Get the free 2005 Amended Minnesota Income Tax

Show details

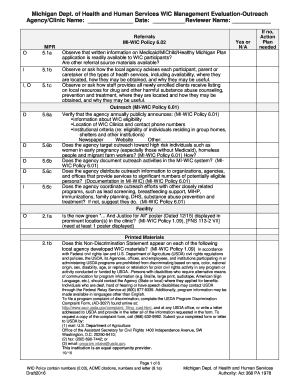

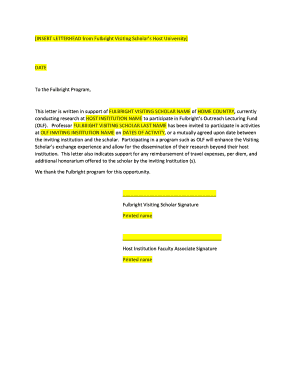

This document is used by individuals to amend their original Minnesota individual income tax return for the year 2005. It allows taxpayers to correct or adjust their tax information based on federal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2005 amended minnesota income

Edit your 2005 amended minnesota income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2005 amended minnesota income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2005 amended minnesota income online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2005 amended minnesota income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2005 amended minnesota income

How to fill out 2005 Amended Minnesota Income Tax

01

Obtain the 2005 Amended Minnesota Income Tax forms from the Minnesota Department of Revenue website.

02

Gather all necessary documents including your original tax return and any relevant financial records.

03

Complete the top section of the form with your personal information, including your name, address, and Social Security number.

04

Indicate that this is an amended return by checking the appropriate box on the form.

05

Make the necessary corrections to your income, deductions, and credits as needed.

06

Calculate your new tax liability or refund based on the amendments you've made.

07

Attach any supporting documents that justify the changes made to your return.

08

Review the completed form for accuracy and completeness.

09

Sign and date the amended return, and then send it to the appropriate Minnesota Department of Revenue address.

Who needs 2005 Amended Minnesota Income Tax?

01

Individuals who need to correct errors on their originally filed 2005 Minnesota tax return.

02

Taxpayers who wish to claim additional deductions or credits that were not included in their original filing.

03

Those who need to report changes in income or adjustments to their tax liability for the year 2005.

Fill

form

: Try Risk Free

People Also Ask about

How do I amend old taxes?

To amend a return, file Form 1040-X, Amended U.S. Individual Income Tax Return. You can use tax software to electronically file your 1040-X online. Submit all the same forms and schedules as you did when you filed your original Form 1040 even if you don't have adjustments on them.

How many years can you file back taxes?

There is no hard limit on how many years you can file back taxes. However, to be in “good standing” with the IRS, you should have filed tax returns for the last six years. If you're due a refund or tax credits, you must file the return within three years of the original due date to claim it.

Can I amend a 5 year old tax return?

The short answer is that the IRS gives you a 3 year runway to fix errors and collect a refund and 2 years for adjustments to paid taxes. That means typically, no - you cannot amend a tax return from 5-10 years ago.

How much is MN state income tax?

Single filers: IncomeTax rate 0 to $31,690 5.35% More than $31,690 to $104,090 6.80% More than $104,090 to $193,240 7.85% More than $193,240 9.85% Mar 10, 2025

How far back can you amend a Minnesota tax return?

To claim a refund, you must file Form M1X within 3½ years of the original due date for your return. If you need a prior year form, see Find a Form.

Is there a penalty for filing an amended tax return?

There is no penalty for simply filing an amended return. But if your mistake caused you to underpay tax, you will owe that additional tax. If you amend your tax return before the April deadline and pay the remaining tax you owe, you won't have to pay a penalty.

What is the M1X amended Minnesota income tax form?

Form M1X is used to amend (correct) a previously filed Minnesota Individual Income Tax Return (Form M1). It allows you to make changes to your original tax filing and ensures your tax liability is accurate.

Is it possible to amend previous tax returns?

Yes. If you need to amend your Form 1040, 1040-SR, 1040-NR, or 1040-SS/PR for the current or two prior tax periods, you can amend these forms electronically using available tax software products.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2005 Amended Minnesota Income Tax?

2005 Amended Minnesota Income Tax is a tax form used by individuals to amend their previously filed Minnesota state income tax return for the tax year 2005. It allows taxpayers to make corrections to their original tax return due to errors or changes in income, deductions, or credits.

Who is required to file 2005 Amended Minnesota Income Tax?

Taxpayers who have already filed their 2005 Minnesota income tax return and need to make corrections or adjustments are required to file the 2005 Amended Minnesota Income Tax. This includes individuals who discover errors in reporting income, deductions, or credits after their original return has been submitted.

How to fill out 2005 Amended Minnesota Income Tax?

To fill out the 2005 Amended Minnesota Income Tax, taxpayers should obtain the correct form from the Minnesota Department of Revenue website, complete the necessary sections including the correction of income, deductions, and credits, and follow the instructions for filing, including providing explanations for the amendments.

What is the purpose of 2005 Amended Minnesota Income Tax?

The purpose of the 2005 Amended Minnesota Income Tax is to provide a means for taxpayers to correct any mistakes or omissions in their original 2005 tax returns, ensuring accurate reporting of income and compliance with Minnesota tax laws.

What information must be reported on 2005 Amended Minnesota Income Tax?

The information that must be reported on the 2005 Amended Minnesota Income Tax includes the taxpayer's corrected income, any changes in deductions or credits, explanations for the changes being made, and any required supporting documents.

Fill out your 2005 amended minnesota income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2005 Amended Minnesota Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.