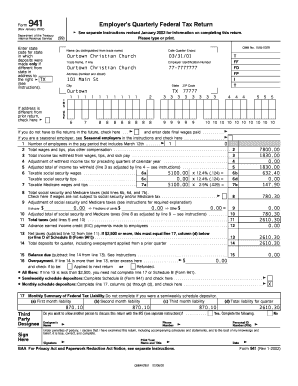

Get the free ESTIMATED TAX INSTRUCTIONS - tax ri

Show details

This document provides instructions for corporations regarding the filing of estimated taxes, including due dates for payments and information on penalties for underpayment.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estimated tax instructions

Edit your estimated tax instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estimated tax instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estimated tax instructions online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estimated tax instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estimated tax instructions

How to fill out ESTIMATED TAX INSTRUCTIONS

01

Gather all necessary financial documents including income statements and expense records.

02

Calculate your expected annual income by estimating all income sources.

03

Subtract any deductible expenses to determine your taxable income.

04

Use the appropriate tax rates to compute your estimated tax liability.

05

Determine whether you expect a refund or need to pay additional taxes.

06

Divide your estimated tax liability by the number of payment periods (usually four).

07

Complete the estimated tax form (Form 1040-ES for individuals) with your calculations.

08

Submit the form and make your first estimated tax payment by the due date.

Who needs ESTIMATED TAX INSTRUCTIONS?

01

Individuals who expect to owe tax of $1,000 or more when filing their tax return.

02

Self-employed individuals who do not have taxes withheld from their income.

03

Anyone with income not subject to withholding, such as rental, investment, or freelance income.

04

Taxpayers who had a tax liability in the previous year and expect a similar situation in the current year.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get tax instructions?

Get the current filing year's forms, instructions, and publications for free from the IRS. You can also find printed versions of many forms, instructions, and publications in your community for free at: Libraries. IRS Taxpayer Assistance Centers.

What triggers the underpayment penalty?

An underpayment penalty is a charge the IRS imposes on taxpayers who did not pay all of their estimated income taxes for the year or paid their taxes late. You'll face an underpayment penalty if you: Didn't pay at least 90% of the tax on your current-year return or 100% of the tax shown on the prior year's return.

What is the rule of thumb for estimated taxes?

A good rule of thumb is to set aside around 30% of your gross income for taxes—approximately 25% for the IRS and 5% for state taxes. Estimated taxes are essential for covering income not subject to withholding, like self-employment income, RSUs, stock options, or bonuses.

What is the 90% rule for estimated taxes?

If the total of your estimated payments and withholding add up to less than 90 percent of what you owe, you may face an underpayment penalty. So you may want to avoid cutting your payments too close to the 90 percent mark to give yourself a safety net.

Is it better to overpay or underpay estimated taxes?

It's best to calculate your estimated tax payments so they are as close as possible to the right amount for the current year, meaning you'll owe little or no tax when you file your tax return. But you also don't want to pay too much, essentially giving the IRS an interest-free loan for months.

What is the income threshold for estimated tax payments?

Individuals who are required to make estimated tax payments, and whose 2023 California adjusted gross income is more than $150,000 (or $75,000 if married/RDP filing separately) must figure estimated tax based on the lesser of 90% of their tax for 2024 or 110% of their tax for 2023 including AMT.

What do you write on a check for estimated taxes?

Make sure your check or money order includes the following information: Your name and address. Daytime phone number. Social Security number (the SSN shown first if it's a joint return) or employer identification number. Tax year. Related tax form or notice number.

What is the 110% rule for estimated tax payments?

If the Adjusted Gross Income (AGI) on your previous year's return is over $150,000 (over $75,000 if you are married filing separately), you must pay the lower of 90% of the tax shown on the current year's return or 110% of the tax shown on the return for the previous year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ESTIMATED TAX INSTRUCTIONS?

Estimated Tax Instructions provide guidelines for individuals and businesses to estimate their tax liability for the year and make quarterly tax payments to avoid penalties.

Who is required to file ESTIMATED TAX INSTRUCTIONS?

Individuals and businesses that expect to owe tax of $1,000 or more when their return is filed, as well as self-employed individuals, are required to file estimated tax.

How to fill out ESTIMATED TAX INSTRUCTIONS?

To fill out Estimated Tax Instructions, taxpayers should use the appropriate forms, calculate their expected tax liability for the year, and divide that amount into quarterly installments.

What is the purpose of ESTIMATED TAX INSTRUCTIONS?

The purpose of Estimated Tax Instructions is to help taxpayers accurately predict their tax obligations and ensure timely payments throughout the year to avoid underpayment penalties.

What information must be reported on ESTIMATED TAX INSTRUCTIONS?

Taxpayers must report their expected income, deductions, credits, and any other pertinent financial information on Estimated Tax Instructions to accurately calculate their tax liability.

Fill out your estimated tax instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estimated Tax Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.