Get the free 2006 Semiannual Statement of Surplus-Line Insurance

Show details

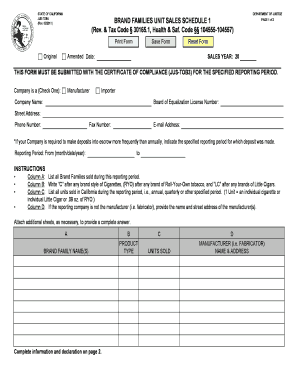

This document is a tax return form required for surplus-line insurance agents to report taxable premiums and calculate taxes owed to the Minnesota Department of Revenue.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2006 semiannual statement of

Edit your 2006 semiannual statement of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2006 semiannual statement of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2006 semiannual statement of online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2006 semiannual statement of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2006 semiannual statement of

How to fill out 2006 Semiannual Statement of Surplus-Line Insurance

01

Start by downloading the official 2006 Semiannual Statement of Surplus-Line Insurance form from the relevant regulatory authority's website.

02

Fill out the insurer's legal name and address at the top of the form.

03

Provide the date and period for which the statement is being submitted.

04

Report the total premiums received during the reporting period in the appropriate section.

05

Include any losses that have occurred during the reporting period.

06

Calculate and enter the total surplus lines premiums taxed in your jurisdiction.

07

Disclose any relevant fees, expenses, or adjustments that may affect the surplus line insurance figures.

08

Review the completed form for accuracy and completeness.

09

Submit the form by the deadline specified by the regulatory authority, making sure to retain a copy for your records.

Who needs 2006 Semiannual Statement of Surplus-Line Insurance?

01

Insurance companies that offer surplus line insurance.

02

Insurance brokers dealing in surplus lines.

03

Regulatory authorities overseeing insurance in the jurisdiction.

04

Investors or stakeholders interested in the financial health of surplus line insurance providers.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of surplus lines insurance?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

Why would someone place their insurance with a surplus lines broker?

Surplus Lines Carriers provide a market of last resort for risks that: (1) admitted insurers (i.e., insurers holding a certificate of authority to transact business in the state where a risk is located) (“Admitted Carriers”) are unwilling to underwrite, or (2) a state has determined are generally unavailable from

Is surplus line insurance more expensive?

Surplus lines insurance protects against a financial risk that a regular insurance company will not take on. Surplus lines insurance policies are available in a variety of types for both individuals and businesses. Surplus lines insurance is generally more expensive than regular insurance because the risks are higher.

Do states keep a list of acceptable surplus lines insurers?

SURPLUS LINES TAXES Most states charge an insurance premium tax to insurance companies licensed and “admitted” to do business within their borders. Generally speaking, those carriers then pass the cost of those taxes onto their policyholders by adding a comparable amount to their premiums.

What are the disadvantages of surplus lines insurance?

Non-admitted insurers, also known as excess and surplus (E&S) lines carriers, sell policies that aren't backed by your state. While they don't fall under traditional insurance regulations, many states do regulate non-admitted carriers. These regulations are usually less strict than those followed by admitted insurers.

What is a surplus line in insurance?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

What is a surplus in insurance?

A policyholder surplus is the assets of a policyholder-owned insurance company (also called a mutual insurance company) minus its liabilities. Policyholder surplus is one indicator of an insurance company's financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

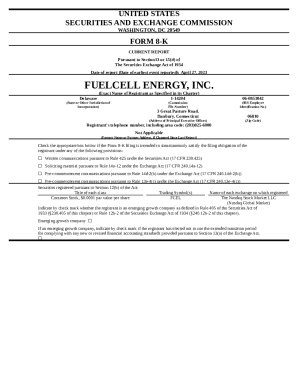

What is 2006 Semiannual Statement of Surplus-Line Insurance?

The 2006 Semiannual Statement of Surplus-Line Insurance is a regulatory document that surplus-line insurers provide to demonstrate compliance with state insurance regulations and to report their financial status.

