Get the free M1PRX

Show details

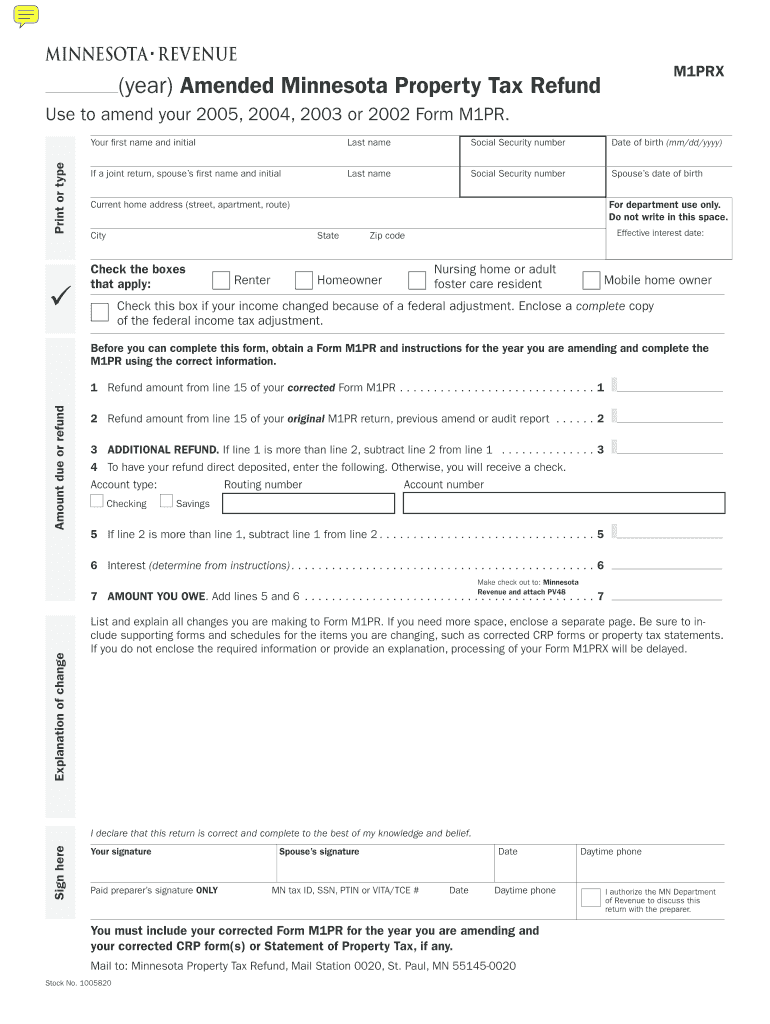

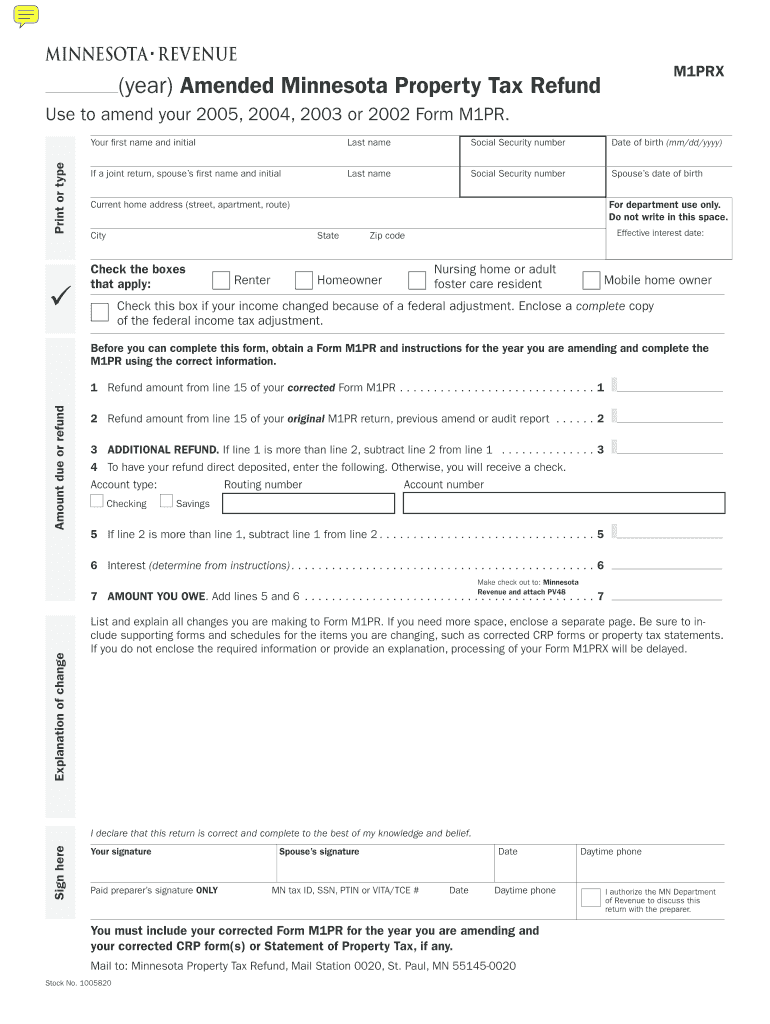

Use this form to amend your original Minnesota Property Tax Refund, Form M1PR, to apply for an additional refund or to pay back some or all of the refund received.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign m1prx

Edit your m1prx form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your m1prx form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing m1prx online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit m1prx. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out m1prx

How to fill out M1PRX

01

Begin by gathering all necessary personal and financial information.

02

Open the M1PRX form on your computer or obtain a physical copy.

03

Fill in your personal details such as name, address, and Social Security number.

04

Accurately report your income sources and amounts as required.

05

Provide any deductions or credits you may be eligible for, ensuring to attach any required documentation.

06

Double-check all entries for accuracy and completeness before submission.

07

Sign and date the form where indicated.

08

Submit the form by the designated deadline through the appropriate filing method.

Who needs M1PRX?

01

Individuals or families who are filing their taxes and may need to report certain credits or claims.

02

Taxpayers seeking to receive refunds based on overpaid taxes or eligible tax credits.

03

Anyone who is required to report additional information to the tax authorities that is not covered in the standard tax form.

Fill

form

: Try Risk Free

People Also Ask about

Does MN have property tax relief for seniors?

Property Tax Deferral for Senior Citizens may allow you to defer a portion of the property taxes you owe. To qualify, all of these must be true: You are 65 or older in the year you apply.

Who is exempt from property taxes in Minnesota?

All properties used exclusively for public purposes, including public hospitals, schools, burial grounds, etc. Certain kinds of personal property, including in most cases property that creates energy, enables commerce, or conserves nature. Qualifying wetlands or native prairie lands.

How long does a MN property tax refund take?

Application & Refund Process Refunds will be mailed in late September or early October if received by the August 15 deadline. Otherwise, you can expect your refund within 60 days of when filed. You may receive your refund earlier if you file electronically.

What is form M1PR Minnesota?

