Get the free Schedule 6—Cigar Tax on Cigars Below Cap - oregon

Show details

This schedule is used for reporting purchases, credits, and sales of cigars below the tax cap in Oregon, required for submission with the Oregon Quarterly Tobacco Tax Return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule 6cigar tax on

Edit your schedule 6cigar tax on form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule 6cigar tax on form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit schedule 6cigar tax on online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule 6cigar tax on. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule 6cigar tax on

How to fill out Schedule 6—Cigar Tax on Cigars Below Cap

01

Obtain a copy of Schedule 6—Cigar Tax on Cigars Below Cap form from the relevant authority.

02

Read the instructions provided with the form carefully.

03

Fill in the name and contact information in the designated fields.

04

Enter the total number of cigars below the cap in the appropriate section.

05

Calculate the total tax due based on the number of cigars and the applicable tax rate.

06

Provide any additional required information, such as the date of sale or purchase.

07

Review your entries for accuracy and completeness.

08

Sign and date the form at the bottom where required.

09

Submit the completed form along with any payment due to the tax authority by the specified deadline.

Who needs Schedule 6—Cigar Tax on Cigars Below Cap?

01

Retailers and distributors of cigars who sell products that are subject to the cigar tax below the cap.

02

Businesses that manufacture or import cigars intended for sale in the jurisdiction that requires Schedule 6.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax on cigars in Washington state?

Tax Rate 75 percent of the taxable sales price (RCW 82.26. 020(1)). Further, a maximum tax rate of $0.50 applies to cigars.

What is the tax on cigars in Massachusetts?

Overview and Registration. The Massachusetts excise tax on cigarettes is $3.51 per pack of 20 cigarettes. If a pack contains more than 20 cigarettes, the excise tax increases. Cigars and smoking tobacco are subject to a state excise tax of 40% of the wholesale price.

What is the excise tax on cigars?

The federal government taxes tobacco products, including cigarettes, cigars, pipe tobacco, and roll-your-own tobacco. The federal excise tax on cigarettes is just over $1.00 per pack. Large cigars are taxed at 52.75 percent of the manufacturer's sales price, with a maximum tax of 40.26 cents per cigar.

Which state has the highest cigar tax?

Premium Cigar Taxes Vary Across US States Utah levies the highest tax of 86 percent, followed by New York and Colorado at 75 percent and 56 percent, respectively. Florida, Pennsylvania, and New Hampshire have exempted premium cigars from an excise tax.

What is the federal tax on cigars?

Over 500 million premium cigars were sold in the United States in 2023. With each sale comes a complex tax. landscape. All large cigars are subject to a federal tax of 52.75 percent, capped at $0.4026 per cigar.

What is WA state liquor tax?

Spirits sales tax rate paid by the general public: 20.5%. Spirits sales tax rate paid by on-premises retailers such as restaurants, bars, etc., on their purchases from distributors, distillers, etc.: 13.7%.

How much tax on cigars?

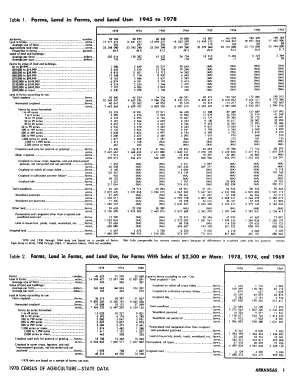

State / LocalitiesTax TypeTax Rate Arkansas Cigarette $57.50/1000 cigarettes OTP 68% of manufacturer's invoiced selling price Premium Cigar $0.50/premium cigar + 2% of manufacturer's invoiced selling price (price ≥ $0.7576/cigar) California OTP 52.92% of wholesale Cost121 more rows

How much are swishers after tax?

For instance, a single Swisher Sweets flavored cigar cost $1.29 before the tax and now costs $1.69. A 5-pack of Swisher Sweets cost $5.49 before the tax and now costs $7.99.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule 6—Cigar Tax on Cigars Below Cap?

Schedule 6—Cigar Tax on Cigars Below Cap is a tax form used to report and pay taxes on cigars that are priced below a certain threshold set by tax regulations.

Who is required to file Schedule 6—Cigar Tax on Cigars Below Cap?

Manufacturers, importers, or wholesalers of cigars that sell cigars priced below the established cap are required to file Schedule 6.

How to fill out Schedule 6—Cigar Tax on Cigars Below Cap?

To fill out Schedule 6, you need to provide details such as your business information, quantity of cigars, prices, and the exact tax calculation based on the number of cigars sold below the cap.

What is the purpose of Schedule 6—Cigar Tax on Cigars Below Cap?

The purpose of Schedule 6 is to ensure compliance with federal tax regulations by tracking the sale of cigars priced below the cap and to facilitate the correct payment of taxes owed on those sales.

What information must be reported on Schedule 6—Cigar Tax on Cigars Below Cap?

Information that must be reported includes the name and address of the manufacturer or seller, the quantity and types of cigars sold, the selling price, and the corresponding tax amount calculated.

Fill out your schedule 6cigar tax on online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule 6cigar Tax On is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.