Get the free Alternative Minimum Tax 2008

Show details

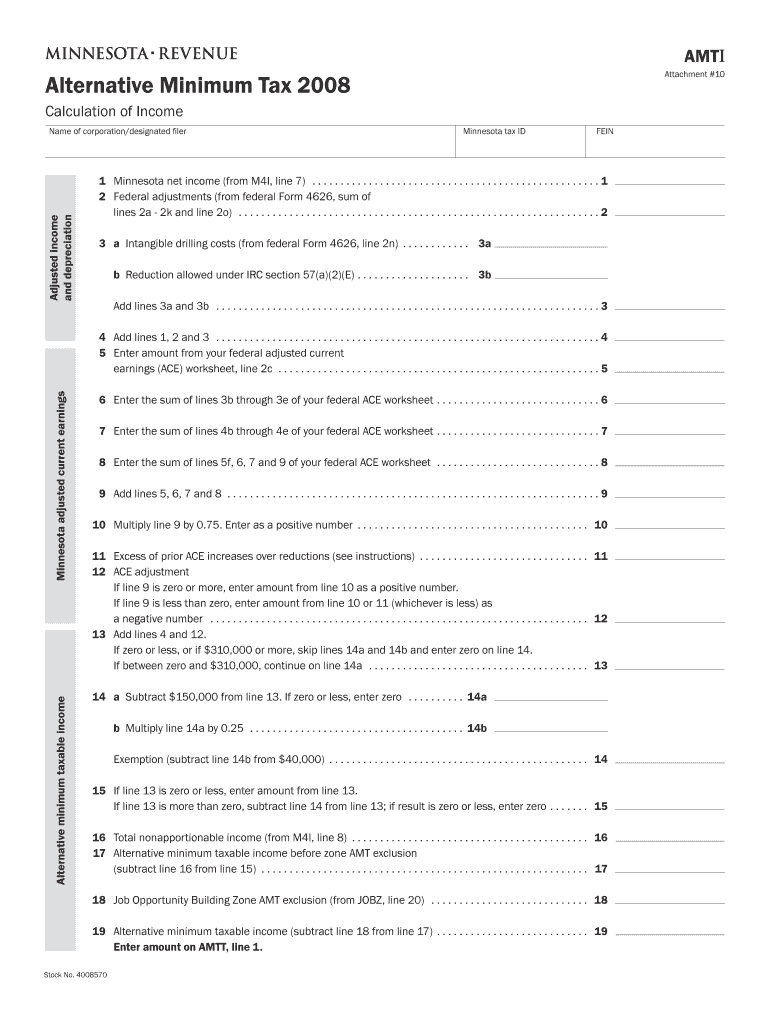

This document is used for reporting Alternative Minimum Tax calculations for corporations in Minnesota, detailing the necessary adjustments and income calculations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alternative minimum tax 2008

Edit your alternative minimum tax 2008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alternative minimum tax 2008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alternative minimum tax 2008 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit alternative minimum tax 2008. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alternative minimum tax 2008

How to fill out Alternative Minimum Tax 2008

01

Gather your tax documents including W-2s, 1099s, and other income statements.

02

Complete your regular Form 1040 up to the point just before your tax liability is calculated.

03

Calculate your Alternative Minimum Taxable Income (AMTI) by adding back certain tax preference items to your regular income.

04

Use Form 6251 to determine your AMT deduction, which is $70,600 for individuals or $112,800 for married couples filing jointly in 2008.

05

Subtract the AMT exemption from your AMTI to find your AMT taxable income.

06

Apply the AMT tax rates (26% and 28%) to your AMT taxable income to compute your tentative AMT.

07

Compare your regular tax liability calculated on Form 1040 with the tentative AMT; pay the higher amount.

Who needs Alternative Minimum Tax 2008?

01

Taxpayers with high income who have a lot of deductions that lower their regular tax liability.

02

Individuals or couples with significant itemized deductions, particularly in areas like state taxes, mortgage interest, or miscellaneous deductions.

03

Those who have exercised incentive stock options (ISOs) or have investment income that might trigger AMT.

Fill

form

: Try Risk Free

People Also Ask about

Is the corporate alternative minimum tax repealed?

Corporate AMT Repealed The Tax Cuts and Jobs Act repealed the AMT on corporations. Conforming changes also simplified dozens of other tax code sections that were related to the corporate AMT. The TCJA also allows corporations to offset regular tax liability by any minimum tax credit they may have for any tax year.

What is the history of the Alternative Minimum Tax?

History of the AMT The predecessor of the AMT – the minimum tax -- was first enacted in 1969 in an attempt to insure that a small group of high-income individuals who had managed to avoid paying any income tax would pay at least a minimum amount of tax.

Does AMT still exist for individuals?

For singles and heads of household, the exemption increased from $54,300 in 2017 to $81,300 in 2023. The AMT has two tax rates. In 2023, the first $220,700 of income above the exemption is taxed at a 26 percent rate, and income above that amount is taxed at 28 percent.

How do I know if I paid AMT last year?

The simplest way to see why you are paying the AMT, or how close you came to paying it, is to look at your Form 6251 from last year. Compare the Tentative Minimum Tax to your regular tax (Tentative Minimum Tax should be the line above your regular tax) to see how close you were to paying the AMT.

How do I know if I have to pay the AMT?

To find out if you may be subject to the AMT, refer to the Alternative Minimum Tax (AMT) line instructions in the Instructions for Form 1040 (and Form 1040-SR). If subject to the AMT, you may be required to complete and attach Form 6251, Alternative Minimum Tax – Individuals. See the Instructions for Form 6251 PDF.

Why am I paying Alternative Minimum Tax?

The Alternative Minimum Tax (AMT) is designed to ensure that wealthy taxpayers can't avoid paying taxes through loopholes. The AMT exemption amounts are automatically adjusted for inflation each year. The AMT exemption amounts are automatically adjusted for inflation each year.

What happened to the alternative minimum tax?

TCJA permanently repealed the corporate AMT (reducing federal revenues by $40 billion from FY2018-2027) and temporarily increased individual AMT exemption amounts and the amount of income at which those exemption amounts begin to phase out.

When did AMT go away?

The AMT provisions, along with almost all other individual income tax measures in the TCJA, are set to expire at the end of 2025.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Alternative Minimum Tax 2008?

The Alternative Minimum Tax (AMT) for 2008 is a parallel tax system designed to ensure that individuals and corporations pay a minimum amount of tax despite deductions, credits, and exemptions that might lower their tax liability.

Who is required to file Alternative Minimum Tax 2008?

Taxpayers who have an AMT taxable income above a certain threshold, typically those with high itemized deductions or certain tax-exempt income, are required to file the Alternative Minimum Tax.

How to fill out Alternative Minimum Tax 2008?

To fill out the Alternative Minimum Tax for 2008, taxpayers must complete IRS Form 6251, which involves calculating AMT income, determining preference items, and applying the AMT exemption.

What is the purpose of Alternative Minimum Tax 2008?

The purpose of the Alternative Minimum Tax is to ensure that taxpayers who benefit from specific tax breaks still pay a minimum level of tax, thereby preventing tax avoidance.

What information must be reported on Alternative Minimum Tax 2008?

Taxpayers must report their regular taxable income, specific tax preference items, deductions disallowed under AMT rules, and the calculation of the AMT exemption on Form 6251.

Fill out your alternative minimum tax 2008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alternative Minimum Tax 2008 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.