You may only use Form M1PR to claim the homestead credit or the homestead special refund. You may claim the renter's credit by completing Schedule M1RENT with your Minnesota Income Tax Return. Use the table below to determine if you should file Form M1PR, Schedule M1RENT, or both based on your living situation.

How much can you get back from property taxes?

If you itemize your deductions, you can deduct the property taxes you pay on your main residence and any other real estate you own. The total amount of deductible state and local income taxes, including property taxes, is limited to $10,000 per year.

Who is eligible for the Minnesota special property tax refund?

Homeowners may also be eligible for a special property tax refund if the net property tax on their homestead increased by more than 12 percent from the previous year and at least $100. This refund has no income limit.

What are the income limits for MN property tax refund?

What are the maximums? For refund claims filed in 2024, based on property taxes payable in 2024 and 2023 household income, the maximum refund is $3,310. Homeowners whose income exceeds $135,410 are not eligible for a refund.

Is property tax refund considered income?

If you received a refund or rebate in of real estate taxes you paid in an earlier year, don't reduce your deduction by this amount. Instead, you must include the refund or rebate in income on Schedule 1 (Form 1040), line 8, if you deducted the real estate taxes in the earlier year and the deduction reduced your tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is M1PRX?

M1PRX is the Minnesota income tax form used for the property tax refund for renters and homeowners.

Who is required to file M1PRX?

Individuals who qualify for a property tax refund in Minnesota, including renters and homeowners who meet specific income and property value criteria, are required to file M1PRX.

How to fill out M1PRX?

To fill out M1PRX, gather your income information, property tax statements, and complete the form by following the instructions provided by the Minnesota Department of Revenue, ensuring all required information is accurately filled.

What is the purpose of M1PRX?

The purpose of M1PRX is to allow eligible individuals to claim property tax refunds regardless of whether they own or rent their residence.

What information must be reported on M1PRX?

M1PRX requires reporting of personal identification details, income information, property tax amounts, and any other relevant financial data necessary to determine eligibility for the property tax refund.

Fill out your m1prx online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

m1prx is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.