Get the free RI-1120V - tax ri

Show details

This form is used to submit a payment of any balance due for corporate taxes in Rhode Island, facilitating the efficient processing of said payment by the Division of Taxation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ri-1120v - tax ri

Edit your ri-1120v - tax ri form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ri-1120v - tax ri form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ri-1120v - tax ri online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ri-1120v - tax ri. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ri-1120v - tax ri

How to fill out RI-1120V

01

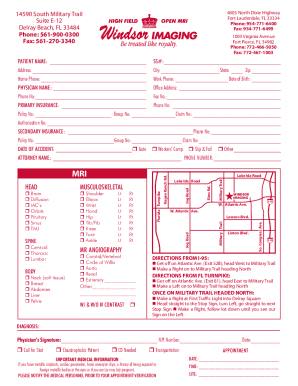

Obtain the RI-1120V form from the Rhode Island Division of Taxation website or your local tax office.

02

Fill in your business name, address, and tax identification number at the top of the form.

03

Indicate the tax year for which you are filing.

04

Calculate your total income and any adjustments as required by the form instructions.

05

Report any tax credits and prepayments you may be eligible for.

06

Compute the total amount due based on your calculations.

07

Sign and date the form to certify that the information provided is accurate.

Who needs RI-1120V?

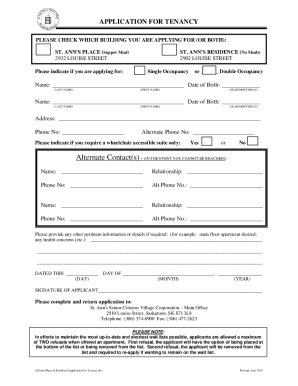

01

Businesses operating in Rhode Island that are required to file corporate income tax returns.

02

Any entity that owes tax to the state of Rhode Island and is making a payment.

03

Corporations that have received a tax assessment and need to submit payment.

Fill

form

: Try Risk Free

People Also Ask about

How are LLCs taxed in Rhode Island?

LLCs in Rhode Island are taxed as pass-through entities by default. Rather than paying taxes at the entity level, LLCs pass profits and losses on to their members, who then pay taxes at the individual level. In Rhode Island, LLC members are subject to both federal and state personal income tax.

What is RI 1065V?

Form RI-1065V is a statement you send with your payment of any balance due on line 13 from Form RI-1065. Using Form RI-1065V allows us to more accurately and efficiently process your payment. We strongly encourage you to use Form RI- 1065V, but there is no penalty for not doing so. HOW TO FILL IN FORM RI-1065V.

How much business tax will I pay?

Here is a sample of current corporate tax rates for some populous states: StateCorporate tax rates California 8.84% Florida 5.5% (only on earnings above $50,000) New York 6.50% to 7.25% Pennsylvania 8.49%2 more rows • Feb 24, 2025

What is the new corporate tax rate?

Corporate tax rates by state StateState Corporate Tax Rate Alaska 0% – 9.4% Arizona 4.9% Arkansas 1% – 4.8% California 8.84%47 more rows • May 6, 2024

Does Rhode Island accept federal extension for corporations?

* Rhode Island does NOT accept an approved IRS extension to extend the deadline of Rhode Island business returns. 5% of the amount of tax for each additional month or fraction of a month, up to 25%. 0.5% a month, up to 25% in the aggregate.

What is the business corporation tax in Rhode Island?

Corporations pay a 7% tax on all Rhode Island taxable income, with a minimum tax of $400. Although S corporations, limited liability partnerships, limited partnerships, and LLCs are generally considered pass-through entities, they're required to pay the $400 minimum tax as well.

What is minimum corporate income tax?

Minimum corporate income tax. A minimum corporate income tax (MCIT) of two percent is imposed on the gross income of domestic and resident foreign corporations annually. It is imposed from the beginning of the fourth taxable year immediately following the commencement of the business operations of the corporation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RI-1120V?

RI-1120V is a form used by businesses in Rhode Island to make a payment for their corporate income tax.

Who is required to file RI-1120V?

Corporations that are required to file a corporate income tax return in Rhode Island must file RI-1120V if they are making a payment.

How to fill out RI-1120V?

To fill out RI-1120V, provide the business's name, address, federal employer identification number (FEIN), and the payment amount, ensuring all relevant sections are accurately completed.

What is the purpose of RI-1120V?

The purpose of RI-1120V is to facilitate tax payments for corporate income taxes owed to the state of Rhode Island.

What information must be reported on RI-1120V?

Information reported on RI-1120V includes the corporation's name, address, FEIN, and the payment amount being submitted for corporate income tax.

Fill out your ri-1120v - tax ri online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ri-1120v - Tax Ri is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.