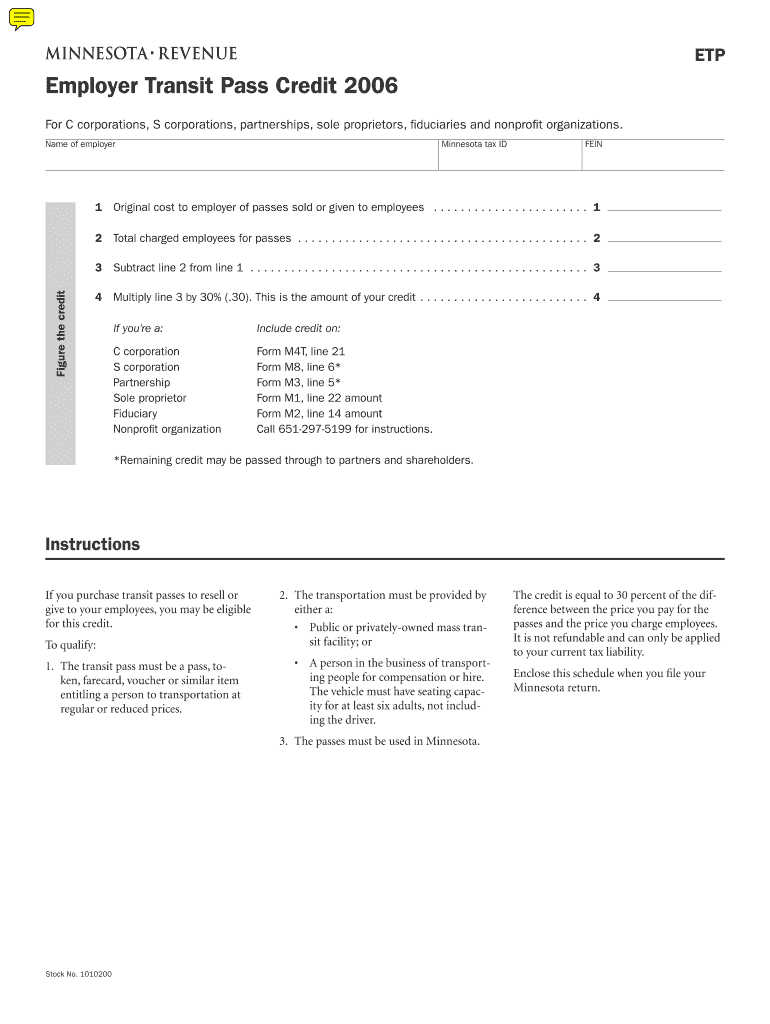

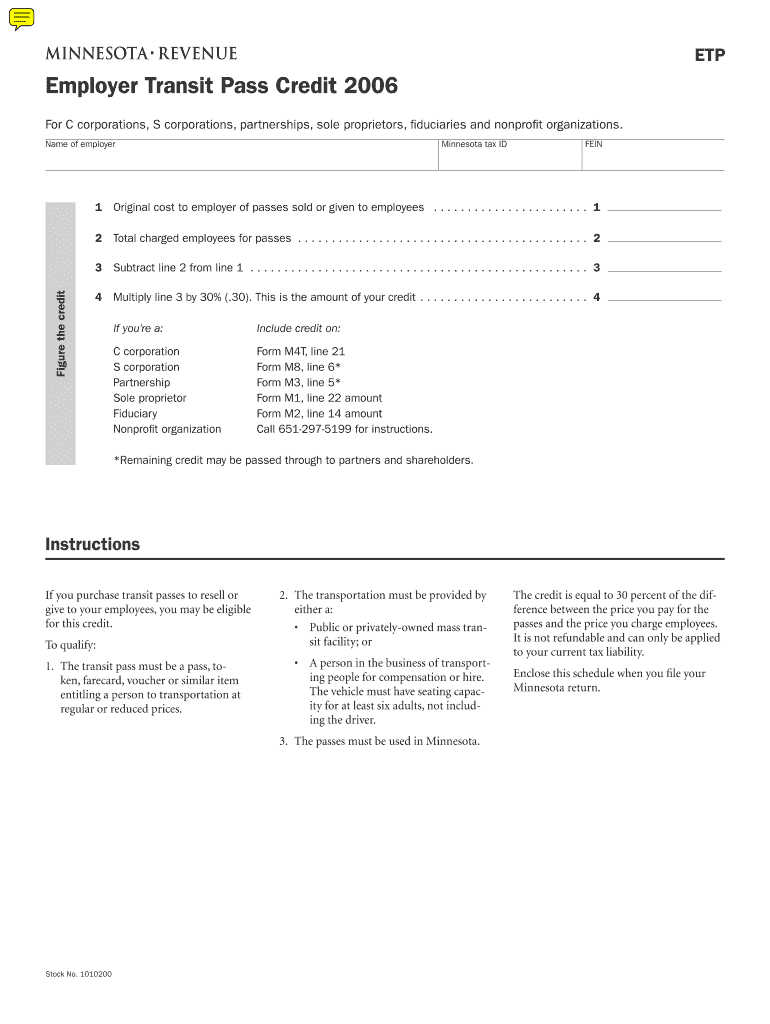

Get the free Employer Transit Pass Credit 2006

Show details

This document provides instructions and calculations for C corporations, S corporations, partnerships, sole proprietors, fiduciaries, and nonprofit organizations to determine eligibility and amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer transit pass credit

Edit your employer transit pass credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer transit pass credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer transit pass credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employer transit pass credit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer transit pass credit

How to fill out Employer Transit Pass Credit 2006

01

Obtain the Employer Transit Pass Credit 2006 form from the official tax website.

02

Fill in your employer's name, address, and Employer Identification Number (EIN).

03

Provide details about the transit passes provided, including the value of the passes and the number of employees who received them.

04

Calculate the total credit by multiplying the number of employees by the amount spent on transit passes.

05

Complete any additional required sections regarding your business's information.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form as instructed, either electronically or by mail.

Who needs Employer Transit Pass Credit 2006?

01

Employers who provide transit passes to their employees.

02

Businesses looking to claim tax credits for employee transit benefits.

03

Organizations that meet the eligibility criteria specified for the Employer Transit Pass Credit.

Fill

form

: Try Risk Free

People Also Ask about

What are employer paid transportation benefits?

Commuter benefits are fringe benefits that cover an employee's transportation-related expenses with pre-tax dollars. Transportation benefits are exempt from income tax withholding, Social Security and Medicare (FICA) taxes, and federal unemployment tax.

What is the commuting valuation rule?

Commuting Valuation Rule ($3.00 per day system) The commuting value for the personal use of the employer-provided automobiles is $1.50 per one-way commute between home and work or $3.00 per day. (See Internal Revenue Code Regulation 1.62. 21(K).) b.

What is the IRS commuting valuation rule?

value of a vehicle they provide to an employee for commuting use by multiplying the number of one-way commutes by $1.50. Use of this rule is subject to stringent requirements, such as having a written policy limiting the employee's use to commuting and de minimis personal use.

