Get the free Life Settlement Provider Report - dbr ri

Show details

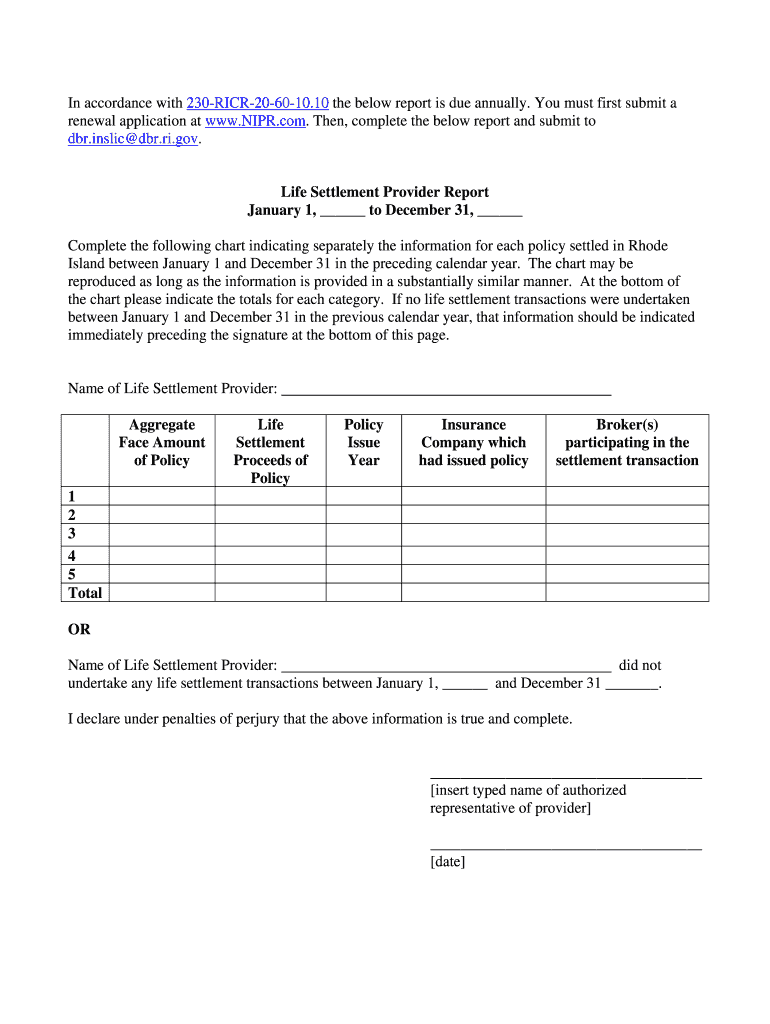

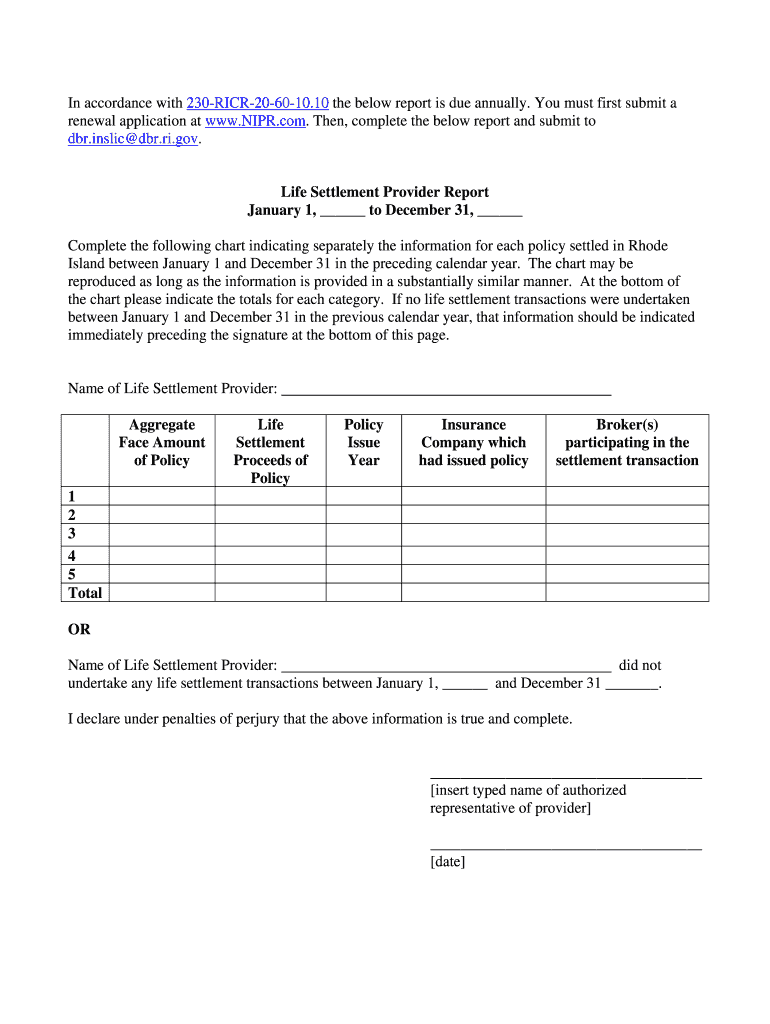

This document is required annually for life settlement providers in Rhode Island to report information on life settlement transactions conducted within the preceding year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life settlement provider report

Edit your life settlement provider report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life settlement provider report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life settlement provider report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit life settlement provider report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life settlement provider report

How to fill out Life Settlement Provider Report

01

Gather all necessary information about the policy including policyholder details, insurance company, policy number, and type of insurance.

02

Collect information about the insured person's health status, including recent medical records and health history.

03

Determine the cash surrender value of the policy by consulting with the insurance company or financial advisor.

04

Identify and document the death benefit amount of the policy.

05

Complete the financial analysis section, including any outstanding loans against the policy and other liabilities.

06

Provide a summary of the policy’s performance over time

07

Review all entries for accuracy and completeness before submission.

08

Submit the report according to the requirements specified by the relevant regulatory body.

Who needs Life Settlement Provider Report?

01

Life settlement providers who need to assess the value of a life insurance policy.

02

Financial advisors looking to provide clients with options for selling their life insurance.

03

Policyholders considering a life settlement as an alternative to policy lapse or surrender.

04

Investors interested in purchasing life insurance policies through life settlements.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a life settlement?

Do you get a good deal as a Life Settlement Broker ? StateAnnual SalaryHourly Wage California $65,804 $31.64 Minnesota $65,304 $31.40 Rhode Island $65,298 $31.39 New Hampshire $64,844 $31.1861 more rows

How much do life settlements pay?

What's the Range for the Valuation of a Life Settlement? Policyholders generally receive anywhere from 10-50% of the face value/death benefit when they sell their life insurance policy. On average, most people receive around 20% of the face value.

What do life settlement companies do?

The life settlement provider becomes the new owner of the life insurance policy, pays any future premiums and receives the death benefit when the person whose life is insured under the policy (the insured) dies.

What is a life settlement producer?

