Get the free Fiscal Note – 1999 Session - mmb state mn

Show details

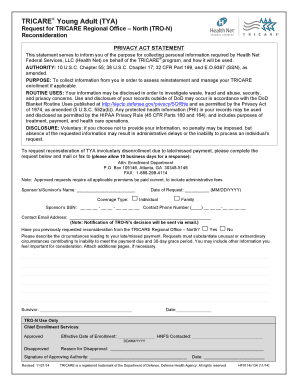

This document provides a fiscal impact assessment of the proposed legislation to extend sales tax rebate filing dates, detailing projected expenditures and revenues for the state government as well

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal note 1999 session

Edit your fiscal note 1999 session form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal note 1999 session form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal note 1999 session online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal note 1999 session. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal note 1999 session

How to fill out Fiscal Note – 1999 Session

01

Obtain a copy of the Fiscal Note form specific to the 1999 Session.

02

Read the instructions carefully to understand the requirements.

03

Fill in the title of the legislation being assessed.

04

Provide a brief summary of the legislation's purpose.

05

Estimate the financial impact of the legislation on government budgets.

06

Include any potential costs associated with implementation.

07

Assess the potential savings or revenue generated by the legislation.

08

Identify stakeholders affected by the legislation and how they will be impacted financially.

09

Review your entries for accuracy and completeness.

10

Submit the completed Fiscal Note form to the appropriate legislative committee.

Who needs Fiscal Note – 1999 Session?

01

Legislators who need to understand the financial implications of proposed legislation.

02

State agencies responsible for analyzing and reporting fiscal impacts.

03

Budget officers involved in fiscal planning and resource allocation.

04

Advocacy groups or stakeholders who want to assess the impact of legislation on funding.

05

Any individual or organization seeking transparency in government fiscal decisions.

Fill

form

: Try Risk Free

People Also Ask about

What does a FiscalNote do?

By uniquely combining data, technology, and insights, FiscalNote empowers customers with critical insights and the tools to turn them into action. Home to CQ, FrontierView, VoterVoice, and many other industry-leading brands, FiscalNote helps organizations stay ahead of political and business risk.

What are the values of FiscalNote?

We are a transparent company that aims to win over public supporters to our way of doing business with action and proven results. We are an agile company with an experienced, cross-industry leadership team that has ambitions to build an enduring, consequential, category-creating, and global enterprise.

What is the purpose of a fiscal year?

Organizations adopt fiscal years for various strategic purposes that extend beyond simple bookkeeping. The primary objective is to provide a more accurate picture of an organization's financial performance by aligning reporting periods with natural business cycles.

What is the purpose of a fiscal policy is to?

Fiscal policy is the use of government spending and taxation to influence the economy. Governments typically use fiscal policy to promote strong and sustainable growth and reduce poverty.

What is the purpose of a fiscal note?

A fiscal note is a written estimate of the costs, savings, revenue gain, or revenue loss that may result from implementation of a bill or joint resolution. It serves as a tool to help legislators better understand how a bill might impact the state budget, individual agencies, and in some instances, local governments.

Is FiscalNote reliable?

We've earned the trust of the U.S federal government, multiple global embassies and security bodies - and for good reason. We offer the only solution counted on by 100 percent of U.S. federal agencies, including leading US government security associations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fiscal Note – 1999 Session?

Fiscal Note – 1999 Session is a document used by legislative bodies to assess the financial implications of proposed legislation during the 1999 legislative session.

Who is required to file Fiscal Note – 1999 Session?

Typically, state agencies, legislative committees, or sponsors of legislation are required to file a Fiscal Note – 1999 Session when proposing new laws or amendments.

How to fill out Fiscal Note – 1999 Session?

To fill out the Fiscal Note – 1999 Session, individuals must provide specific details about the proposed legislation, including estimated costs, sources of funding, and any potential economic impact.

What is the purpose of Fiscal Note – 1999 Session?

The purpose of the Fiscal Note – 1999 Session is to provide lawmakers with a comprehensive analysis of the financial effects of proposed legislation to facilitate informed decision-making.

What information must be reported on Fiscal Note – 1999 Session?

The Fiscal Note – 1999 Session must report information such as estimated costs, funding sources, anticipated revenue changes, and any financial implications for state or local budgets.

Fill out your fiscal note 1999 session online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Note 1999 Session is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.