What does the IRS consider fringe benefits?

A fringe benefit is a form of pay for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work. Fringe benefits are generally included in an employee's gross income (there are some exceptions).

What is the unsafe conditions commuting rule?

The unsafe conditions commuting rule applies if the employee would ordinarily walk or use public transportation and you only allow the employee to use the vehicle for commuting.

What is the IRS commuter rule?

ing to the IRS, any expenses related to commuting between your home and regular workplace are generally considered personal and nondeductible. Commuting is an everyday activity that is not considered a business expense.

What does IRS consider commuting distance?

Commuting miles are not tax deductible, and the IRS defines them as: Driving from home to a permanent workplace. Driving from home to your second workplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer Transit Pass Credit 2006?

The Employer Transit Pass Credit 2006 is a tax credit available to employers who provide transit passes to their employees as a means of encouraging public transportation use.

Who is required to file Employer Transit Pass Credit 2006?

Employers who offer qualified transit passes to their employees and wish to claim the credit on their tax filings are required to file the Employer Transit Pass Credit 2006.

How to fill out Employer Transit Pass Credit 2006?

To fill out the Employer Transit Pass Credit 2006 form, employers must provide details about the transit passes provided, including the total amount spent on the passes, employee information, and any relevant tax identification numbers.

What is the purpose of Employer Transit Pass Credit 2006?

The purpose of the Employer Transit Pass Credit 2006 is to incentivize employers to support public transit use among their employees, thereby reducing traffic congestion and promoting environmentally friendly transportation options.

What information must be reported on Employer Transit Pass Credit 2006?

Employers must report information including the total cost of transit passes provided, the number of employees who received them, and details on the specific transit passes used.

Fill out your employer transit pass credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Transit Pass Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.