Get the free Franchise Tax for Nonprofit Organizations 2004

Show details

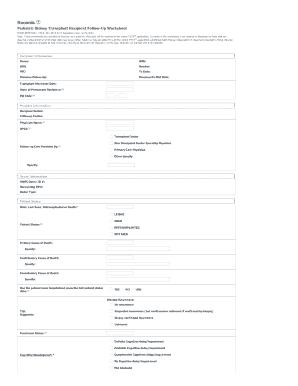

This document is used by nonprofit organizations to report unrelated business income and calculate their franchise tax obligations for the calendar or fiscal year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign franchise tax for nonprofit

Edit your franchise tax for nonprofit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your franchise tax for nonprofit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit franchise tax for nonprofit online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit franchise tax for nonprofit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out franchise tax for nonprofit

How to fill out Franchise Tax for Nonprofit Organizations 2004

01

Gather necessary documentation: Collect all financial records, including income statements, balance sheets, and receipts for the year 2004.

02

Identify your nonprofit's exempt status: Ensure your organization qualifies as a nonprofit under IRS regulations.

03

Determine the appropriate form: Depending on the revenue generated, choose the correct Franchise Tax form for nonprofit organizations.

04

Complete the form: Fill out the required sections, such as organization name, address, and financial data.

05

Calculate your tax: Apply the relevant tax rates to your revenue to compute any Franchise Taxes owed, if applicable.

06

Review for accuracy: Double-check all entries and calculations to minimize errors.

07

Submit the form: File the completed Franchise Tax form by the due date to avoid penalties.

Who needs Franchise Tax for Nonprofit Organizations 2004?

01

Nonprofit organizations operating in the state that generate revenue and meet the requirements set by the state's tax authority.

02

Organizations that have obtained nonprofit status but still engage in taxable activities, leading to potential Franchise Tax implications.

Fill

form

: Try Risk Free

People Also Ask about

What are the IRS rules for 501c3?

Exemption requirements - 501(c)(3) organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

Is the IRS fee for 501c3 $275 or $600?

Fees for the federal application for tax exemption range from $275 - $600. In the end, this is the only way to obtain federal tax exemption and the credibility of operating a nonprofit organization with 501(c)(3) status.

What is the 33% rule for nonprofits?

If your organization receives more than 10 percent but less than 33-1/3 percent of its support from the general public or a governmental unit, it can qualify as a public charity if it can establish that, under all the facts and circumstances, it normally receives a substantial part of its support from governmental

How many directors does the IRS require for a 501c3?

Nonprofit charities are under the jurisdiction of state and national laws, so they must comply with both legal systems. With that in mind, the federal government requires a minimum of three board members to acquire coveted 501c3 tax-exempt status.

How much does the IRS charge for a 501c3?

How much does it cost to set up a 501c3? | Filing with the IRS for tax-exempt status Name of FeeEstimated Fees Articles of Incorporation $20-$100 Charitable Solicitation Registration $25 IRS Tax-exempt Status $275 or $600

What is the difference between a 501c3 and a 501c4?

501(c)(3) organizations are either a public charity, private foundation or private operating foundation with open membership whereas 501(c)(4) organizations are civic leagues or associations operated exclusively for the promotion of social welfare or local associations of employees with limited membership.

What is the IRS tax code for a nonprofit organization?

Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code ("IRC") section 501(c)(3).

When did nonprofits become tax-exempt?

Organizations that were dedicated to charitable purposes were not required to pay the federal income tax. The Wilson-Gorman Tariff Act of 1894: established the requirements for the tax-exempt status for charitable organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Franchise Tax for Nonprofit Organizations 2004?

Franchise Tax for Nonprofit Organizations 2004 is a tax imposed on certain nonprofit entities operating within a jurisdiction, aimed at funding state services and programs.

Who is required to file Franchise Tax for Nonprofit Organizations 2004?

Nonprofit organizations that meet specific revenue thresholds and operate as corporations or associations within the state are required to file the Franchise Tax for Nonprofit Organizations 2004.

How to fill out Franchise Tax for Nonprofit Organizations 2004?

To fill out the Franchise Tax for Nonprofit Organizations 2004, organizations typically need to complete the designated form, provide accurate financial information, and report any applicable deductions and exemptions.

What is the purpose of Franchise Tax for Nonprofit Organizations 2004?

The purpose of the Franchise Tax for Nonprofit Organizations 2004 is to generate revenue to support state operations and services that benefit both the nonprofit sector and the public.

What information must be reported on Franchise Tax for Nonprofit Organizations 2004?

The information that must be reported includes the organization’s total revenue, expenses, net assets, and details on any activities that generate unrelated business income.

Fill out your franchise tax for nonprofit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Franchise Tax For Nonprofit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.