Get the free 2006 Premium Tax for Life Insurance Companies

Show details

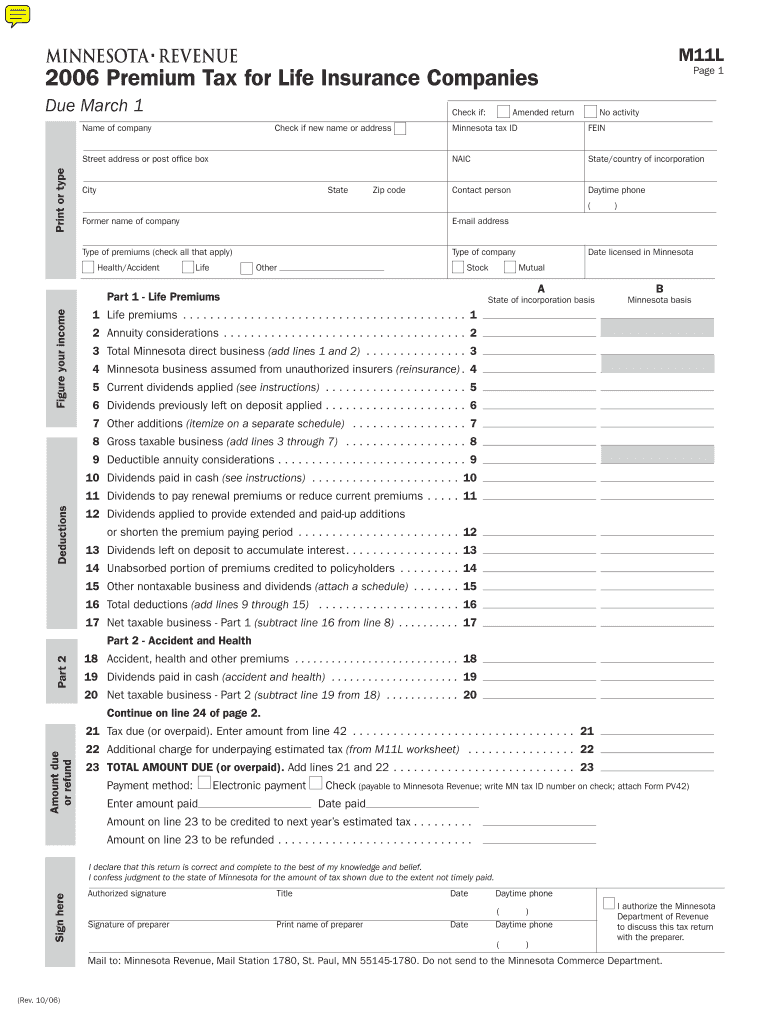

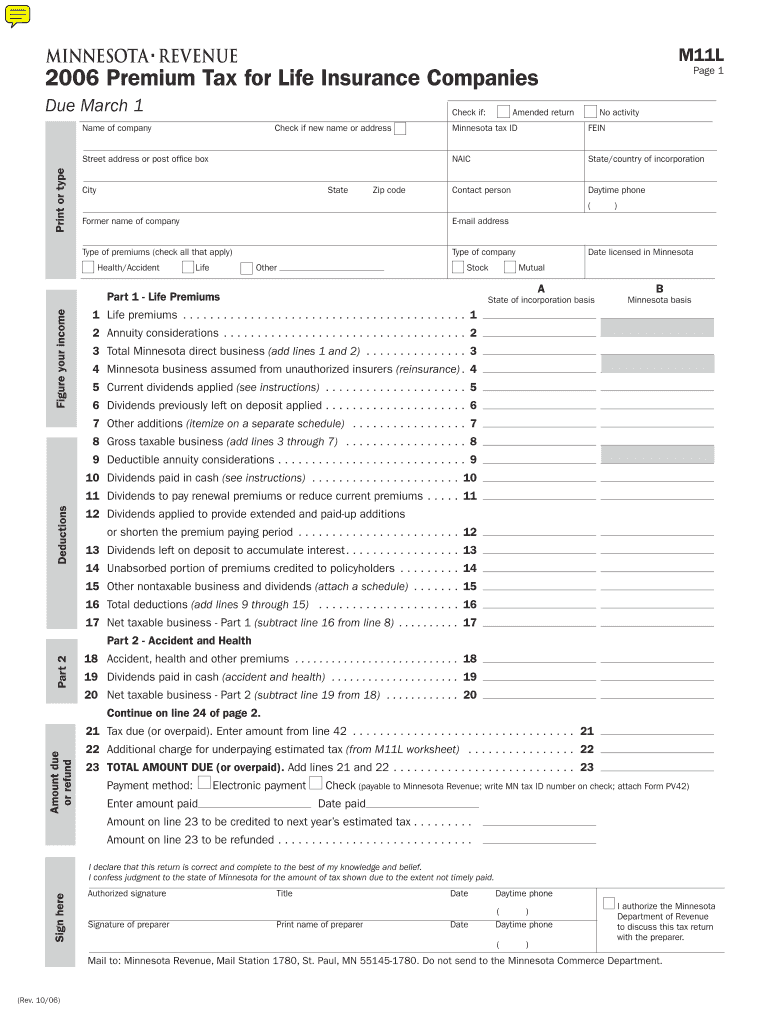

This document is a tax form for life insurance companies to report their premium income and calculate their tax liabilities to the state of Minnesota.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2006 premium tax for

Edit your 2006 premium tax for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2006 premium tax for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2006 premium tax for online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2006 premium tax for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2006 premium tax for

How to fill out 2006 Premium Tax for Life Insurance Companies

01

Gather all necessary documents related to your life insurance premiums for the year 2006.

02

Determine the total amount of premiums received during the year from all policies.

03

Identify any deductions or exemptions applicable to your policies as per IRS guidelines.

04

Calculate the taxable premium amount by subtracting deductions from the total premiums received.

05

Fill out the required forms provided by the IRS for the 2006 Premium Tax, ensuring all figures are accurate.

06

Double-check all calculations and ensure the form is signed and dated.

07

Submit the completed form along with any necessary supporting documents to the appropriate IRS office.

Who needs 2006 Premium Tax for Life Insurance Companies?

01

Life insurance companies that collected premiums during the tax year 2006.

02

Companies that are required to report their premium tax obligations to the IRS.

03

Insurance companies that have policy holders whose premiums are subject to the life insurance premium tax.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay back a premium tax credit?

If your income is more than what you told us on your application, you may have to repay some or all of the advanced premium tax credits that you got.

How to avoid paying back Obamacare?

Another way to avoid having to repay all or part of your premium assistance is to elect to have all or part of your premium assistance sent to you as a tax refund when you file your tax return, instead of paid in advance to your health insurer during the year.

How can I avoid paying back my premium tax credit?

