Get the free 2007 Employer Transit Pass Credit

Show details

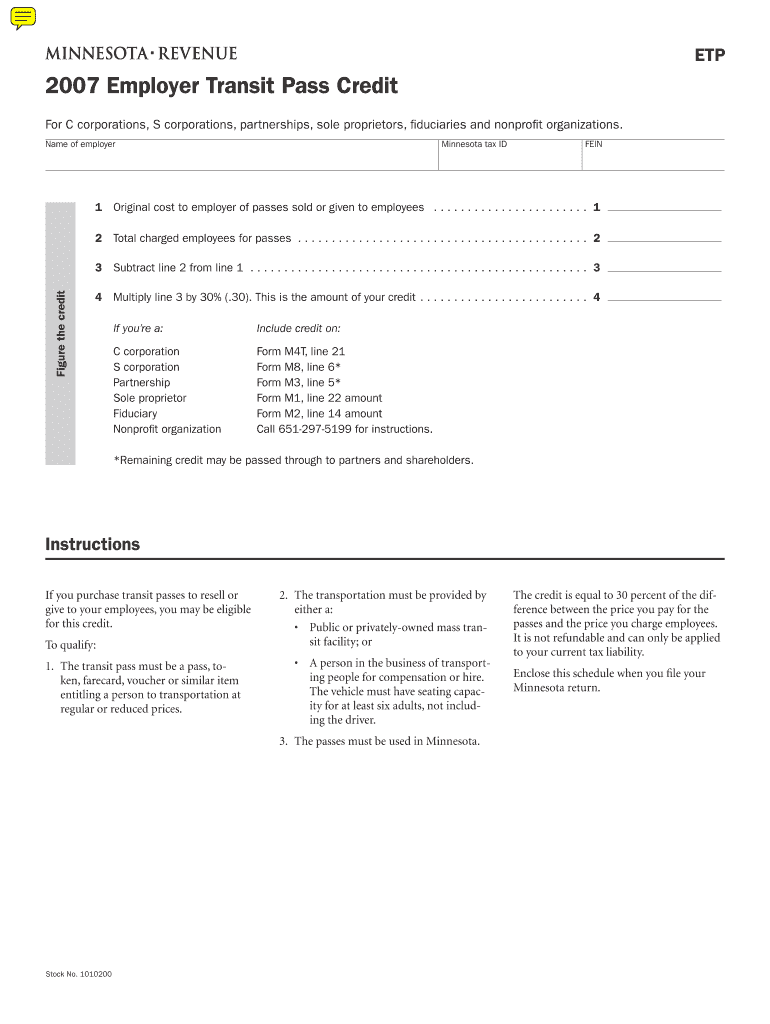

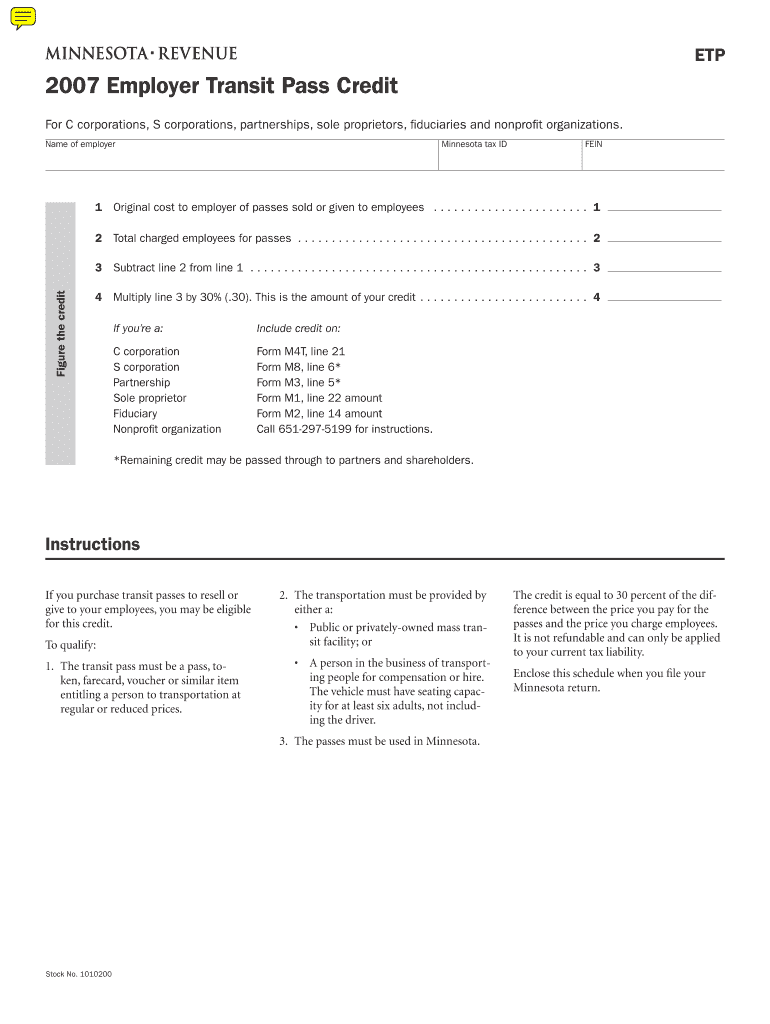

This document provides instructions for employers in Minnesota to claim a credit for the cost of transit passes provided to employees. It outlines eligibility requirements, calculation steps, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2007 employer transit pass

