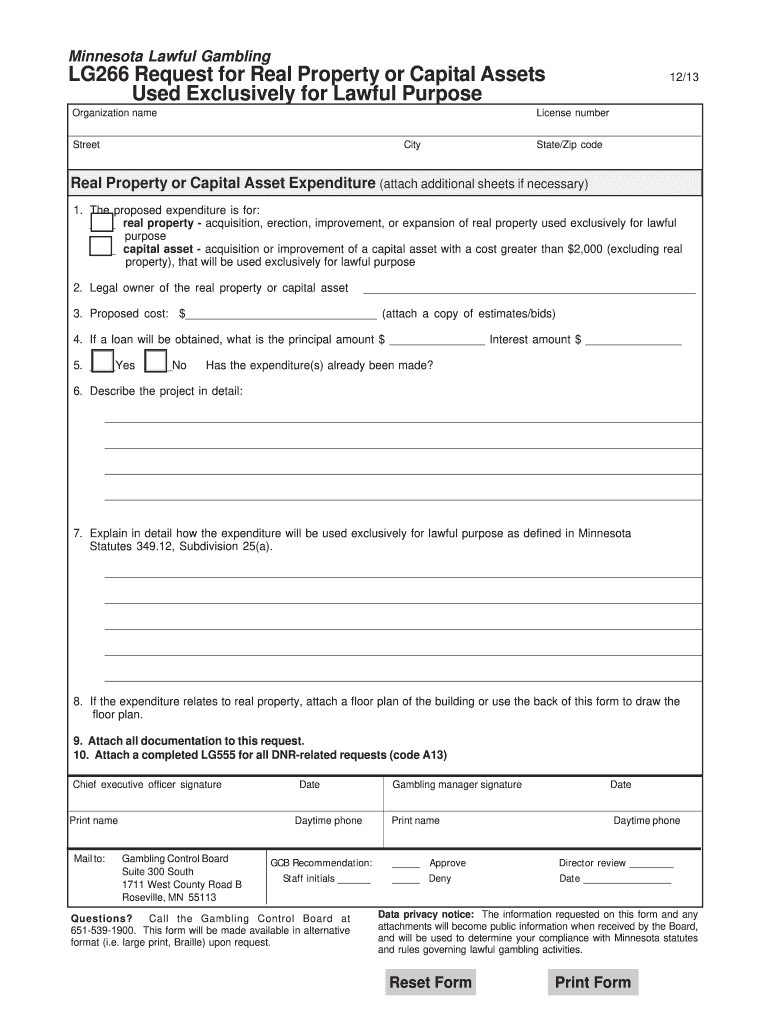

MN LG266 2013-2025 free printable template

Get, Create, Make and Sign lg266 - gcb state

Editing lg266 - gcb state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lg266 - gcb state

How to fill out MN LG266

Who needs MN LG266?

Instructions and Help about lg266 - gcb state

You're about to listen to a discussion at the November gambling control board meeting relating to taxation and accounting procedures used to monitor our local charities that are involved in pull-tab and other form of charitable gaming that you as citizens have a right to see and need to make sure it's on your community channel as well as the Minnesota channel of public TV all across the state of Minnesota and run a number of times and passed on to all charitable gamers that do poll tabs in Minnesota as well as the organizations that provide gaming and provide services to our community is something your legislature and the media empires don't want you to see so listen very carefully to Mr chairman and board members as well I wanted to cry and congratulate you first I'm Ellen rep key inform TV and radio congratulate you on a growing industry that you're involved in, and I commend you on your regulatory end I'm here today to get some clarification of taxation and accounting and as a journalist trying to see that the public is informed on what is really going on Tom you mentioned that the media picked this up some, and I think I heard a little burp both on Fox and STP and I think they both kind of give a misleading response to the public as far as what charitable gaming that you folks regulate how it really works and the money and no Fox said well it looks like the stadium is going to get paid off early, and I find when I talked to groups that they really don't understand what's taking place with charitable gaming and really where the money goes and what it's used for, and I'm very Pro what you guys are doing I watched it in Alexandria, and it's good for the community it's good entertainment for small bars and restaurants and I want to keep it going but my question to you Mr chairman or to Tom or board whatever is every business to get the public to understand what really goes on in an industry everybody is referencing profit, and you mentioned in your annual report here Tom that the net profit was a hundred and fifty-seven million this year on the first page of your report or if you're watching it on your computer there folks and then when you go down to lawful purpose expenditures it shows that the charities receive seventy million dollars I'm rounding numbers here and the state of Minnesota received 75 million dollars in state income tax on a net profit of a hundred and fifty-seven million dollars and yet the way the accounting process works and Tom can probably give me some clarification well I am kind of giving you a scope of why I'm here and then when you put in the local federal state unrelated business income tax and that I'm really in a business income tax as what I think it should be taxed as all these numbers at 98 percent like other business they're taxed and then when you look at license and regular regularly fees we're looking at over 80 million dollars of net profit of 157 million that's a 50 of the revenue or profit of these...

People Also Ask about

How much engine oil does a John Deere hold?

How much oil does John Deere S100 take?

How often to change oil on John Deere S100?

How much oil do I put in my John Deere lawn mower?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the lg266 - gcb state electronically in Chrome?

Can I create an eSignature for the lg266 - gcb state in Gmail?

How do I edit lg266 - gcb state on an iOS device?

What is MN LG266?

Who is required to file MN LG266?

How to fill out MN LG266?

What is the purpose of MN LG266?

What information must be reported on MN LG266?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.