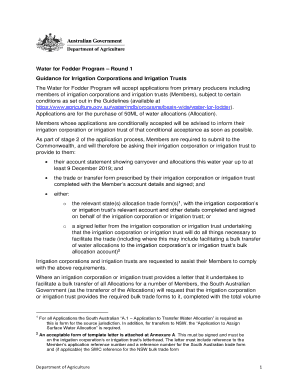

Get the free Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission F...

Show details

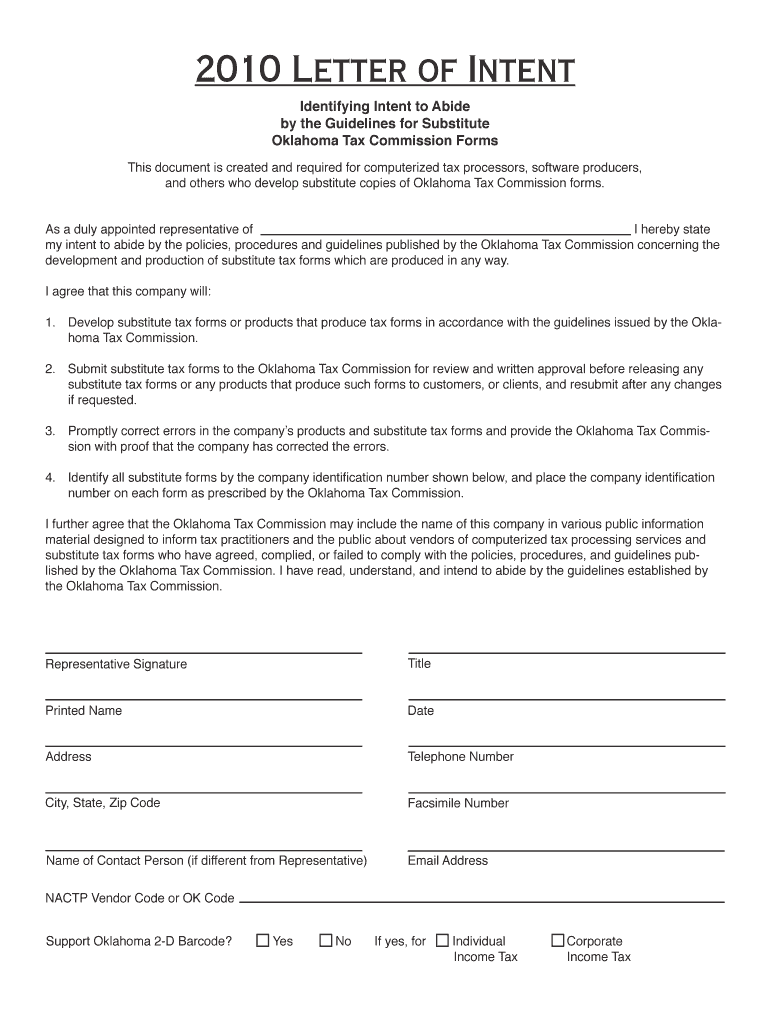

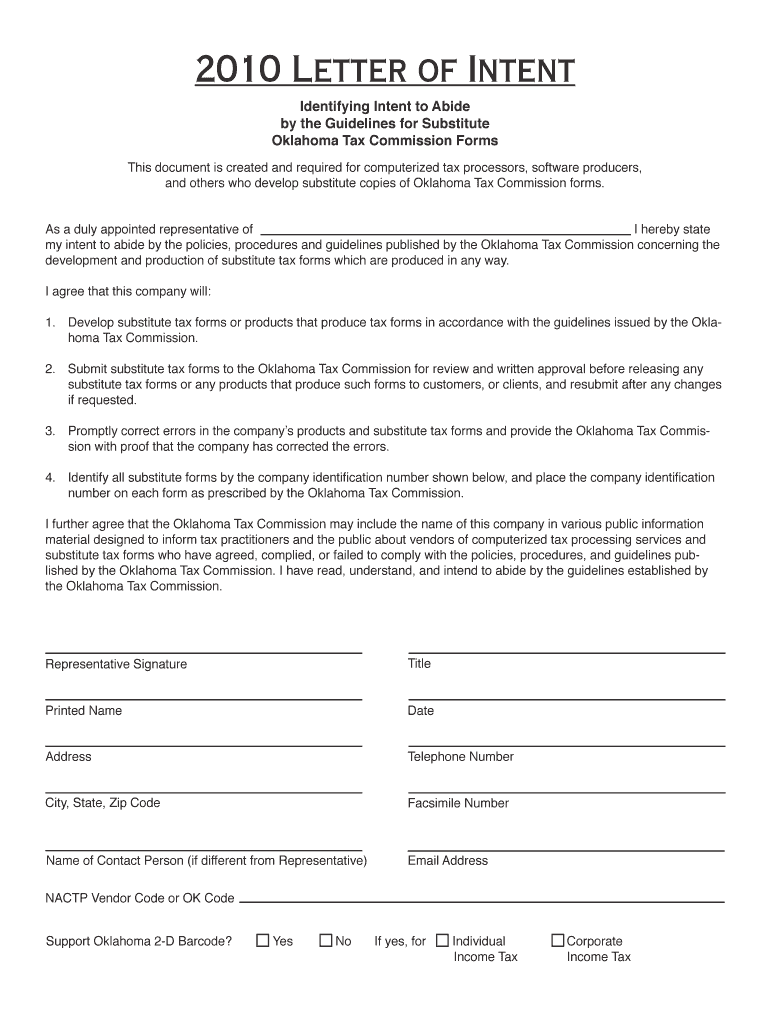

This document serves as a declaration of intent by companies to adhere to the Oklahoma Tax Commission's guidelines for substitute tax forms and reporting.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letter of intent to

Edit your letter of intent to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letter of intent to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing letter of intent to online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit letter of intent to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letter of intent to

How to fill out Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms

01

Begin by obtaining the official Letter of Intent template from the Oklahoma Tax Commission website.

02

Fill in the date at the top of the document.

03

Include your name and contact information in the designated fields.

04

Provide your organization’s name and address in the appropriate section.

05

Clearly state your intent to abide by the guidelines outlined for substitute forms.

06

Outline any specific details regarding the types of substitute forms you will be using.

07

Sign the document in the designated area at the bottom.

08

Review your letter for accuracy and completeness before submission.

09

Submit the signed Letter of Intent to the Oklahoma Tax Commission as instructed.

Who needs Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms?

01

Individuals or businesses submitting substitute forms to the Oklahoma Tax Commission that are not using the standard forms.

02

Tax professionals or accountants who are preparing tax documentation for clients in Oklahoma.

03

Organizations that regularly handle tax forms and need to ensure compliance with state guidelines.

Fill

form

: Try Risk Free

People Also Ask about

What is the Oklahoma Tax Commission forgiveness program?

Oklahoma VCI/Tax Amnesty is available for a taxpayer that did not file the required Oklahoma tax return(s), underreported tax due on a previously filed tax return(s), or did not pay previously assessed taxes. The program applies to both Oklahoma residents and out-of-state taxpayers who owe Oklahoma taxes.

How far back can the Oklahoma Tax Commission audit?

Any return filed timely within the last three years may be selected for a review. If the return is a monthly, quarterly or semi-monthly tax return, the period selected for review can be no older than 36 months from the filing date of the return, if filed timely.

What is a letter ruling for the Oklahoma Tax Commission?

A letter ruling is a written decision by the Oklahoma Tax Commission that is sent in response to a taxpayer's request for guidance on an unusual circumstances or complex question about their specific tax situation.