Edit your 2007 employer transit pass form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2007 employer transit pass form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2007 employer transit pass online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2007 employer transit pass. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2007 employer transit pass

How to fill out 2007 Employer Transit Pass Credit

01

Gather all relevant documentation, including your transit pass receipts and employer information.

02

Obtain Form 8830, which is required to claim the credit.

03

Fill out the personal information section on the form, including your name and tax identification details.

04

Document the total cost of transit passes purchased for the year in the appropriate section of the form.

05

Calculate the amount of credit being claimed based on your total transit pass expenses and the IRS guidelines for the year 2007.

06

Complete any additional sections on the form that pertain to your specific situation, including employer information if necessary.

07

Double-check all entries for accuracy and completeness before submission.

08

Submit the completed Form 8830 along with your tax return to the IRS.

Who needs 2007 Employer Transit Pass Credit?

01

Employees who commute using public transit and work for an employer who provides transit passes.

02

Employers who offer transit pass benefits to their employees and wish to help them claim the credit.

03

Taxpayers eligible for tax credits related to transportation expenses in the year 2007.

Fill

form

: Try Risk Free

People Also Ask about

Are transportation fringe benefits taxable?

Any fringe benefit that is a "qualified transportation fringe" (QTF) is excluded from income (IRC 132(a)(5)) up to the amount of a monthly dollar limitation.

How do you calculate tax on severance pay?

Calculate Federal Income Tax: Multiply your severance pay by the percentage of your tax bracket. For example, if your severance pay is $30,000 and you're in the 22% tax bracket, your federal income tax would be $6,600.

What earnings are considered supplemental wages?

Supplemental wages are additional payments made to an employee in addition to their regular wages. They include overtime, bonuses, commissions, and more. If an employer provides supplemental wages, they may be required to withhold taxes from these payments.

What is the employer transit pass credit in Minnesota?

The credit is equal to 30% of the difference between the price you pay for the passes and the price you charge employees. It is not refundable and can only be applied to your current tax liability. Enclose this schedule when you file your Minnesota return.

What is a highly compensated employee in 2007?

The dollar level for becoming a highly-compensated employee stays at $100,000 of pay in 2007 for determinations in 2008 (the same level as applies for determinations in 2007 based on 2006 pay).

Is a severance package considered wages?

Because severance payments are considered taxable wages, employers must report them, pay the employer's tax portion, and withhold employee taxes as required by the IRS. Failure to comply could result in fines and penalties. A payroll tax attorney can provide guidance to ensure compliance requirements are met.

Should severance be taxed at supplemental rate?

The severance payment would be considered additional income and would attract a flat 22% withholding rate for federal tax, along with any applicable state taxes (depending on the state). Social Security and Medicare taxes would also be applicable, subject to wage limits.

Does severance have to be taxed as supplemental wages?

Yes, severance pay is taxable in the year that you receive it. Your employer will include this amount on your Form W-2 and will withhold appropriate federal and state taxes. See Publication 525, Taxable and Nontaxable Income, for additional information. Is accumulated leave (vacation and/or sick pay) taxable?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2007 Employer Transit Pass Credit?

The 2007 Employer Transit Pass Credit is a tax credit available to employers who provide transit passes to their employees as a fringe benefit. It was designed to encourage the use of public transportation among employees.

Who is required to file 2007 Employer Transit Pass Credit?

Employers who provide their employees with transit passes and meet the eligibility criteria established by the IRS are required to file for the 2007 Employer Transit Pass Credit.

How to fill out 2007 Employer Transit Pass Credit?

To fill out the 2007 Employer Transit Pass Credit, employers must complete the appropriate IRS form, providing necessary details such as company information, the number of employees receiving transit passes, and the total amount spent on the passes.

What is the purpose of 2007 Employer Transit Pass Credit?

The purpose of the 2007 Employer Transit Pass Credit is to incentivize employers to provide public transportation benefits to employees, thereby reducing traffic congestion and promoting environmentally friendly commuting options.

What information must be reported on 2007 Employer Transit Pass Credit?

Employers must report information including the total amount of transit passes provided, the number of employees who received the benefits, and any other relevant financial data required by the IRS forms.

Fill out your 2007 employer transit pass online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2007 Employer Transit Pass is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.