the date of purchase, description of items, purchase price, and the applicable use tax rate.

What is the purpose of Consumer Use Tax Report?

The purpose of the Consumer Use Tax Report is to ensure that consumers self-report and pay the appropriate amount of use tax on goods used, consumed, or stored in their state.

What information must be reported on Consumer Use Tax Report?

The information that must be reported includes the purchaser's name and address, purchase dates, item descriptions, total purchase amounts, and the calculated use tax owed.

Fill out your consumer use tax report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consumer Use Tax Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.