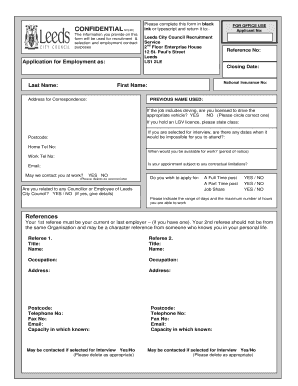

Who is required to file 2006 Semiannual Statement of Surplus-Line Insurance?

Surplus-line insurers and brokers who transacted business within a specific state are required to file the 2006 Semiannual Statement of Surplus-Line Insurance.

How to fill out 2006 Semiannual Statement of Surplus-Line Insurance?

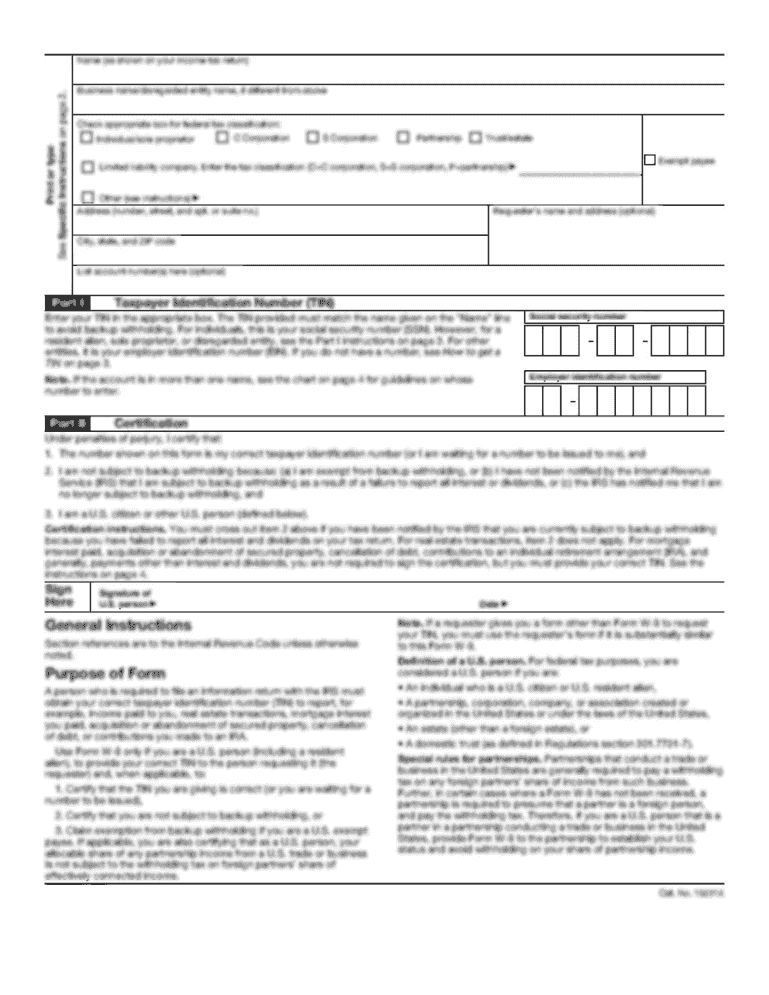

To fill out the 2006 Semiannual Statement of Surplus-Line Insurance, filers must complete required fields including financial data, policy information, and compliance indicators as per the guidelines provided by the state's insurance department.

What is the purpose of 2006 Semiannual Statement of Surplus-Line Insurance?

The purpose of the 2006 Semiannual Statement of Surplus-Line Insurance is to provide regulatory authorities with essential financial information, ensuring transparency and compliance in the surplus-line insurance market.

What information must be reported on 2006 Semiannual Statement of Surplus-Line Insurance?

The report typically requires information such as total premiums, claims incurred, expenses, and other financial metrics that reflect the surplus-line insurer's business activities during the reporting period.

Fill out your 2006 semiannual statement of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2006 Semiannual Statement Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.