What is an IRS letter ruling?

A private letter ruling, or PLR, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's represented set of facts. A PLR is issued in response to a written request submitted by a taxpayer. A PLR may not be relied on as precedent by other taxpayers or by IRS personnel.

Why would the Oklahoma Tax Commission send me a letter?

To combat identity tax fraud, the OTC is requesting additional information from taxpayers to ensure your tax refund is received by you. You may receive an identity verification letter from the OTC after filing to verify your identity to receive your refund.

How much can the Oklahoma Tax Commission garnish?

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673 (2023).)

Why would I get a letter from Oklahoma Tax Commission?

0:03 3:08 Return. I authorized someone else to file this return on my behalf. Or I did not file this returnMoreReturn. I authorized someone else to file this return on my behalf. Or I did not file this return click next to submit your response.

How do I write a check to the Oklahoma Tax Commission?

Attach a check or money order for the tax period payable to " Oklahoma Tax Commission". Mail the coupon and check/money order to the Form OW-8-ES address here. Additional Information:Use one of these payment options if you want to submit estimated taxes rather than submit all your taxes owed at once.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms?

The Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms is a document submitted by taxpayers indicating their intention to adhere to specific guidelines when using substitute forms for tax filings.

Who is required to file Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms?

Taxpayers who wish to use substitute forms instead of standard Oklahoma Tax Commission forms are required to file the Letter of Intent.

How to fill out Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms?

To fill out the Letter of Intent, taxpayers must provide their basic information, indicate their intention to comply with the guidelines, and may need to include details about the specific substitute forms they plan to use.

What is the purpose of Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms?

The purpose is to ensure that taxpayers using substitute forms are aware of and agree to follow the guidelines set by the Oklahoma Tax Commission, thereby maintaining the integrity and standardization of tax filings.

What information must be reported on Letter of Intent to Abide by the Guidelines for Substitute Oklahoma Tax Commission Forms?

The Letter of Intent must include the taxpayer's name, contact information, a statement of intent to adhere to the guidelines, and specifics about the substitute forms being utilized.

Fill out your letter of intent to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letter Of Intent To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.