Get the free Bemidji Taxing Area by Zip Code

Show details

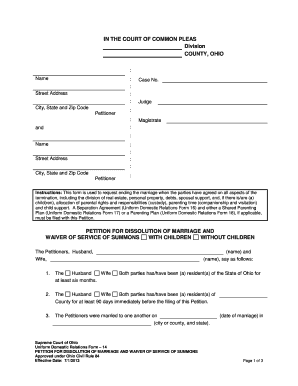

A document listing the specific zip codes in the Bemidji area where sales tax applies for deliveries, providing a detailed breakdown of streets and addresses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bemidji taxing area by

Edit your bemidji taxing area by form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bemidji taxing area by form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bemidji taxing area by online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bemidji taxing area by. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bemidji taxing area by

How to fill out Bemidji Taxing Area by Zip Code

01

Visit the official Bemidji city website or local government site.

02

Locate the section on taxation or tax areas.

03

Find the Bemidji Taxing Area by Zip Code link or document.

04

Download or open the document, if available.

05

Identify your current zip code.

06

Cross-reference your zip code with the provided taxing area information.

07

Fill out any forms as instructed, noting the correct taxing area based on your zip code.

08

Submit the completed forms as per the provided instructions.

Who needs Bemidji Taxing Area by Zip Code?

01

Residents of Bemidji to understand their tax obligations.

02

Property owners who need to determine property tax rates.

03

Businesses operating in the area to comply with local tax regulations.

04

New residents to find their tax district easily.

Fill

form

: Try Risk Free

People Also Ask about

How do I figure out my tax rate?

The easiest way to figure out your marginal tax rate is to look at the federal tax brackets and see in which bracket your taxable income ends. This represents your marginal tax rate. If you need help determining your tax bracket, visit TurboTax's Tax Bracket Calculator.

What is the local sales tax rate in New York City?

New York City local sales and use tax rate of 4.5 percent. New York State sales and use tax rate of 4.0 percent. Metropolitan Commuter Transportation District surcharge of 0.375 percent.

What city in Minnesota has the highest sales tax?

The city of St. Paul's new 1 percent sales tax increase began Monday, raising the total county, state and local sales tax to nearly 10 percent — the highest in Minnesota, ing to the Department of Revenue.

How do I find my local sales tax?

How do I find my local sales tax? Search online (try a ZIP code search as taxes can vary by community) Check local store receipts. Ask a competent merchant or cashier in your area.

What is the tax rate in Bemidji, MN?

Bemidji sales tax details The minimum combined 2025 sales tax rate for Bemidji, Minnesota is 8.51%. This is the total of state, county, and city sales tax rates. The Minnesota sales tax rate is currently 6.88%.

How do I calculate my local and state sales tax?

Sales Tax Formulas/Calculations: State Tax Amount = Price x (State Tax Percentage / 100) Use Tax Amount = Price x (Use Tax Percentage / 100) Local Tax Amount = Price x (Local Tax Percentage / 100) Total = Price + State Tax Amount + Use Tax Amount + Local Tax Amount.

What cities in MN have a city tax?

With the exception of Minneapolis and St. Paul, all the local governments imposing a general local sales tax are located in Greater Minnesota. The cities of Hermantown, Mankato, Minneapolis, New Ulm, Proctor, Rochester, St. Paul, Two Harbors, and Winona impose a 0.5 percent general sales tax.

How do you find the sales tax of something?

The formula for calculating the sales tax on a good or service is: selling price x sales tax rate, and when calculating the total cost of a purchase, the formula is: total sale amount = selling price + sales tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Bemidji Taxing Area by Zip Code?

The Bemidji Taxing Area by Zip Code refers to the specific geographic regions within Bemidji, Minnesota, that are subject to property taxation. Each zip code corresponds to particular taxation rates and regulations set by local government.

Who is required to file Bemidji Taxing Area by Zip Code?

Property owners and businesses located within the Bemidji Taxing Area by Zip Code are required to file tax documents related to their assessed property. This typically includes individuals who own real estate or commercial properties.

How to fill out Bemidji Taxing Area by Zip Code?

To fill out the Bemidji Taxing Area tax forms, individuals should gather their property details, including the zip code, assessed value, and any applicable deductions. Then, follow the instructions provided on the tax form and ensure all required fields are completed before submission.

What is the purpose of Bemidji Taxing Area by Zip Code?

The purpose of the Bemidji Taxing Area by Zip Code is to categorize properties for taxation based on their geographical location, ensuring that local government can effectively levy taxes for public services, infrastructure, and community programs.

What information must be reported on Bemidji Taxing Area by Zip Code?

Information that must be reported includes the property owner's name, property address, zip code, assessed property value, any exemptions claimed, and other financial details pertaining to the property.

Fill out your bemidji taxing area by online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bemidji Taxing Area By is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.