Get the free Sales and Use Tax Regulation SU 11-20 - tax ri

Show details

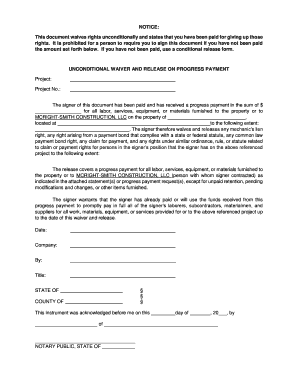

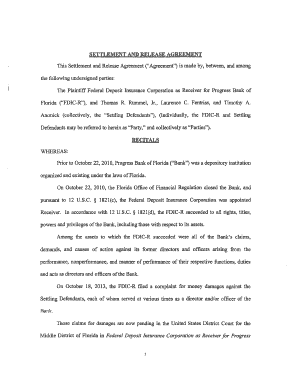

This regulation outlines the procedures for the registration and collection of sales and use tax by retailers in the state of Rhode Island, including definitions, statutory authority, and requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales and use tax

Edit your sales and use tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales and use tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sales and use tax online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sales and use tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales and use tax

How to fill out Sales and Use Tax Regulation SU 11-20

01

Begin by downloading the Sales and Use Tax Regulation SU 11-20 form from the official state website.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Fill in your business information, including name, address, and tax ID number.

04

Provide details about the sales and uses of taxable goods or services.

05

Calculate the total sales tax owed based on your reported sales.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form to certify that the information is correct.

08

Submit the completed form to the designated tax authority by the specified deadline.

Who needs Sales and Use Tax Regulation SU 11-20?

01

Businesses that sell tangible personal property or taxable services.

02

Individuals or entities making taxable purchases in the state.

03

Businesses registered for Sales and Use Tax in the jurisdiction requiring the form.

04

Tax professionals preparing tax filings on behalf of businesses.

Fill

form

: Try Risk Free

People Also Ask about

What items are exempt from sales tax in Rhode Island?

Clothing and footwear are generally exempt from Rhode Island sales tax. However, certain items like accessories, protective equipment, and sports or recreational equipment may still be taxable.

What type of tax is sales tax considered?

A sales tax is a consumption tax imposed by the government on the sale of goods and services. A conventional sales tax is levied at the point of sale (POS), which is collected by the retailer and passed on to the government.

What is the exemption certificate for sales and use tax?

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. Exemptions are based on the customer making the purchase and always require documentation. Different purchasers may be granted exemptions under a state's statutes.

What is the difference between property tax and sales tax?

0:37 2:43 And services when you buy an item a percentage of that sale goes to the government. This taxMoreAnd services when you buy an item a percentage of that sale goes to the government. This tax fluctuates based on the amount spent and the local tax rate meaning that during busy shopping seasons

What items are usually tax exempt?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption. Sales to the U.S. Government. Sales of prescription medicine and certain medical devices. Sales of items paid for with EBT cards.

Is sales and use tax the same as property tax?

Property tax is a direct tax, for which the owner of the property is obligated to pay the taxes. Sales tax is an indirect tax, for which a company collects tax from a customer on behalf of the government. Property owners are responsible for paying taxes on their property every year.

What is exempt from Rhode Island sales tax?

Tax-exempt goods Examples include most non-prepared food items, prescription medications, and some clothing. We recommend businesses review the laws and rules put forth by the Rhode Island Division of Taxation to stay up to date on which goods are taxable and which are exempt, and under what conditions.

What is US sales and use tax?

Sales and use tax rates vary from state to state and generally range from 2.9% to 7.25% at the state level. Many states also allow a 'local option' that permits local jurisdictions, such as cities and counties, to impose an additional percentage on top of the state-level tax and to keep the related revenues.

What is not taxed in RI?

Clothing and footwear are generally exempt from Rhode Island sales tax. However, clothing accessories, protective equipment, sports equipment, and rentals remain taxable.

What is considered property tax?

Property tax is the tax that is imposed on immovable property like land and buildings, as well as on movable property, like vehicles and equipment. Property tax is the single largest source of state and local revenue in the U.S. The capital is used to fund schools, roads, police, and other services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Sales and Use Tax Regulation SU 11-20?

Sales and Use Tax Regulation SU 11-20 is a regulation that outlines the requirements for the collection, reporting, and payment of sales and use taxes in a specific jurisdiction. It provides guidelines for taxpayers regarding their tax obligations.

Who is required to file Sales and Use Tax Regulation SU 11-20?

Any individual or business that engages in taxable sales, leases, or purchases of goods and services in the jurisdiction covered by Regulation SU 11-20 is required to file this regulation.

How to fill out Sales and Use Tax Regulation SU 11-20?

To fill out Sales and Use Tax Regulation SU 11-20, taxpayers need to provide detailed information regarding their sales and purchases, including total taxable sales, exempt sales, and calculate the amount of tax owed using the provided forms and instructions.

What is the purpose of Sales and Use Tax Regulation SU 11-20?

The purpose of Sales and Use Tax Regulation SU 11-20 is to ensure compliance with sales and use tax laws, to provide clear guidance on tax obligations, and to facilitate the accurate reporting and remittance of tax by businesses and individuals.

What information must be reported on Sales and Use Tax Regulation SU 11-20?

Sales and Use Tax Regulation SU 11-20 requires reporting of total sales, taxable sales, exempt sales, and the amount of tax collected. Additionally, pertinent identification information of the taxpayer must also be included.

Fill out your sales and use tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales And Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.