Get the free RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008 - tax ri

Show details

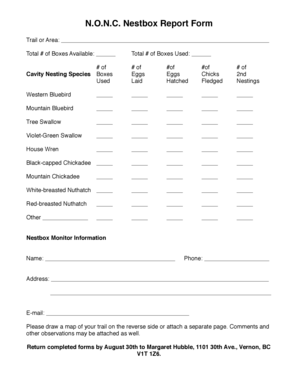

This document is a tax return form for reporting composite income tax for various entity types in Rhode Island for the tax year 2008.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ri-1040c rhode island composite

Edit your ri-1040c rhode island composite form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ri-1040c rhode island composite form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ri-1040c rhode island composite online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ri-1040c rhode island composite. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ri-1040c rhode island composite

How to fill out RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008

01

Obtain the RI-1040C form from the Rhode Island Division of Taxation website or local tax office.

02

Fill out the top section with the entity's name, address, and federal employer identification number (FEIN).

03

Complete the income section by listing all sources of income received by the composite entity.

04

Calculate the total income and any allowable deductions as specified in the instructions.

05

Fill out the tax calculation area by applying the correct tax rates to the taxable income.

06

Provide information regarding any credits or prepayments that may apply.

07

Include the names, addresses, and social security numbers of all individual partners or shareholders if required.

08

Sign and date the return after verifying that all information is accurate.

09

Submit the completed RI-1040C along with any required payment by the deadline to the Rhode Island Division of Taxation.

Who needs RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008?

01

Businesses or entities that have multiple partners or shareholders and are filing taxes collectively in Rhode Island.

02

Entities that derive income from sources within Rhode Island and wish to report it as a composite return.

03

Tax professionals preparing returns for clients who meet the criteria for filing a composite income tax return.

Fill

form

: Try Risk Free

People Also Ask about

Who are required to file return?

Every person having taxable income and whose accounts are not liable to audit must file an Income Tax Return. If total income exceeds Rs. 5 lakh, it is mandatory to file the return online.

What is the standard deduction for RI income tax?

The new standard deduction amounts for 2024 are as follows: Single- $10,550. Married Filing Joint: $21,150. Surviving Spouse: $21,150.

Do I need to file a RI tax return?

RESIDENT INDIVIDUALS – Every resident individual of Rhode Island who is required to file a federal income tax return must file a Rhode Island individual income tax return (RI-1040).

Who must file a RI estate tax return?

Do You Need to File a Rhode Island Estate Tax Return? All estates must file Form RI-706, which is modeled after Federal Form 706. If the value of the gross estate is less than $1,802,431 (for deaths in 2025), no tax is owed.

What is the statute of limitations on Rhode Island income tax?

Laws§ 44-30-83 provides in part as follows: Limitations on assessment. (a) General. Except as otherwise provided in this section the amount of the Rhode Island personal income tax shall be assessed within three (3) years after the return was filed, whether or not the return was filed on or after the prescribed date.

Who is required to file a Rhode Island tax return?

Who has to file Rhode Island state income tax? StatusDefinition Resident You consider Rhode Island your permanent home or maintain a permanent home in Rhode Island and spend over 183 days annually in the state. Part-year Resident You lived in Rhode Island for part of the year and resided elsewhere for the remainder.1 more row • Apr 8, 2025

What is the extension for Rhode Island personal income tax return?

Use Form RI-4868 to obtain an automatic 6 month extension of time to file a Rhode Island Individual Income Tax Return. Form RI-4868 can be used to extend the filing of Form RI- 1040, Rhode Island Resident Individual Tax Return, or RI- 1040NR, Nonresident Income Tax Return.

Who is obligated to file a tax return?

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008?

RI-1040C is the Rhode Island Composite Income Tax Return form for the tax year 2008, used by partnerships, S corporations, and other entities to report the income of non-resident partners or shareholders.

Who is required to file RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008?

Entities such as partnerships and S corporations that have non-resident members or shareholders must file the RI-1040C return if they have income derived from Rhode Island sources.

How to fill out RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008?

To fill out RI-1040C, gather the necessary financial information for the entity, complete the required sections detailing income, deductions, and apportionment, and ensure to report the individual shares of Rhode Island income for each non-resident member or shareholder.

What is the purpose of RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008?

The purpose of RI-1040C is to enable partnerships and S corporations to collectively report and pay the Rhode Island state income tax on behalf of their non-resident partners or shareholders.

What information must be reported on RI-1040C RHODE ISLAND COMPOSITE INCOME TAX RETURN 2008?

The RI-1040C must report total income earned from Rhode Island sources, specific deductions, the net income allocated to each non-resident member or shareholder, and the corresponding tax calculated on that income.

Fill out your ri-1040c rhode island composite online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ri-1040c Rhode Island Composite is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.