A life settlement provider is the person or company that becomes the new policy owner in return for a pay- ment made to the seller. The life settlement provider becomes the policy owner, must pay any premiums that are due, and eventually collects the full amount of the death benefit from the insurance company.

What is a life settlement provider?

Examples of life settlement cases The business was sold and the life insurance policies were no longer needed. The cash value of each policy was less than $35,000. The first policy was sold in a life settlement for $409,000, and two years later the second policy was sold for $984,000.

What is the primary purpose of a life settlement contract?

A life settlement refers to the sale of an existing insurance policy to a third party for a one-time cash payment. The policy's purchaser becomes its beneficiary and assumes payment of its premiums, and receives the death benefit when the insured dies.

What is the average payout for a life settlement?

In most cases, the payout from a life settlement will be between 10% and 25% of the policy's face value. For example, if you have a $500,000 life insurance policy, your average payout will be around $100,000. Again, this amount changes based on different factors, like the life expectancy of the policyholder.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Life Settlement Provider Report?

The Life Settlement Provider Report is a document that provides detailed information regarding life settlements, which are transactions where a policyholder sells their life insurance policy to a third party for a cash payment.

Who is required to file Life Settlement Provider Report?

Life settlement providers, which are companies or individuals that purchase life insurance policies from policyholders, are required to file the Life Settlement Provider Report.

How to fill out Life Settlement Provider Report?

To fill out the Life Settlement Provider Report, the provider must gather necessary information including policy details, transaction amounts, and relevant dates, and accurately report them according to the guidelines set forth by the regulatory authority.

What is the purpose of Life Settlement Provider Report?

The purpose of the Life Settlement Provider Report is to ensure transparency and compliance within the life settlement industry by providing regulators with a clear overview of life settlement transactions.

What information must be reported on Life Settlement Provider Report?

The information that must be reported includes the policyholder's details, policy number, the amount paid for the policy, date of the transaction, and any commissions or fees involved in the transaction.

Fill out your life settlement provider report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Settlement Provider Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.