To avoid having to repay advance premium tax credits, you should: Make sure that DC Health Link has your most up-to-date income. Report changes in your income, household size, and other offers of health insurance coverage to DC Health Link as quickly as possible. Consider taking less than the full amount.

How much tax do I pay on a life insurance policy?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.

How to reduce premium tax credit repayment?

to lower your monthly payment, you'll have to “reconcile” when you file your federal taxes. This means you'll compare: The amount of the premium tax credit you used during the year. (This was paid directly to your health plan so your monthly payment was lower.)

What states have an insurance premium tax?

Key Facts About State Premium Taxes on Annuities California, Colorado, Maine, Nevada, South Dakota, West Virginia and Wyoming charge premium taxes on life insurance and annuity contracts. In many of these states, the tax is not charged until the annuity contract has been annuitized.

What is premium tax on life insurance?

Premium Tax refers to a state-imposed tax on insurance premiums, including those paid for Indexed Universal Life (IUL) policies. This tax is typically a percentage of the premium amount and can vary from state to state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2006 Premium Tax for Life Insurance Companies?

The 2006 Premium Tax for Life Insurance Companies is a tax imposed on life insurance premiums collected by insurance companies, used to fund state and local government activities.

Who is required to file 2006 Premium Tax for Life Insurance Companies?

Life insurance companies that collect premiums on policies issued in the relevant jurisdiction are required to file the 2006 Premium Tax.

How to fill out 2006 Premium Tax for Life Insurance Companies?

To fill out the 2006 Premium Tax form, companies need to report their gross premiums collected, deductions allowed, and calculate the tax due based on the state's tax rate.

What is the purpose of 2006 Premium Tax for Life Insurance Companies?

The purpose of the 2006 Premium Tax is to generate revenue for state and local governments that support public services and regulatory oversight of the insurance industry.

What information must be reported on 2006 Premium Tax for Life Insurance Companies?

Companies must report total premiums collected, any allowed deductions, the tax rate, and the resulting tax liability on the 2006 Premium Tax form.

Fill out your 2006 premium tax for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2006 Premium Tax For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.