Get the free APPLICATION TO INDIVIDUALLY SELF-INSURE - wcc sc

Show details

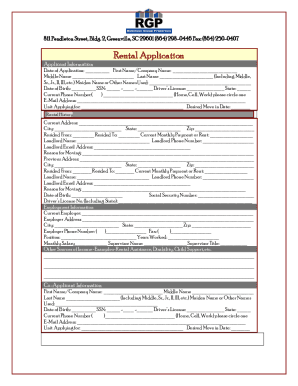

This document is an application form for employers seeking to self-insure their workers' compensation in South Carolina, including details on business operations, claims history, and financial capacity.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application to individually self-insure

Edit your application to individually self-insure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application to individually self-insure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application to individually self-insure online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application to individually self-insure. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application to individually self-insure

How to fill out APPLICATION TO INDIVIDUALLY SELF-INSURE

01

Gather necessary documents such as proof of income and insurance history.

02

Obtain the APPLICATION TO INDIVIDUALLY SELF-INSURE form from the appropriate regulatory agency.

03

Fill out personal information accurately, including name, address, and contact details.

04

Provide required financial information, including assets and liabilities.

05

Include details regarding the types of risks you wish to self-insure against.

06

Review the form for completeness and accuracy.

07

Submit the completed application along with any required fees to the designated agency.

Who needs APPLICATION TO INDIVIDUALLY SELF-INSURE?

01

Individuals who wish to self-insure rather than purchase traditional insurance.

02

People with significant assets who can afford to cover potential losses themselves.

03

Individuals who prefer to manage their own risk instead of relying on insurance providers.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of self-insurance?

Self-insurance can provide cost savings, flexibility, control, and improved cash flow. However, it also carries financial risk, administrative burden, resource challenges, and the possibility of unforeseen (or catastrophic) losses.

What is a major disadvantage of a self-insured program?

Cons of Self-Insured Companies: Risk: Large, unexpected claims can strain finances, prompting many businesses to consider stop-loss insurance. Administration: Self-insurance demands administrative effort, either internally or via third-party administrators.

Is it a good idea to self-insure?

Self-insuring against certain losses may be more economical than buying insurance from a third party. The more predictable and smaller the loss is, the more likely it is that an individual or firm will choose to self-insure.

What does self-insured mean on a police report?

Self-insured usually means you have the cash/assets to cover the cost of all damages you cause in a collision that is your fault. Uninsured means you are unable to cover the cost of any damages you cause in a collision that is your fault.

Can an individual be self-insured?

Self-insurance allows individuals to retain the money they would have spent paying annual insurance premiums. These individuals can use those funds to build up a nest egg, which can be maintained if they do not experience losses. Self-insurance also allows individuals to choose what they want to insure.

When should I self-insure?

Remember, you're ready to be self-insured for your life insurance when you're debt-free and have plenty in savings to cover your income year after year. For most people, that happens when they're approaching retirement or when their term life insurance is coming to an end.

Is self-insuring worth it?

In summary, it's not the worst idea if you have a lot of money to actually self insure, but it's a pretty bad idea overall. Paying premiums and your share of the costs is going to be cheaper in the long run for the vast majority of people. Healthcare costs only go up as you age.

Why would a company choose to be self-insured?

Some large businesses may choose to self-insure to save money and control costs for their commercial property, auto and general liability coverages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION TO INDIVIDUALLY SELF-INSURE?

APPLICATION TO INDIVIDUALLY SELF-INSURE is a formal request submitted by an individual or entity to the relevant regulatory authority, seeking permission to self-insure against potential losses instead of purchasing traditional insurance coverage.

Who is required to file APPLICATION TO INDIVIDUALLY SELF-INSURE?

Typically, businesses or individuals who wish to accept a greater financial risk and opt out of standard insurance policies must file the APPLICATION TO INDIVIDUALLY SELF-INSURE. This can include larger businesses with sufficient assets to cover potential claims.

How to fill out APPLICATION TO INDIVIDUALLY SELF-INSURE?

To fill out the APPLICATION TO INDIVIDUALLY SELF-INSURE, applicants need to complete the prescribed form, provide supporting documents such as financial statements, and detail the risks they intend to self-insure against. Specific instructions and requirements may vary by jurisdiction.

What is the purpose of APPLICATION TO INDIVIDUALLY SELF-INSURE?

The purpose of the APPLICATION TO INDIVIDUALLY SELF-INSURE is to evaluate whether the applicant has the financial capability and necessary plans to manage risks without relying on conventional insurance. It helps regulatory authorities assess risk management strategies.

What information must be reported on APPLICATION TO INDIVIDUALLY SELF-INSURE?

Applicants must report relevant financial information, including balance sheets, income statements, and details about their assets and liabilities. Additionally, they may need to provide information regarding the types of risks they intend to self-insure against and their risk management practices.

Fill out your application to individually self-insure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application To Individually Self-Insure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.