Get the free Supplemental Form C Corporate Information - consumer sc

Show details

This form is required for businesses filing with the South Carolina Secretary of State, including corporations, LLCs, and limited partnerships, to provide essential corporate information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental form c corporate

Edit your supplemental form c corporate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental form c corporate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supplemental form c corporate online

Follow the steps below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit supplemental form c corporate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

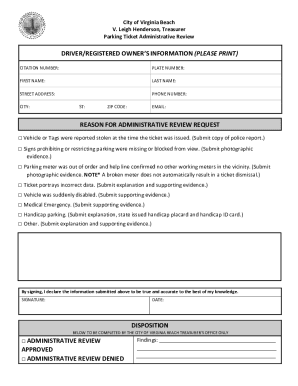

How to fill out supplemental form c corporate

How to fill out Supplemental Form C Corporate Information

01

Gather your company's basic information, including the legal name, address, and contact information.

02

Provide the Corporate Tax Identification Number (TIN) if applicable.

03

Fill in details about the officers and directors of the corporation, including their names, titles, and contact details.

04

List the shareholders and their ownership percentages.

05

Include any relevant business licenses or permits that your corporation holds.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the appropriate regulatory authority as required.

Who needs Supplemental Form C Corporate Information?

01

Businesses operating as a corporation that are required to provide detailed corporate information for regulatory compliance.

02

Organizations that file taxes as a corporation and need to disclose ownership and management structure.

Fill

form

: Try Risk Free

People Also Ask about

What is C corporation tax form?

C corps pay their own taxes The corporation must file a Form 1120 each year to report its income and to claim its deductions and credits. Income earned by a corporation is normally taxed at the corporate level using the corporate income tax rates shown in the table below.

Can I fill out my own schedule C?

You can download all versions of a Schedule C on the IRS website. You can also use online tax preparation software to access a Schedule C and complete your tax return.

How do I start my own C corp?

Here's a rundown of the steps involved in forming a C corp: Choose a business name. Forming a C corp begins with selecting a business name. Select a state of incorporation. Designate a registered agent. File articles of incorporation. Draft corporate bylaws. Appoint directors. Conduct an organizational meeting. Issue stock.

What are the requirements for a C corp?

C corporations need to have shareholders, directors, and officers. They must hold director and shareholder meetings, keep corporate minutes, and allow shareholders to vote on major corporate decisions.

What is a form C?

Form C is an offering statement that must be filed by any company conducting a Regulation Crowdfunding offering. Form Cs are submitted through the Securities and Exchange Commission's EDGAR online filing system.

Is it better to be an LLC or C corp?

This is because C corps allow for the easy transfer of ownership through the sale of shares and are a familiar and trusted structure for many investors. On the other hand, if your primary goal is to keep things simple while protecting yourself from personal liability, an LLC might be a more suitable choice.

What is required for a C corporation?

C corporations need to have shareholders, directors, and officers. They must hold director and shareholder meetings, keep corporate minutes, and allow shareholders to vote on major corporate decisions.

What are the disadvantages of a C corp?

The main disadvantage of the C corporation is that it pays tax on its earnings and the shareholders pay tax on dividends, meaning the corporation's earnings are taxed twice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplemental Form C Corporate Information?

Supplemental Form C Corporate Information is a document required by certain regulatory bodies that provides detailed information about a corporation, its structure, and its operations.

Who is required to file Supplemental Form C Corporate Information?

Corporations that are seeking to register securities or are engaged in specific business activities as defined by regulatory agencies are required to file Supplemental Form C Corporate Information.

How to fill out Supplemental Form C Corporate Information?

To fill out Supplemental Form C Corporate Information, you need to provide information regarding the company's legal structure, ownership details, financial statements, and any other required disclosures as specified by the regulatory authority.

What is the purpose of Supplemental Form C Corporate Information?

The purpose of Supplemental Form C Corporate Information is to ensure transparency and compliance by providing regulators with essential information regarding a corporation's operations and financial status.

What information must be reported on Supplemental Form C Corporate Information?

The information that must be reported includes the corporation's name, address, principal place of business, ownership details, business activities, financial statements, and any other disclosures requested by the regulatory authority.

Fill out your supplemental form c corporate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Form C Corporate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.